This article first appeared in the July/August 2024 issue of Pro Builder.

Almost any conversation about quantifying productivity, profit, or performance in home building begins with time. That’s because time sets the standard by which many other home building variables can be tracked and tabulated to understand opportunities for operational improvement. Time is a benchmark by which organizational effectiveness can be assessed, understood, and optimized.

But the benchmarking process is easier said than done, and it’s one more thing for a builder to add to an already extensive to-do list. Except that benchmarking isn’t just another box to check; benchmarking is the key to consistently beating the competition and sustaining operational excellence and profitability.

“The idea of benchmarking is really simple: How do you begin to learn from others about how they do things better than you do?” says George Casey, a housing industry icon and group chair for Vistage, arguably the largest executive benchmarking and coaching organizations in the world. “And from that you begin to realize there’s another way [to do something], start learning from that, and get yourself better.”

It also requires humility. “The people who really benefit from benchmarking tend to be humble, rather than letting their egos get in the way,” Casey says. “You think you’ve got a secret sauce and you don’t want anybody to get it? Let me tell you: There are no secret sauces.”

Still on the fence about benchmarking? Then ease into it by focusing on data. You have it, of course, from every corner of your operations. You may even use it already to “benchmark” your business against past performance.

RELATED

- Business Metrics and the Imagination Age of Home Building

- Got Benchmarking?

- Managing With Data (or How to Get Your Processes to Talk to You)

But looking inward only reveals a fraction of the potential. As Casey and other high-performing builders say (and do), the real value of benchmarking is looking outward, to reliable, accurate, and objective third-party industry (and even non-industry) sources and data to serve as a sounding board against which you can compare your numbers and experience.

“Time, quality, and money,” says Seamus Mulroy, product manager of data services at Constellation HomeBuilder Systems, one of several industry-specific construction management software providers—and one that offers objective benchmarking opportunities to its home builder clients. “Benchmarking is an opportunity to improve all three.”

Benchmarking as a Way to Improve Quality

For most of housing’s history, defining—much less measuring—construction quality has been an elusive goal, at best.

But more recently, as home builders confront stricter building codes, rising warranty costs, and legal liability for defects and shoddy workmanship, the ability to objectively assess and measure construction quality has become part of a benchmarking regimen for those looking to improve.

As the program manager of Builder Solutions at IBACOS, a source for services and research for the U.S. home building industry, Richard Baker considers the science of ensuring continuous improvement in construction quality his calling, and has spent 18 years with the Pittsburgh-based innovation company developing and delivering new processes and product improvements to do just that.

“My sweet spot is the interaction of building components, rather than the aesthetic of the final product,” Baker says. “When a builder makes incremental improvements by benchmarking against our construction quality assurance data, it has a rewarding ripple effect throughout the operation.”

IBACOS’ Perform platform offers a robust yet user-friendly scorecard system that allows builders to establish construction quality and sustainability standards for each product type and to measure against that benchmark in the field.

The scorecard covers almost 800 categories across 13 major building systems, says Baker, which IBACOS’ in-house team of building performance specialists use to rate a builder’s work from zero to 4 as they physically walk homes under construction.

Benchmarking is the key to consistently beating the competition and sustaining operational excellence and profitability.

“Over time, good builders always improve,” Baker says. “The key is to benchmark first, then track progress, and, most importantly, to stick with it.”

Taylor Morrison (No. 6 in Pro Builder’s 2024 Housing Giants rankings), an IBACOS client, considers such benchmarking good business and a means to optimizing building performance. “With IBACOS, we establish the construction standard we expect as a benchmark using their scorecard system,” says Curt Wick, the builder’s national director of construction optimization. “It’s one of many tactics in our optimization program.”

The Scottsdale, Ariz.-based public builder reported 11,495 closings in 20 markets across 12 states in 2023. That scope enables Taylor Morrison to generate apples-to-apples construction quality data to benchmark by division and metro location for each system evaluated and scored—a customizable dashboard of both current performance and historical trends that the IBACOS program provides (see charts below showing data for two anonymous builders).

