The current housing market continues to spiral with few homes for sale and hungry buyers, pushing home prices up and buyer hopes down, but one economist believes capital gains tax reform could bring relief. Ralph McLaughlin, chief economist and senior vice president for real estate finance company Haus, says reforming the capital gains tax could lure more sellers into listing and directly benefit first-time buyers. With his suggestion, the capital gains tax would be exempt for property sellers if their home is sold to a first-time buyer, says MarketWatch. It could be most attractive to investors who may have purchased homes to convert into rental units as some rental markets across the country have struggled amid the pandemic.

“You’re enticing a swap of ownership from investors to the people who are renting those homes,” McLaughlin said.

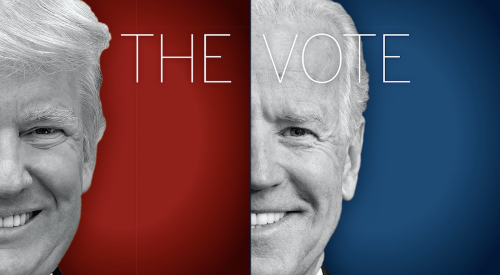

If the policy gained traction, McLaughlin believes that Americans could see more momentum from existing homeowners listing their homes on the market. What’s more, McLaughlin argues that such a policy could see bipartisan support, since various elements would appeal to Democrats and Republicans alike.

The carrot vs. the stick

McLaughlin’s vision differs significantly from the tax policies President Joe Biden proposed last month to pay for his broader economic agenda.

The White House has called on Congress to increase the capital gains tax rate for households making over $1 million to 39.6%. The Biden administration also proposed other changes, including eliminating the Section 1031 exchange program that allows real-estate investors to defer taxes in certain scenarios.