In the decade since the onset of the Great Recession, economic experts examine what the U.S. learned from the crash, what has changed, stayed the same, and what remains to be fixed.

While the unemployment rate is at an 18-year low, the stock market continues to grow, and corporate profits are peaking, the homeownership rate only just stopped its decline, and male workforce participation is still sitting at record lows. As well, household debt is rising.

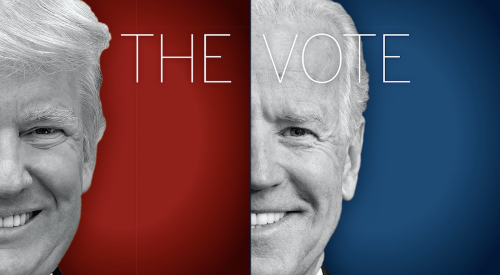

At the policy level, the 2011 recession autopsy by the Financial Crisis Inquiry Commission finding that the crisis was "man-made, predictable, and entirely avoidable." The Obama administration has been faulted for not going far enough in policy reform and in punishing financial executives for reckless lending. Today, experts say the U.S. remains just as prone to financial crisis as it did before the Great Recession, and CNN reminds that Congressional Republicans have rolled back Obama-era regulatory protections against predatory lending, and that the Trump administration picks for the heads of the Securities and Exchange Commission and the Consumer Financial Protection Bureau have either worked in banking, or "have been harsh critics of the agency they've been put in charge of." In both cases, they have slowed or stopped enforcement of the protections, and have cut staff to limit the agencies' abilities to investigate fraud.

When John Taylor starts remembering the years leading up to the financial crisis, his fury wells up all over again. "We're sitting here, 10 years later, with a short-term memory that doesn't seem to recall how we got into that mess," Taylor says. "We got into that mess because of the lack of regulation, and now we're talking about making banks less accountable. It makes no sense whatsoever." As president of the nonprofit National Community Reinvestment Coalition, he warned Congress about the predatory and fraudulent lending that was fueling a housing bubble as early as 2000. Lawmakers told the Federal Reserve to write rules that would have put a stop to the worst practices. But the crash came first.