Home Builders, How’s Your Supply Chain?

When Michigan’s COVID-19 stay-at-home mandate starting on March 24 shut down Mid-America’s manufacturing facility in Metamora, lead times for the company’s custom shutters, battens, and other siding accessories jumped from three days to 30. That delay meant Tim O’Brien Homes, with operations in Milwaukee and Madison, Wis., would have to find another supplier or a workaround for sourcing its preferred exhaust vents with an animal cage.

“It’s one thing to miss an accessory where you can find a different solution that’s not code-related,” says company president Tim O’Brien, “but to be in a situation where we may not have a required electrical code part, that could hurt.”

In late April, one of O’Brien’s electrical contractors told him that, according to his wholesaler, a Square D plant that makes arc-fault circuit interrupters would shut down for two to three weeks, causing a potential shortage of that spec. “I notified our electricians to make additional orders with their supply chains to make sure they have enough to cover our jobs,” O’Brien says.

A Square D spokesman said the Schneider Electric division’s supply-chain operations are “fundamentally sound and we have contingency plans in place to ensure we continue providing services to our customers during this difficult time.”

Extended Lead Times for Windows and Doors

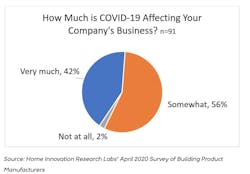

A mid-April survey by Home Innovation Research Labs found that 42% of building product manufacturers polled stated their business was affected “very much” by COVID-19 with about half of respondents saying they have had to restrict or shut down operations. Seventy percent reported disruptions to their supply chain. Consequently homebuilders are adjusting.

Pennsylvania’s mandated shutdowns began on March 23, which prompted MI Windows and Doors to transfer production from its Gratz, Hegins, and Millersburg plants in that state to Flower Mound, Texas. In a March 24 statement, the company said lead times for custom patio doors and painted exterior products would range from four to six weeks, flex screens two to three weeks, and two months for garden windows.

Ryan Clarke, director of operation for Robuck Homes, says MI Windows and Doors lead times for his Raleigh, N.C., market as of the last week of April were nine to 12 weeks, compared with two weeks before the COVID-19 pandemic. “We issue purchase orders on windows and doors basically at the time of permit, so going to 12 weeks is OK,” he says. “By the time we get to permit, foundations, and framing, we’re right about where we need doors and windows.”

A New Jersey builder reported learning from his door distributor that Therma-Tru’s lead time has been affected by the pandemic shutdown, and he had difficulty receiving exterior doors. Until then, he’s covering door openings to his homes with plywood. Thermu-Tru dealers in the Midwest confirmed that as of April 30, lead times for exterior doors extended into early June.

Lead times for some manufacturers as of the last week of April were nine to 12 weeks, compared with two weeks before the COVID-19 pandemic.

A Georgia builder and client of Mark Hodges, a strategic planning and quality management consultant for Blueprint Strategic Consulting, in Haddonfield, N.J., ordered 20 houses worth of window blinds and all the stainless steel appliances he can warehouse because his distributors warned that there may be supply issue with manufacturers.

"He’s stockpiling materials because he has numerous homes nearing completion and if he can’t get appliances, he can’t close those homes,” says Hodges. “Smart builders are reaching out to suppliers and asking if there is anything on the horizon that they should be worried about, and if so creating a plan to address possible delivery delays. They ask, 'If you think we’re going to run into shortages, get me materials now.' Some are even asking suppliers to accept advance orders and stockpile them at their distribution points, so the builder doesn't have to find empty garages where they can store products."

Bottlenecks for Imported Building Materials and Components

Builders that are contacting their trades and suppliers regarding possible bottlenecks collectively report that products from China, such as door hardware and sheet metal, could take longer to source in the coming months if imports sit on a dock.

A septic system installer for Classica Homes, in Charlotte, N.C., told Brian Hall, VP of operations, that a septic tank model from Clearstream Wastewater Systems was on backorder because the manufacturer was waiting for parts from China and needed to repair a production line. The builder is in the process of constructing about 70 homes in two neighborhoods. The six-week delay might have affected the handful of homes that are approaching closing within 30 days, but Classica was able to secure a couple of tanks and already planned to use other septic system models.

Schlage temporarily shut down door-lock manufacturing at a plant in Mexico for three to four weeks, and UltraCraft Cabinetry is staggering work crews, pushing its delivery window for custom cabinetry by an extra week to three weeks out, Hall says.

However, the delays aren’t significantly affecting builders that already adjusted starts and lengthened construction schedules to accommodate social distancing by limiting the number of crews that can be on a jobsite and when.

Various lumber mills such as Interfor, West Fraser Timber, and Weyerhaeuser announced in March that they would cut production for a couple of weeks and reassess the market. In a spot check of builders, none reported any problems with the availability of framing or board lumber, and all expressed that they don’t foresee a shortage of wood products for now should the economy and construction rebound.

“Some plants in Canada are slowing down because they have so much lumber sitting in their yards now that isn’t being purchased, and that is my understanding of why they’re slowing down,” O’Brien says.