Housing Giants Are Changing With the Times

This 2015 Housing Giants report, which includes our annual rankings of the largest builders and the state-by-state map, as well as deeper dives into safeguarding your business from the next downturn, growth from consolidation, and process improvement, offers a closer look at the gains made, how they were achieved, and how they can be sustained.

Overall, the largest 225 Housing Giants (of the 277 Giants reporting) made respectable headway over 2013: a 16 percent increase in revenue and a 7-percent bump in closings. But taking a longer view reveals just how far they’ve come. Revenue for the top 225 jumped 107 percent and closings 57 percent since the industry’s low point in 2011. This is especially laudable considering the dearth of affordable land and skilled labor and the climbing cost of materials.

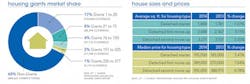

While much of that growth was organic, a good deal of it came from mergers and acquisitions. A big push toward consolidation, which began in earnest with the announcement in late 2013 of Toll Brothers’ intention to purchase Shapell Homes, followed closely by TRI Pointe’s Weyerhaeuser acquisition (which gave the company a stratospheric 566 percent increase in revenue year over year), has not slowed yet. UCP, Century Communities, William Lyon, and LGI all increased revenue and market reach through acquisitions in 2014, and more are in the pipeline.

Some of the acquisitions occurred as a way to maintain growth in profits for shareholders and some to enable a company to gain a foothold in a new market with local people already in place, but in many cases they were also driven by the need for land. Availability of land has been on the Housing Giants’ list of biggest challenges for several years, but it tops the chart in 2014, with 56 percent of respondents calling it a concern. And it is: Prices in some areas have skyrocketed. In Phoenix, for example, the median price of residential land increased by 40 percent in 2014. It’s no surprise that a major factor in Toll’s decision to purchase Shapell was its land portfolio of 5,200 home sites, 97.5 percent of them entitled, along the pricey California coast.

With 41 percent of Housing Giants calling niche markets one of their biggest opportunities, it seems many of them have fully embraced product diversity. No longer do they build one size fits all single-family detached homes in the suburbs. Today’s home building company relies on serious market research to discover and hone its target market. During the last few years, builders have wrapped their arms around multifamily, multigenerational, urban, net-zero, walkable, infill, and, yes, even farm-to-table-style new-home communities. But perhaps even more remarkable is the number of single-family detached and attached builders, more than 13 percent on this year’s list, offering both for-sale and rental properties.

Ryland Homes CEO, Larry Nicholson, presided over impressive increases in revenue, closings, and number of active communities. When Nicholson sums up 2014, he’s positive, and with good reason: Ryland had a very good year and is poised for substantial growth. Yet when Nicholson speaks of the future, he adds an important condition “provided the macro factors that influence housing remain stable or improve”; his optimism wisely tempered by the events of the preceding years.

Despite the pace of the recovery, and perhaps even because of it, the nation’s largest builders have shown themselves to be innovative, resourceful, and more ready to change with the times than ever before. Click here to see the full Housing Giants 2015 Ranking List. PB