Housing Affordability Affects Housing Choice

The National Association of Home Builders firmly believes that the nation’s housing affordability crisis is a problem of insufficient supply. NAHB members want to construct affordable homes and apartments for people of all income levels, and in all areas where the housing is needed, including the suburbs.

To that end, NAHB strongly supports the Fair Housing Act and the intent of the 2015 Affirmatively Furthering Fair Housing (AFFH) Final Rule, though the rule had serious implementation problems and was repealed by the Trump administration.

Without certainty in local land use policies, and federal funding to serve low- to moderate-income renters and homeowners, builders face substantial difficulties providing affordable housing.

Similarly, most of NAHB’s multifamily builder members have stories about NIMBY (not in my back yard) opposition thwarting the development of new apartment communities.

NAHB has a long history of working with all levels of government to increase new housing supply, preserve affordable housing, and expand housing choice for buyers and renters. Those efforts should be a point of emphasis now.

We encourage policymakers to focus on incentives for local governments to embrace new housing developments, including affordable low-income and workforce housing. Federal policymakers should also address concerns about the 2015 AFFH Rule’s burdensome compliance mandates, potential for excessive federal encroachment on local land-use decisions, and its vague approval processes, which could jeopardize participants’ housing and community development funds.

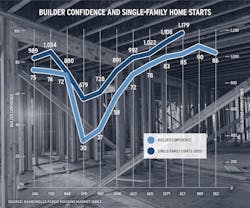

2020 Single-Family Starts Mirrored Builder Confidence

Builder confidence in the market for newly built single-family homes fell four points to 86 in December, according to the latest NAHB/Wells Fargo Housing Market Index (HMI). Despite the modest decline, the figure was still the second-highest reading in the series’ 35-year history, after November’s all-time high reading of 90.

The HMI has been at or near record highs for four consecutive months. The metric reflects positive market conditions, including low interest rates and strong demand for housing, as residential construction remains a bright spot for the recovering economy.

The graphic at right demonstrates the relationship between the HMI and single-family starts. The HMI gauges builder perceptions of current single-family home sales and expectations for the next six months as “good,” “fair,” or “poor.”

The survey also asks builders to rate prospective buyer traffic. To gauge builder confidence, any number above 50 indicates that more builders view conditions as being good rather than poor.