|

Heather McCune's Editorial Archives

|

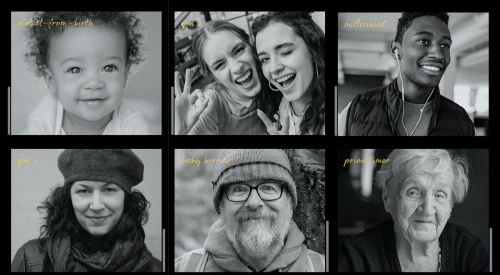

The data keeps piling up on the leading wave of the baby boomers. Beginning this month, the oldest of this 76-million strong generation turns 55-the age when they are officially welcome in most of America's retirement communities.

Del Webb Corp., the largest and most well-known builder and developer of active adult communities, recently completed its latest baby boomer study and the if the data says one thing its this: This generation intends to be forever young.

LeRoy Hanneman, Del Webb president and CEO, says that after studying Boomers' attitudes for years, he feels the term "baby boomers" is becoming out of date, and has coined the label "zoomers" for the oldest of this generation. "They are zooming into retirement with fast and far-reaching agendas. The zoomers are the financially established, healthy and demanding boomers who will continue to redefine retirement."

Heartening to a company like Del Webb and other builder/developers is data that suggests America's newest seniors will consider an active adult retirement community when they retire. "Del Webb will never build another shuffleboard court," adds Hanneman. "We will, however, build computer labs, health spas and college classrooms in our communities."

Boomer Gap

In its fourth survey of this demographic group, Webb polled both ends of the boomer generation born between 1946 and 1964. The results reveal some surprising similarities as well as some striking differences. The oldest and youngest of the baby boomer generation agree on the following:

The two areas where the oldest and the youngest of the Boomers disagree were on the topics of lifestyle and technology. Twice as many of the younger boomers say technology is important in their homes. Likewise, in a two to one margin, younger boomers say they want to "upsize their lifestyles to live more extravagantly in retirement than they do now."

Show Me the Money

Financial concerns for retirement weighed heavily on 55-year-olds as they approach retirement. Supplementing social security and/or retirement savings was the factor that would most influence a decision to return to work, according to 34 percent of the respondents.

When asked how much disposable income would be necessary to achieve the desired retirement lifestyle (after paying for housing, utilities, food and medical expenses), half the total respondents said they would need less than $1000 per month. However, 16 percent of the oldest boomers said they would need more than $3000 per month.

"These income projections are high compared to those of former generations," explains Hanneman. "They reflect government studies that show the income levels of boomers are at least a third higher than their parents' generation. The boomers are financially more prepared to entire retirement and this will be reflected in their spending."