Lumber Prices Hit Another Record High

The price of lumber reached an all-time high of $1,495 per thousand board feet on May 14, according to wood industry price and news service Random Lengths. That’s up more than 300% from May 2020, when the price was roughly $360 per thousand board feet.

Record-high lumber costs have pushed up the price of the average new single-family home by almost $36,000, according to analysis by economists at the National Association of Home Builders (NAHB).

In addition, rising lumber prices have added nearly $13,000 to the market value of the average new multifamily home, which translates into households paying $119 per month more to rent a new apartment.

And the problem isn’t confined to lumber prices and supply. Prices paid for goods used in residential construction, excluding energy, have increased more than 12% in the past year, according to a recent Producer Price Index report from the U.S. Bureau of Labor Statistics. Copper, brass, steel, and ready-mix concrete prices are rising due to stressed global supply chains.

RELATED

- Lumber Prices Hit Record High, Threatening Housing's Momentum

- A Look at Lumber Prices From the Supply Side

- What’s Behind the Softwood Lumber Price Spike?

- NAHB Addresses Rising Lumber Prices, Builder Concerns

NAHB is working on multiple fronts to address the crisis, including meeting with and asking the Biden administration to find ways to increase domestic lumber production and temporarily lower Canadian softwood lumber tariffs. NAHB members have provided testimonials about how lumber prices are affecting their business.

NAHB also is working with lumber industry officials to ensure they understand that high demand for lumber isn’t a transient phenomenon and is leading a coalition of more 35 organizations asking Commerce Secretary Gina Raimondo to study the problem and work with industry stakeholders to increase lumber production.

Home Office or Exercise Room? Or Both?

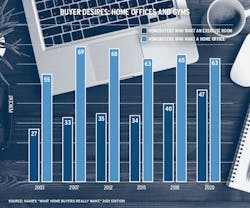

The latest edition of NAHB’s study of consumer preferences, “What Home Buyers Really Want,” reveals that 63% of recent and prospective homebuyers want a home office.

Since coming in at 55% on the 2003 survey, the share of buyers who want a home office has remained at or above 63% in every edition of the survey since 2007. Home offices are particularly popular among buyers paying $500,000 or more for their home (79%), Millennials (74%), and married couples with children (70%).

When asked about the desirability of an exercise room in the home, 47% of recent and prospective homebuyers rate an exercise room as essential or desirable. While buyers’ desire for a home office is still markedly higher than it is for an exercise room, the increasing popularity of home exercise rooms is unmistakable, having grown from 27% in 2003 to 47% in 2020.

Get a comprehensive look at “What Home Buyers Really Want” at eyeonhousing.org/special-studies.