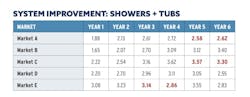

Properly waterproofing showers and tubs is tricky. Here, a production builder operating in five markets saw construction quality improve for that system over six years of third-party, in-person assessments based on comparisons with industry best practices. DECLINES (shown in red, above) could indicate a change in trades, product specs, or quality management. Source: IBACOS

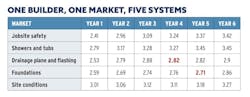

This production builder saw relatively consistent improvements in construction quality across five key building systems assessed on a scale of 0 to 4 over six years in one of its markets. The benefits of benchmarking against industry best practices include better trade relations and fewer warranty service calls and associated costs. Source: IBACOS

Real cost data from 150 home builders representing 86,000 closings shows that average warranty service costs rose 13% while home sizes shrank by 5%. This could indicate a dip in construction quality practices or management and/or higher costs for labor and materials needed to fix warranty issues. Source: Constellation HomeBuilder Systems

“We have a ton of data from a wide range of sources that we use to drive decision-making,” Wick says. “It’s not about listening to others around you or one person coming up with a great idea. Good analytics should eliminate inference to improve quality operations.”

Understanding analytics is one thing; doing something about them is what matters.

“The most important thing is what you do after the benchmark is set,” Wick adds, from refining products and processes to reestablishing those benchmarks as technologies and performance improve. “Construction standards define exactly how we want a window or shower installed, which creates efficiencies for the workforce by reducing the learning curve and establishing a repetitive process.”

Wick also points to a home’s warranty service record as the ultimate benchmark for construction quality. “Warranty is where we learn,” he says. “If you don’t take a hard look at the things you return to fix after you sell the home, then you’re doing everyone a disservice.”

The Role of Benchmarking in Examining Costs

What do you spend on warranty service work? And, if you track it, to what level of granularity—and by definition, value—can (or do) you examine it?

What about variances to budget for key product categories, or by their share of your sales prices? How did those costs change during and after the COVID-19 pandemic?

While job cost analyses are far more common and standardized than construction-quality assessments, the two are similar in that they both provide valuable, if often untapped, insights that can help builders be more competitive and improve profitability. “I love getting in the weeds of data to understand the storytelling aspect and turning messy data into user-friendly reporting,” Constellation’s Mulroy says.

How? With its client’s permission, Constellation extracts real cost data that builders input into the company’s software programs and then shares it anonymously in the aggregate with its clients to benchmark common costs on a national, state, or perhaps local market scale—datasets that represent more than 86,000 homes closed by 150 builders in 37 U.S. markets last year (see charts above and below).

Variance costs erode profitability, so comparing variance costs against budget (above) for key product categories is critical to catching and fixing them.

The cost share of key products (above) offers a valuable snapshot for the purchasing team to negotiate better pricing. Source: Constellation HomeBuilder Systems

One of those clients is Riverside Homebuilders, a Fort Worth, Texas-based company that earned nearly $272 million from 594 closings in 2023, making it the No. 86-ranked builder among our 2024 Housing Giants.

The company started investing in analytics about a year and a half ago, says operations analyst Scott Jacobson, and it uses Constellation’s BuilderMetrix platform to source accurate financial and operational data from live enterprise resource planning (ERP) systems—in layman’s terms, real (and real-time) data from real-world experiences.

“That system allows us to generate data and reporting that aligns with our mission and vision to enhance decision-making,” he says. “Part of the art of data science is getting useful, pragmatic insight that is more than information alone.” Whatever benchmarks Riverside establishes must be “validated and rooted, and support what we are doing as a company,” he says.

The process can be arduous, or at least out of most builders’ comfort zones. “It requires active listening, collaborating, and developing benchmarks and processes that enhance our ability to deliver what matters the most to our division leaders,” Jacobson says, “and with a certain cheerful curiosity about your work and how to do it better.”

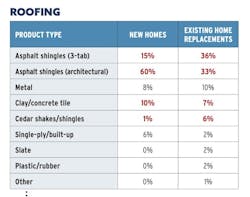

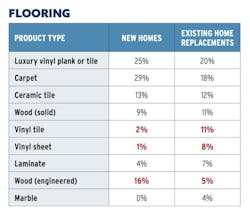

The DIFFERENCES (shown in red in these charts) between what builders specify in new homes and what consumers select for remodeling projects can vary widely. That difference could be due to a disconnect between builders and current consumer trends, or by costs, available supply, or consumer perceptions of building material quality. Source: Home Innovation Research Labs

Using Benchmarks to Track Trends and Stay Competitive

“Home building is a business that rewards builders who provide value to homebuyers,” says Ed Hudson, director of Market Research at Home Innovation Research Labs, in Upper Marlboro, Md. “The builders that do it most effectively stand to be rewarded the most, which is where the benefits of benchmarking come in.”

At Home Innovation, Hudson and his team study the intersection of product innovation, builder practices, and consumer preferences to improve the quality, affordability, and sustainability of newly built and renovated housing. In the process, they give builders valuable, product-specific insights into what their peers are up to and what consumers want—and will pay for—in a new home.

