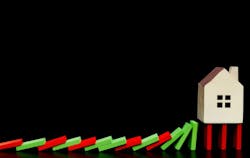

Housing Experts Forecast Falling Home Prices in the Next Phase of a Market Correction

In June, housing experts sounded the alarms of a market reset as mortgage rates skyrocketed and homebuying activity slowed nationwide. Two months later, August housing data reveals the impact of that downturn on affordability, and according to Fortune, the next stage of a full-blown correction could be defined by double-digit price drops in the nation’s most popular markets.

Already, home prices are falling in 98 regional markets where housing costs reached unsustainable highs during a mid-pandemic homebuying boom. Moody’s Analytics predicts that U.S. home prices could fall 5% in the year ahead, but in significantly overvalued housing markets like San Francisco and Boise, that price drop could range from 5% to 10%.

Among the 148 regional housing markets tracked by John Burns Real Estate Consulting, 98 housing markets have seen home values fall from their 2022 peaks. Just 50 markets remain at their peak.

In 11 markets, the Burns Home Value Index* has already dropped by more than 5%. That includes a 8.2% drop in San Francisco home values. While it's common for median list prices to drop around this time of year, it's not common for home values or "comps" to fall because of seasonality. Simply put: The home price correction is sharper—and more widespread—than previously thought.