How Tariffs on Canadian Lumber Will Hurt U.S. Housing

Lumber price volatility has been the single biggest drag on the residential construction industry during the COVID-19 pandemic. That’s why the National Association of Home Builders (NAHB) was so disappointed when the Commerce Department moved forward in late November with its next administrative review to double the tariffs on Canadian lumber imports from 8.99% to 17.9%.

Increasing the tariffs acts as a huge tax increase on American homebuyers and renters, who experience higher housing costs as Canadian lumber tariffs drive up the cost of lumber. This comes as millions of American households are already paying too much of their income for housing.

It’s no secret to the Commerce Department that the nation’s home builders are dealing with supply chain disruptions that have driven up the cost of lumber, steel, copper, and other key building materials. At one point in 2021, the price per thousand board feet of lumber reached an all-time high of $1,495, according to wood industry price and news service Random Lengths, and pushed up the cost of an average new single-family home by almost $36,000.

RELATED

- Rising Lumber Prices Could Add More Than $18,600 to New-Home Value

- Residential Construction Inputs Continue to Rise at the End of 2021

- The Synergy of Industrialized Construction and Built-for-Rent Housing

After relaxing from record highs in the fall—though still above pre-pandemic record highs—lumber prices have begun to rise again. The framing lumber composite price jumped 10% in early December and lumber futures increased nearly 20%, going above $900 per thousand board feet as of Dec. 3.

NAHB is working with the Biden administration in an effort to achieve less burdensome tariffs and is urging the administration to engage Canadian trade officials in negotiations to reach a long-term solution to the trade dispute.

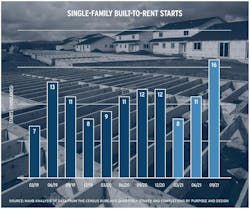

Record Starts for Single-Family Built-to-Rent Homes

Many households are looking for the space and privacy of a single-family home, but not all can overcome the barriers to homeownership, such as high list prices and down payment requirements. In response to rising affordability concerns, the number of single-family built-to-rent construction starts reached its highest quarterly volume on record during the third quarter of 2021.

NAHB economists note that there were roughly 16,000 single-family built-to-rent starts during the third quarter. Given the relatively small size of this market segment, the quarter-to-quarter movements typically are not statistically significant.

This analysis considers only those homes built and held by the builder for rental purposes, but excludes homes that are sold to another party for rental purposes. NAHB economists estimate that the latter segment of homes may represent another 3% to 4% of single-family starts.