| Tom Stephani Photo by Marc Berlow |

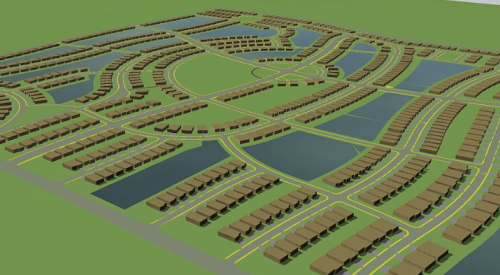

Project: Dole Crossing, Crystal Lake, Ill.

Builder-developer: Tom Stephani, William Thomas Homes Inc., Crystal Lake

Project size: Approximately 8.5 acres

Proposed development: Build a small, 23-unit, traditional neighborhood with walking links to an existing downtown shopping district.

Landowner: An estate for a woman whose family owned the property for decades

Site considerations: Decades ago the site had been home to a large greenhouse that supplied orchids to the Chicago wholesale flower market. The buildings had long since been carted away, and all that remained were a couple of shacks, an old foundation and quite a bit of broken glass. Trees and foliage covered most of the site.

Deal story: Stephani knew of the family who owned the parcel and through a mutual acquaintance received an introduction to a family member who told him the property was in an estate that had not been liquidated. He made this contact just months before the piece was set to hit the market.

| Four existing homes, in white, were incorporated into the new community. |

During several conversations, Stephani says, he gradually got to know the landowner enough to set up a meeting to make a proposal. Before making that proposal, Stephani learned more about the site through public records. The title was clean, but the plat, originally laid out in the 1800s, probably needed fine-tuning. At the meeting, Stephani brought a preliminary site plan detailing home sites and a central park with gazebo. He also brought early sketches of the types of homes he wanted to build.

The vision he presented appealed to the seller, and so did the enhanced yield of the property as a residential use. Based on the positive response from the landowner, Stephani offered the following deal:

"It is rare in life that things turn out exactly the way you envision them or better," Stephani says. "In this case it turned out exactly and better."