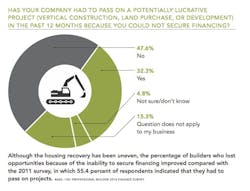

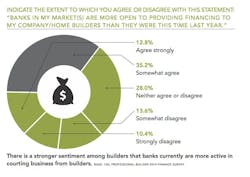

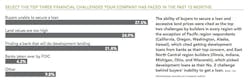

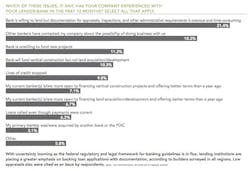

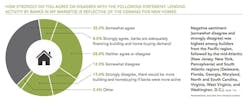

Traditional loans from banks are the lifeblood of home builders. National figures from the FDIC and this survey suggest the availability of AD&C loans improved in the first quarter of 2014 compared with both previous quarters and Professional Builder’s 2011 Finance Survey. Yet there are still reminders that credit is tight.

Methodology and Respondent InformationThis survey was distributed between July 31 and August 14, 2014, to a random sample of Professional Builder’s print and digital readers. No incentive was offered. By closing date, a total of 125 eligible readers responded. Respondent breakdown by discipline: 27 percent diversified builder/remodeler; 20.6 percent custom home builder; 15.9 percent production builder for move-up/move-down buyers; 7.9 percent architect/designer engaged in home building; 4.8 percent luxury production builder; 4.8 percent production builder for first-time buyers; 4 percent multifamily; 2.4 percent manufactured, modular, log home, or systems builder; and 12.7 percent other. Approximately 47 percent of respondents sold one to five homes in 2013, and 20.2 percent sold more than 50 homes.

As a California builder remarked about his experience with banks, “They run you through fees, but no loan at the end; [I] doubt they had money to lend.” A builder in New York noted that some banks are demanding steep terms such as in-house funding levels between 35 and 50 percent. While some banks are willing to extend development loans, another New York builder said the terms are very expensive.

For more results, see the charts from the survey below.

PB

Sign-up for Pro Builder Newsletters

Get all of the latest news and updates.