If finding skilled labor isn’t your top concern, then chances are pretty good that finding lots to build on is your biggest challenge. Since 1997—almost 20 years—the NAHB/Wells Fargo Housing Market Index has periodically tracked builder sentiment regarding lot availability. In that time, the percentage of builders reporting shortages has never been as high as it is now: In the May survey, 64 percent of respondents reported a “low” or “very low” lot supply—a 2 percent increase from the previous record set in May 2015.

Even back in 2005—when the market was strong and roughly twice as many new homes were being built nationwide—the share of builders reporting shortages was at 53 percent.

The percentage varies somewhat based on the region of the country, builder size, and the type of lot. Although the categories are seldom precisely defined, builders often think in terms of A, B, and C lots, based on the desirability of their location. As you might expect, the shortage tends to be most acute for A lots. In the May 2016 survey, 69 percent of the builders said A lots were in short supply, compared with 60 percent for B lots and 47 percent for C lots.

Nowhere is the scarcity of land more apparent than in the West, where 39 percent of builders said lot supply was “very low” (compared with 23 percent in the South and 18 percent in both the Midwest and the Northeast). But when specifically referring to premium “Class A” lots, builders from coast to coast reported widespread shortages.

“Here in Northeast Ohio, the supply of ‘A’ lots has really dwindled,” said Bill Sanderson, vice president of construction and land for Knez Homes, a Cleveland-area custom home building company. “A few spots are available for redevelopment, but that process takes time, and there still isn’t a ton of [land].”

Sanderson, who also serves as president of the Ohio Home Builders Association, says that many builders have little choice but to look farther and farther out into the suburbs, where the prices need to be highly competitive to entice enough buyers. “In those secondary locations, increased entitlement time and more regulations, including environmental and other issues, mean that lots are not coming online as quickly as planned,” he explained.

Lot shortages were also reported somewhat more often by larger home builders. Overall, 70 percent of builders with more than 100 starts reported a low or very-low supply of lots, compared with 65 percent for builders with six to 99 starts, and 62 percent of builders with fewer than six starts.

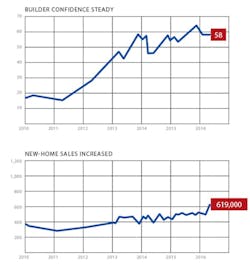

Housing Market Snapshot

According to the NAHB/Wells Fargo Housing Index, builder confidence was unchanged in May at 58. April new-home sales jumped 16.6 percent from March to an annual rate of 619,000, and housing starts also increased, 6.6 percent during the same period to an annual rate of 1.17 million. Remodeling spending in April fell 3.2 percent to $142.2 billion.