What goes down must come up, and the 31 home-building executives who responded to this year’s survey have pointed out many impressive positives over last year’s study and are projecting even better results for 2014, albeit with a few additional challenges. Last year’s respondents who saw the home building glass as half-full are vindicated because 2013 brought us both increased new-home sales and higher profits, too!

The most improved areas of 2013

Our end-of-the-year home builder survey had a lot of good news, with 30 of the 31 respondents reporting increased sales (97 percent) and higher sales prices (82 percent). Most respondents were confident they could sustain and even improve their 2014 sales given their better land/lot positions (66 percent), higher profit margins (58 percent), and improved employee hiring/training (50 percent).

Although the growth rate for new-home sales was slightly softer by the end of 2013, average closings were still up an impressive 32 percent. Clearly, the most important change came from stronger pricing power, which led to higher average sales prices and provided for higher margins and net profits.

2013 growing pains

But along with the good news of growth returning to the new-home market, we can’t ignore the growing pains. The most significant challenge facing builders was the difficulty of finding quality-minded trade partners and internal staff, a result of the long downturn. So many home building staffers and trade people chose to change industries that there simply weren’t enough trained people to meet the increasing demand. This serious issue is reflected in four of the top five reported challenges in 2013: longer cycle times (59 percent), trade contractor shortages (45 percent), decreased customer satisfaction (39 percent), and back-office processing/staff capacity (30 percent). The remaining challenge was finding lots and land to continue to feed the machine (33 percent).

The respondents who reported that customer satisfaction ratings took a hit claimed it was due to trade partner shortages and lean home builder staffs having more difficulty delivering the home on time and with acceptable product quality. Home builders call this problem “longer cycle times,” while customers call it “late/incomplete home deliveries.” Most of the home building survey respondents blamed the longer cycle times and product quality declines squarely on their inability to find qualified trades.

Four things to feel good about

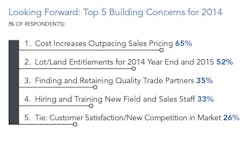

Four areas of noticeable builder attitudinal improvement were fewer concerns about current lot/land inventories, working capital, developing new product, and appraisal problems. It seems the average respondents in this study solved many of their short-term lot/land needs, but are still leery of the long entitlement process. They find themselves growing increasingly concerned about higher earnest money requirements and the added risk of higher take-downs. Several respondents speculated that municipality staffing cutbacks were affecting the entitlement process and could potentially delay 2014 year-end sales and challenge their 2015 carry-over backlog. On another note, many respondents went out of their way to comment positively on the nice return on their 2013 sales training investments. This sales improvement seems to confirm the idea that additional sales training leads to better performance.

The big 2013 improvement?

About the StudySurveys were sent to 50 geographically diverse home building executives. Sixty-two percent (31) of the respondents completed substantial portions of the survey. These 31 respondents closed 5,322 homes in 2013 (an increase of 32 percent from 2012). While this study has significant quantitative data, it also includes empirical data, opinions, and comments more qualitative in nature. We would like to thank the respondents for sharing their information, opinions, and 2014 outlook with our readers. The survey was administered, interpreted, and this article written by Charlie Scott of Woodland, O’Brien & Scott. He can be reached at [email protected].

Let’s compare results to see how things looked in the 2012 survey versus 2013. First we notice that 2012 had a steeper sales increase trajectory, but unfortunately those sales lacked sustainable margins. In 2012’s year-end study, we saw closings increase by 45 percent and carryover backlogs built up by 60 percent. Those 2012 sales increase numbers were obviously welcome, but since the 2012 margins were still very slim, all hard-cost increases challenged these slim margins. In 2013, 97 percent of the home builder respondents increased sales by an average of 32 percent. More importantly, these increased sales had higher sales prices, and thus led to higher revenue streams, better cash flow, and higher profits. How quickly things can change.

What about the customer?

