Single-family housing starts in 2016 increased by 9.3 percent over the previous year, according to census numbers, and it’s little surprise that national builders played a significant role. But data culled by housing market research firm Meyers Research of the most active builders in the top 50 metro areas found that in some Metropolitan Statistical Areas (MSAs), regional builders not only held their own but rose to the top.

Typical advantages for big builders include brand familiarity and easier access to financing and land acquisition. But the benefits of size can cut both ways. Smaller home builders can be more flexible in meeting customer needs. Because they are small and local, these builders are experts at offering consumers a more personalized, informed experience. Here’s a look at how five regional builders remain not only competitive, but in some ways outperform their bigger national competitors.

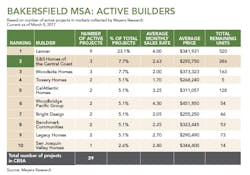

S & S Homes of the Central Coast Bakersfield, Calif.In a state where home prices have gone hog wild, oil and agriculture-rich Bakersfield, located in the San Joaquin Valley, remains one of the more affordable areas in which to live. Home prices there increased by more than 6 percent last year, but the cost of living is 0.3 percent below the national average, and the median home price is $234,400 compared with $498,000 in the Los Angeles metro area, according to Forbes’ 2016 ranking.

S & S Homes is based in San Luis Obispo County on California’s Central Coast, but most of its projects are in Bakersfield, 100 or so miles north of LA. As a regional builder primarily focused on single-family communities, S & S has built about 2,000 homes over the last 30 years in an area where three-quarters of households consist of families.

S & S recently sold out of Crestview Meadows, a 98-home neighborhood; has a small number of homes still available at Tyner Ranch III, a 44-lot development; and is now selling Wildhorse at Bridle Creek, a 318-home community

with prices starting in the high $200,000s. Copper Creek is the builder’s premier community, with 140 homes. Fifty of the lots are controlled by S&S. The builder also has a small semi-custom community on the Central Coast.

When it comes to holding steady against the nationals, Janet Axelsen, VP of operations and a company co-owner, credits teamwork and flexibility. She says open floor plans and lots big enough to accommodate three- or four-car garages or recreational vehicles are popular with her buyers. Each plan incorporates customizable options, including many that offer additional living spaces for multigenerational families.

A recent addition to the builder’s portfolio is a modern ranch farmhouse exterior style that, before now, wasn’t readily available in Bakersfield, Axelsen says. S & S plans to continue bringing appealing floor plans with standout customizable options to the production home market at an affordable price.

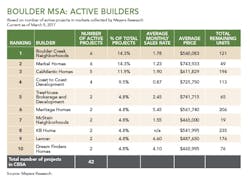

Boulder Creek NeighborhoodsLouisville, Colo.Nestled against the foothills of the Rocky Mountains and 25 miles northwest of Denver, Boulder sits more than a mile above sea level. With abundant protected open space, the area is famed for all things outdoors, including biking, hiking, and rock climbing. Its physically fit and educated residents boast a 94 percent high school graduation rate, and 60 percent of residents hold a bachelor’s degree or higher. But there’s a cost for living in such natural beauty: Boulder’s median home price is nearly half a million dollars, and the cost of living is almost 20 percent above the national average.

Boulder Creek Neighborhoods is the area’s No.1 builder, and it knows that buyers probably want to spend more time adventuring or playing with grandchildren than they do maintaining their house and yard, so its homes are aimed at those seeking an easier way of life, says David Sinkey, president and founder. “That can be the empty-nester Baby Boomer demographic, but many times it can also be busy professionals, single folks, or those who like to travel,” he says. The homes are built for low maintenance, but that buyer target cuts a wide swath beyond buyers 55 and older.

Sinkey admits that providing attainable homes that meet discerning buyers’ standards can be a challenge. While often on Top 10 lists of most desirable places to live, Boulder was also rated the most expensive city in Colorado last year by financial news website 24/7 Wall St. Boulder Creek works in areas where there’s already significant price escalation of land, fees, and materials, as well as a shortage of quality trade labor, and Sinkey says the builder will continue to evolve its product and price points without compromising construction quality or floor plan design.

Boulder Creek is currently building single-family patio and attached homes in nine neighborhoods from Denver to Boulder County and north. Prices range from the mid-$200,000s to above $1 million. “The Denver market is extremely tight on inventory right now, with the number of homes for sale quoted as being at the lowest level in 30 years,” Sinkey says. “Add to that the unique marketing positioning of our low-maintenance homes, and we really can’t build them fast enough.” The builder foresees a growing market as Baby Boomers continue to retire here and out-of-state buyers move to Colorado. But Sinkey says his company will also stay on the forefront of new housing ideas. Case in point: Boulder Creek’s Wee-Cottages are 900 square feet, with a starting price half that of other new homes in the Denver market.

