The need for starter homes has been well documented recently. With a lack of affordable homes on the market for young, first-time buyers, demand for homes is starting to build. But what if it is not only a low supply that has these first-time buyers waiting, but a low demand for starter homes?

Yes, it seems crazy and goes against everything that has been said recently about the housing industry. But as HousingWire reports, Bank of America’s Homebuyer Insights Report shows some interesting statistics when it comes to people who are looking to purchase a home.

When asked “Which describes the type of home you’re looking for?” a whopping 75 percent of first-time homebuyers said they wanted a home that they can grow into and will fit their needs in a few years, even if it doesn’t now. The remaining quarter said they wanted a home that fit their needs now, but might not in a few years. Additionally, when asked whether they would rather save more money and move into a nice home in the future or move into a starter home now, 69 percent answered with the former. Only 31 percent wanted to move into a starter home immediately.

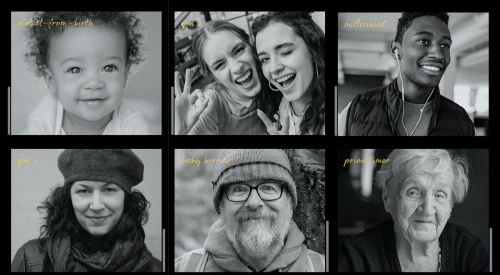

This follows a trend of patience that millennials have been exhibiting; they tend to wait longer than previous generations to get married and to have kids, so it makes sense that waiting a little bit longer and skipping starter homes altogether isn’t a deal breaker, but may be what they prefer.

Just how serious are first time homebuyers about purchasing their forever home? A rather significant 35 percent said they would like to retire in their first home purchase.

However, for buyers who currently have a plan in place to purchase a home, 41 percent said they want to buy a starter home. Only 23 percent of people who “someday” would like to purchase a home want to begin with a starter home. Still, 59 percent of buyers with a plan in place are looking to avoid purchasing a starter home and focus on more long-term options.

It isn’t all just about waiting for the right house to come along, though, as 32 percent of Millennials and 43 percent of Gen Xers have postponed buying a home because of debt.