The House and Senate are addressing several issues pertaining to the housing industry, including tax reform, housing finance, and the National Flood Insurance Program (NFIP), which will expire on Sept. 30.

NAHB is asking Congress to provide a five-year reauthorization of the NFIP that:

• Eliminates a provision that would have ended NFIP coverage of new homes constructed in the 100-year floodplain.

• Ensures that “grandfathering” will remain available for all policyholders if their risk changes, which will enable homeowners to have continued access to affordable flood insurance.

• Sustains affordability by raising the annual premium floor for rate hikes from its current 5 percent level to 6.5 percent instead of the proposed rate of 8 percent.

While there is no deadline on tax reform, several Trump Administration officials, including Treasury Secretary Steven Mnuchin, have said it remains a priority for this year.

NAHB is a defender of the mortgage interest deduction, which has been part of the tax code since its inception in 1913. Homeowners may deduct interest on up to $1 million of acquisition mortgage debt and up to $100,000 of home equity loan debt. These amounts were set in 1987 and have not been adjusted for inflation since. This deduction is a tool for younger middle-class buyers looking to enter the housing market and move up as their families grow.

Other tax issues for the residential construction industry include:

• The Low Income Housing Tax Credit (LIHTC), which produces safe, quality, affordable rental housing. The LIHTC creates 96,000 new full-time jobs per year across all U.S. industries and generates $3.5 billion in federal, state, and local tax revenue.

• The mortgage interest deduction for a second home, which is often misunderstood. Many homeowners have owned a second home and inadvertently taken advantage of this provision. For example, when a homeowner sells one home and purchases another, they effectively own two residences in a single year.

• Business interest deduction (BID). To ensure that our future tax code is truly pro-growth, Congress must maintain a BID for small businesses.

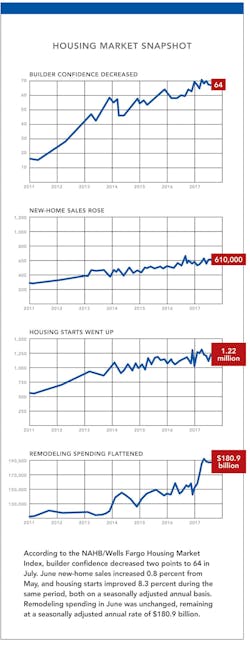

(Click charts to enlarge)