Home Innovation's Annual Builder Practices Survey (ABPS) gathers data for more than 50 product categories and home features from about 1,500 builders, a study with a bank of data representing the market volume and market share of almost every part of a house for the past 30 years.

“We can provide that data down to the state or metropolitan area to allow builders to track trends and know what their competitors are doing,” Hudson says.

The National Association of Home Builders’ latest Cost of Doing Business Study reporting 2020 financials from 607 builders provides benchmarks for the average share of hard costs against revenue and shows the impact of various operating expenses on net profit (see footnotes below chart), especially for those purchasing and developing land for all of their building projects.

In turn, builders can adjust their home designs, product specifications, and marketing strategies to either keep up with or surge ahead of the market while better meeting consumer wants and needs ... and taking “secret shopping” to the next level.

Hudson also keeps a close eye on Home Innovation’s Annual Consumer Practices Survey, a companion to the builder version that studies the remodeling sector for design and product trends, which he says serve as data-driven indicators of what’s to come in new construction.

“Consumers drive remodeling, so what goes into their home renovation projects is a more timely reflection of trends than new homes offer, especially for products such as flooring materials and cabinet styles,” he says.

Consider the rise in popularity of luxury vinyl tile flooring, which Hudson says caught on much more quickly in remodeling than it did in new construction—one of several examples indicating that gap (see roofing, front entry door, and flooring selections charts, above).

“If you want to improve performance through benchmarking, establish best practices to aim for,” Hudson recommends. “And then benchmark your performance and improvements against them.”

Home Builder Business Benchmarks: Tightening the Focus

Most benchmarking advocates encourage companies to look outward and compare their performance against others in their field or market, but home builders are often wary of the reliability and comparative accuracy of third-party data.

Large-volume production builders operating in multiple states and perhaps several locations with that footprint, however, can and have found value in looking inward to a sort of “micro-industry” under the corporate umbrella to benchmark various performance metrics. “Internally, we measure everything that we can across our divisions,” says Matt Graves, VP of production for Drees Homes (No. 28 in our 2024 Housing Giants rankings). Based in Fort Mitchell, Ky., Drees Homes builds in 10 metro markets across seven states, earning a reported $1.65 billion from 2,128 closings in 2023.

The company tracks customer satisfaction, trade relations, and cycle time, among several other metrics, which it uses to fulfill its mission of “doing the right thing,” Graves says.

“Benchmarking is about using data to make informed decisions instead of shooting from the hip,” he adds. “Our objective is continuous improvement wherever possible.”

That’s a common theme among builders that benchmark. Thrive Home Builders, Pro Builder’s 2017 Builder of the Year, a perennial Housing Giant (No. 217 this year), and a leader in energy-efficient, high-performance home building, has had its ups and downs with data but always finds value in benchmarking. “We’ve been challenged to make sure we’re presenting the right data and only so much for us to take action,” says Bill Rectanus, Thrive’s COO. “The hardest part is learning how to use that data and interpret it properly.”

While data-driven benchmarking is generally kept in-house, Thrive has shown it is open to more anecdotal opportunities to compare itself with—and learn from—other builders and industry standards.

In 2018 and 2019, it opened itself to intense scrutiny from the National Housing Quality Awards program, a measuring stick of operational best practices ranging from strategic planning to trade relations and human resources, earning the company Bronze and Silver awards, respectively.

Builder Benchmarking Group: Sharing Experiences as a Way to Grow and Improve Business

Thrive also helped establish the Builder Benchmarking Group (BBG) run by the Energy & Environmental Building Association (EEBA). Akin to the 20 Clubs program from the National Association of Home Builders, EEBA’s group gathers 20 home builders from disparate, noncompetitive markets to share experiences and best practices specific to delivering high-performance homes.

“We talk about new products and innovations in the market, how someone builds their wall assembly and things like that,” says EBBA CEO Aaron Smith. “But we also shared how we were managing COVID lockdown and work-from-home policies, which was very valuable.”

Casey also makes an appearance at the BBG’s semi-annual in-person meetings, namely to benchmark the members’ financial statements against one another, against industry standards, and even against other industries.

“There is tremendous value in seeing how our costs compare to other builders and that we are spending so much more money in a particular category or very little in another, and it gives you an opportunity to ask them how they do it and why, and what tools they have,” Rectanus says. “And then you start sharing best business practices to help each other out and it's just a great learning opportunity.”

By Sean Vincent O’Keefe, with Pro Builder editorial director Rich Binsacca

Sean Vincent O’Keefe is a Denver-based writer and communications professional for the design, construction, and commercial building products industry.