| Todd Menke Photo by Greg Wilson |

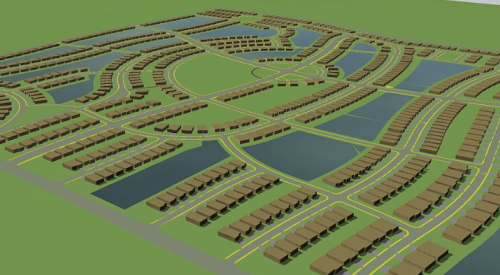

Project Name: Golf Villas at Bobcat Trail, North Port, Fla.

Builder-developer: Todd Menke (pictured) and David Hunihan, Fidelity Homes Inc., North Port, Fla.

Project size: A 30-acre site in three 10-acre pieces

Proposed development: Complete a half-finished community of duplexes and townhomes on a golf course in southwest Florida. Mapped and ready to go, the project had three phases.

Landowner: A local bank owned Phases 1 and 2. The original master developer still held Phase 3.

Site considerations: Twenty-four uncompleted units remained to be built on the fully entitled and fully permitted Phases 1 and 2. Phase 3 had a map but little else.

| Fidelity Homes gambled on Phase 3 and eventually got all three phases. |

Deal story: In 2000, Menke and Hunihan launched a home building company after years as executives at another home building firm (see "From the Ground Up," March 2001). With investors at the ready, they sought the opportunity to complete the first two phases of Bobcat Trail. So, too, did a number of other builders.

To break the logjam, Menke and Hunihan attempted an end-around maneuver that worked beautifully. They made an offer to the owner of Phase 3 to purchase those 10 acres and its 36-unit map outright. Conventional wisdom was that this piece would be "icing on the cake," says Menke, for the builder who closed a deal on finished Phases 1 and 2. After Menke and Hunihan put together a cash deal to buy Phase 3, it took away any incentive for other builders seeking to complete the earlier phases.

"By causing everyone to leave the dance, we got the opportunity to carve out a very advantageous deal, which essentially gave us ultimate control of the first two phases," Menke says.

Three months after buying Phase 3, Menke and Hunihan had a project management deal with the bank that owned the first two phases. It essentially allowed them to share in the profits of building and selling the remaining 24 homes from the initial two phases without buying the land. An additional bonus: All remaining capital required for those two phases drew funding from the bank’s credit facility.

Key points of the deal included a two-pronged attack for three 10-acre parcels:

1) A cash deal to purchase a final, unbuilt phase of the master development.

2) A project management, profit-sharing deal to build out the 24 remaining parcels.

Risk was reduced on the purchase of the initial parcel by negotiating for closing to be deferred until all improvements were put in place. These improvements were coventured between the buyer and the seller.

In exchange for managing the building and sales of all remaining units in the first two phases, Menke and Hunihan were able to control and profit from land they never owned. Performance benchmarks stipulated by the bank/owner held the deal in place for both parties.

"As a developer, you can find a lot of deals where you assume all of the risk," says Menke, who now runs a land development company, Menco Companies Inc., that was split off from the home building firm. "The deals that you want to seek out are the ones where you can spread that risk out. If you can do that, then you don’t have that one deathblow that hits you if something goes wrong."