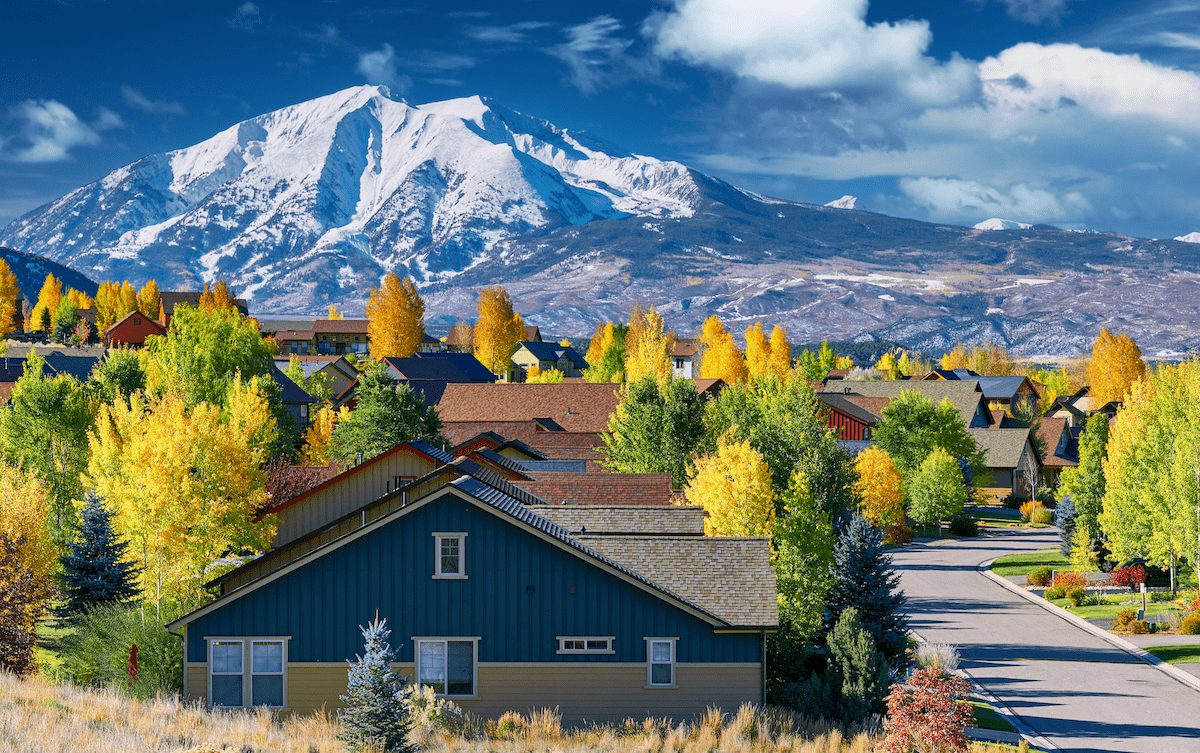

In recent years, many states have seen property values skyrocket. For states in the Mountain West region, the surge in home prices has been partly due to an influx of new residents from the East and West coasts. That escalation in home prices has resulted in rapidly rising property tax rates for millions of residents. Although states such as Colorado and Montana have some of the lowest property tax rates in the nation, they have also seen some of the biggest property tax price hikes (40% or more in some places).

Such increases hit fixed-income retirees and low-income homeowners particularly hard, and public pressure is prompting policymakers in many of these states to seek sustainable solutions to property tax issues that will provide relief for homeowners while also creating much-needed local government funding, Route Fifty reports. In Nebraska, Gov. Jim Pillen kicked off 2024 with an ambitious goal: cut property taxes statewide by 40%. The cut would be funded by a controversial proposal to increase the state’s sales tax. But the proposal failed to pass.

Montana Gov. Greg Gianforte has taken a different approach to tackling property taxes. In January, he signed an executive order establishing a property tax task force focused on developing policy proposals that slow the property tax growth rate, increase transparency in state and local property tax decisions, protect low-income and retired homeowners, and ease the burden of large spikes in property reappraisals. Gianforte wants the group to do all of that without raising sales taxes or cutting into school funding. During the task force’s first meeting in February, he warned, “This is no small task. Property taxes are very complex, and we're not going to kick the can down the road again. We need to solve it.”

Advertisement

Related Stories

Housing Markets

5 Housing Markets That Would See a Huge Increase in Homeownership if Mortgage Rates Dropped

Spokane, Wash., would experience an 11.4% increase in affordability if rates dropped to 6%

Housing Markets

Spring Housing Markets: Which Markets Saw the Most Appreciation, and Which Saw the Least?

Florida metros saw the weakest appreciation of all housing markets in the US

Business Management

How 2023's Housing Market Conditions Are Affecting the 2024 Market

Last year ended on an optimistic note, but persistent headwinds still exist to keep 2024 from getting the housing market back to pre-pandemic levels