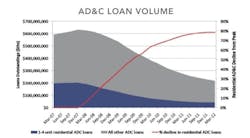

Data from FDIC and Federal Reserve indicate turning point for AD&C lending

For the first time since the first quarter of 2008, the total amount of loans outstanding for residential construction (1 to 4 units) rose on a quarter-over-quarter basis, according to data from the FDIC.

The amount of the net increase was small (about $22 million), with the stock growing from $43.54 billion to $43.56 billion from the first to the second quarter of 2012. It is worth noting that this is a net change, so given ongoing payoffs/discharges of existing AD&C loans, the actual amount of originated lending for AD&C purposes was considerably larger but cannot be estimated using the FDIC data.

The stock of residential AD&C loans now stands 79 percent lower than the peak level of AD&C lending of $203.8 billion reached during the first quarter of 2008.

The FDIC data reveal that the total decline from peak lending for home building AD&C loans continues to exceed that of other AD&C loans (nonresidential and some land development). NAHB survey data suggest that land development loans face tighter lending conditions than loans for residential construction purposes.

A broader look at credit conditions comes from the Senior Loan Office Survey from the Federal Reserve, which has generally been more positive than both the FDIC data and NAHB surveys. In general, the Fed survey indicated that the days of credit tightening, as reported by lending institutions, ended some time ago.

For more, visit NAHB’s Eye on Housing blog at www.eyeonhousing.wordpress.com.