What successful home builders are saying about the coming year“We are trying to be more proactive with our lumber partners and locking prices longer.” — Mike Tuskes, Tuskes Homes“Customers are starting to realize the days of open-ended negotiations for a home are over.” — Jim Clarke, Robertson Homes“We are very bullish for 2014. We believe the Texas market will continue to attract jobs at a rate above the national average.” — Don Klein, Chesmar Homes“We had a number of challenges in 2013 from hard cost increase to land acquisition terms and employee recruiting. However, we are very optimistic about our market and are currently looking for field and sales staff to support our expansion.” — Kevin Egan, American Legend Homes“We see customers becoming more demanding given the trade shortage and on-time delivery challenges. We have prepared a communication piece to teach our customers the challenges of today’s home building and to set proper expectations in regard to potential delivery delays.” — Anonymous, Texas“We feel good about 2014. We could face headwinds if Washington fumbles the ball on the budget early in the year. We are also concerned about interest rates.” — Anonymous, Texas“We believe customers are becoming more realistic about what they can afford and less demanding as interest rates and prices increase.” — JD Espana, Piedmont Residential“In good times, plan for the bad times and in bad times, plan for the good times. As far as Vantage Homes is concerned, we view ourselves as being in the people business, not the building business.” — George Hess, Vantage Homes“Switching from survival to growth mode caused a variety of struggles. We were surprised at some of our struggles given we kept our best staff through the downturn. Our old processes and experiences were not as quick to reboot as we expected and this was also compounded by trade partner shortages. For 2014, we believe customers will continue to become more demanding in terms of features and service.” — Gene Brown, Atlantic Builders“More competition is entering our market and driving up prices of land and trade contractors. On the customer side, customer demands will remain unchanged even as the market moves to a more normalized or even a seller’s market because customers are becoming more savvy buyers.” — Mick Michael, HHHunt Homes

On the customer side, many of our home building executives believe buyers are starting to realize the pendulum is swinging toward a seller’s market, with the days of discounting and open-ended negotiations drawing to a close. The fact that 69 percent of the executives believe customers will be easier to satisfy demonstrates that expectation. Let’s hope there is some truth to this belief, since the average builder experienced a drop in both willingness to refer and customer enthusiasm. (See “The New Home Buyer’s State of Satisfaction” in Professional Builder, September 2013, p. 30)

The home builders acknowledged their leaner, less experienced staffs had more difficulty managing the volume increases. Also, the less-than-satisfactory performance of their trade partners led to later-than-planned deliveries and lower quality delivery scores to boot. This is a bad customer satisfaction combination—late and still not complete. Despite the home executives’ beliefs that customers will be less demanding on the negotiation side of the equation, they will probably continue to be as demanding (if not more) when it comes to their home’s product quality.

What about your 2014 backlog?

Our annual study always looks carefully at year-over-year backlogs as of Jan. 1, and this year revealed an interesting change in the backlog. An increase in backlog can be a good news/bad news scenario, and it was. Let me explain. In our study, the backlog fell into two categories, in-process sold contracts and in-process speculative starts. In this study the average builder’s backlog was up an outstanding 37 percent year-over-year. That’s good, right? Well, not so fast. There was a noticeable shift among the makeup of this year’s backlog.

Backlog bad news

On average, the speculative backlog jumped 47 percent while the sold backlog increased just 32 percent. Respondents noted that much of this increase in speculative carry-over was due to filling in production slots as a result of the new-home sales soft patch. Many builders experienced a sales slowdown this fall during the government shutdown and the ever-present pessimistic press. Several respondents also indicated their increased sold backlog was actually due to the aforementioned longer cycle times and were homes they had really hoped to close in 2013.

Backlog good news

On the other hand, two takeaways from the backlog story are that builders are finding funding to start more speculative inventory. Many builders will be well positioned for spring inventory and for better first- and second-quarter cash flow.

Sign-up for Pro Builder Newsletters

Get all of the latest news and updates.