EGStoltzfus HomesLancaster, Pa.EGStoltzfus Homes is tied for most active builder with another Lancaster, Pa.-area regional. The builder's Dalton American model, targeted to families, is 2,374 square feet, with four bedrooms, 2 1/2 baths, and a two-car garage.

Here, modern and low-tech lifestyles coexist. Regional builder EGStoltzfus Homes has found success by connecting at a local level—something national builders may find more difficult to do. Founded by Elam G. Stoltzfus Jr. nearly 50 years ago, the family-owned business is in a virtual tie for first place in its MSA based on the number of active projects (see chart, page 41). Andy Dula, COO and CFO, credits EGStoltzfus’ success to attention to relationships, not just with customers but also with employees, trade partners, suppliers, and associates. “A lot of our business comes from referrals and repeat customers, and 90 percent of our customers would recommend EGStoltzfus to a friend or relative,” he says.

EGStoltzfus is currently building in 18 communities throughout five counties, with prices ranging from the mid-$100,000s for townhomes to $500,000 and higher for single-family homes. “Our prospects and homebuyers look for a builder that can construct a high-quality home that delivers on value,” Dula says, “and EGStoltzfus hangs its hat on doing just that. We don’t compromise quality or craftsmanship for cost savings. Many options come standard in our homes and, in turn, we’re able to create remarkable spaces for our customers to live and work.”

The playing field isn’t always a level one when it comes to competing with bigger builders, but Dula knows that the key is leveraging the unique opportunities that a regional builder has to stand out. A close-knit, dedicated team that prizes excellence is a key factor, he says. Although EGStoltzfus may not spend what a national builder does on advertising or branding, it plays to its strengths as a local builder.

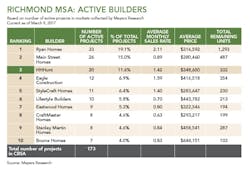

HHHuntRichmond, Va.“We’ve built strong relationships in the market and are trusted to deliver,” says Dan Schmitt, president and COO, of HHHunt’s competitive position as a local. An important strategy is diversification: apartments, senior living, single-family detached, townhomes, and master planned communities. HHHunt builds in Virginia and North Carolina for first-time homeowners, move-up buyers, and active adults. It has apartment and senior-living communities in Virginia, North Carolina, Maryland, and South Carolina. The builder makes this individual attention a focus. “We have four brand promises,” Schmitt says. “The first is employee-centered, the second is customer-focused, the third is [focused on] quality, and the fourth is being an engaged community partner.”

HHHunt stays out of the custom business but is aware that meeting the demands of a growing area and staying up to date with design trends is key. “We’re growing so fast but can’t continue to do the same as we’ve always done,” Schmitt says, noting that keeping up with new ideas is essential.

The builder sees growth in its future and has an eye on urban and suburban infill opportunities for multifamily, senior, and higher density multigen communities. Schmitt also sees the Millennial homebuying market breaking open in the next decade. “Right now they’re mostly living in apartments, but they’ll be looking for their first home in the next 10 years and they’re going to want something different from what’s been available before,” he says. Beyond that, the vast part of the population headed into pre-retirement and retirement wants an active life. “In a lot of ways, Millennials and Baby Boomers want similar things, just at different times of day,” Schmitt says.

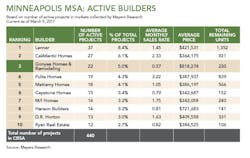

Gonyea Homes & RemodelingMinneapolisRanked No.3 in its MSA, Gonyea’s knack for staying competitive is based on good quality and a great build experience, says company owner Tony Sonnen, who also handles sales and marketing. But maintaining an edge depends on a great team of industry pros who love what they do and strive to deliver the ultimate customer experience, adds COO and co-owner Tyler Wenkus. The company provides design-build remodels and new homes from $150,000 to $2 million. It formed a production building division in 2016 to fill the void between local custom builders and national production builders and expects to produce 20 to 30 projects in 2017. It also has a land development team that handles acquisition and development, providing finished lots in order to maintain 18 months of inventory for each division.

Gonyea is busy. Its new-home division closes 60 to 70 homes annually and controls more than 200 lots in several of the Twin Cities’ most desirable communities and school districts. The long-term goal is 100 to 150 homes annually, plus 20 to 30 remodels per year. Two things will drive this success, according to Wenkus: “Our business model is unique, but the key to our differentiation success is land acquisition,” he says.

Staying competitive with national builders is certainly part of the plan. But Gonyea is also a neighborhood developer, and it offers one-stop shopping with a boutique-like design center staffed to help buyers sort through numerous choices. Because building a new home can be an overwhelming process for buyers, Gonyea delivers by being a trusted guide, Sonnen says. And exceptional customer service will continue to be a primary driver, he adds. It’s a strategy that seems to work. “Over half of the other builders were gone when we came out of the downturn,” Wenkus points out. “Now it’s a smaller pie, but we have a larger piece.” PB

Debbie Reslock is a certified planner and freelance writer. She’s based in Evergreen, Colo.