City migration, preference for community could be harbingers for infill

Contrast the interpretations regarding living preferences for demographic groups with U.S. Census numbers that show where people actually live and you have a riddle about future housing demand.

A report from the Urban Land Institute showed that 61 percent of the three major generations polled—Millennials, Gen X, and Baby Boomers—said they would prefer living in a smaller home with a shorter commute than in a larger home with a longer commute. More than half also said they would want to live in mixed-income housing that is close to shopping and public transportation. Those findings suggested demand for infill housing that is less car dependent would increase while demand for homes in the distant suburbs would decline.

The Brookings Institution also released its analysis of Census data for the nation’s 51 largest metropolitan areas. Those figures showed the population of cities grew faster than those cities’ suburbs in most cases during July 2011 through July 2012 compared with the 2010 to 2011 period. Overall city populations increased 1.12 percent versus 0.97 percent for the suburbs, but the factors to explain this phenomenon are not so clear-cut.

Some of the analysis of the Brookings’ number-crunching reported in the media attributed this growth to urban revival, while others speculated that city residents are unable to move because their ability to buy in the suburbs has been hurt by the recession and slow recovery.

Sixteen of the 20 largest cities posted accelerated growth rates. Among those metros were Chicago, Indianapolis, Columbus, Ohio, Los Angeles, San Francisco, and San Diego—cities that grew much more slowly during the suburban housing boom years. New York led all cities by gaining 161,000 people between the 2010 Census and July 2012, compared with an increase of 166,000 during the previous decade. Los Angeles added 65,000 people compared with 97,000 over the previous 10 years. The fastest-growing cities are in the Sunbelt led by Austin, Fort Worth, Dallas, San Antonio, Charlotte, N.C., and Phoenix.

One Chicago builder benefitting from the migration to urban infill is Andriy Stetsyuk of SmartTech Homes. His company recognized there was a shortage of new infill single-family homes for college-educated “tech junkies” looking to move into the city or out of their apartments and condos. Stetsyuk and partners adopted designs that take a small footprint and build Energy Star-rated homes, using methods like spraying an air- and moisture-infiltration barrier from Tremco on the building envelope and installing features such as a tankless water heater and high-efficiency HVAC.

Eighty SmartTech homes have sold since the first product went to market in 2010, with floor plans from 2,400 to 3,200 square feet and prices ranging from $369,000 to $619,000. As land prices increase, SmartTech will unveil a home with less than 1,900 square feet.

“Urban jobs have a lot to do with (people thinking about) cutting commute time and investing in the quality of life,” said Karen Biazar of North Clybourn Group, the listing agent for SmartTech. “People who raise their children are wanting to come back to the city. It’s also a combination of people with children, people thinking of having children, couples that are in partnerships that don’t have children. It’s also about what is enough; since the recession, people are questioning whether they really need a 5,500-square-foot house. 2,400 (square feet) seems to be enough especially for the age groups that are prevalent in home buying.”

Zillow survey finds consumers need Mortgage 101

There may be opportunity in ignorance, particularly for builders and real estate agents who make an effort to educate consumers about basic mortgage information.

A recent Zillow Mortgage Market–place survey showed that consumers who took an online survey incorrectly answered basic questions about mortgages nearly one-third of the time. The lack of understanding is not novel since Zillow surveys as far back as 2011 reported almost half of survey participants back then admitted they were not confident in their knowledge of home loans.

Survey results showed one-third of first-time home buyers did not know that getting a home loan with less than a 5-percent down payment was possible. Twenty-four percent of home buyers believed that they would find the best interest rates and fees from the bank that they currently do business with, and 26 percent said they thought they were obligated to close their loan with the lender who pre-approved them. A third didn’t know they should shop around for mortgages because they assumed lenders were required by law to charge the same fee for credit reports and appraisals.

One in five, or 14 million homeowners according to Zillow, did not believe underwater borrowers could refinance. Thirty-one percent believed they have to wait seven years after a short sale or foreclosure to buy a home again. Typically the wait can be two to four years for a buyer with a short-sale history and three-to-seven years after a foreclosure to qualify for a new loan. A third did not know what the term annual percentage rate (APR) means, and half of prospective home buyers in the survey did not realize mortgage rates changed throughout the day.

Six builders break ground in Canyon Falls, Texas

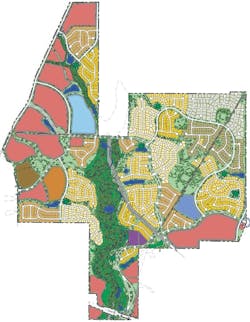

The first group of builders broke ground in Canyon Falls, a 1,200-acre master-planned community in Denton County, Texas.

Among the builders for the $1 billion development are Ashton Woods Homes, Roswell, Ga.; K. Hovnanian Homes, Red Bank, N.J.; Highland Homes, Plano, Texas; Toll Brothers, Horsham, Pa.; and Plantation Homes, a brand of McGuyer Homebuilders, Houston.

Canyon Falls is slated for 1,700 single-family homes priced from the high-$200,000s to $600,000s. The property will include such features as a community clubhouse, resort-style pool, sports field, playgrounds, and walking trails along a creek. The plan also calls for commercial development including retail and multifamily units. Construction of initial roads and home sites is expected to be completed late this year with home sales beginning in early 2014.

Wheelock Street Capital, Boston and Greenwich, Conn., acquired the property in July 2012 from Highland Capital Management for a reported $27 million to $30 million. The property had been in bankruptcy protection when Highland filed for Chapter 11 in 2010.

About the Author

Mike Beirne

Mike is the senior editor of Pro Builder and Custom Builder magazines. A two-time Jesse H. Neal Award winner, Mike has nearly 30 years of journalism experience plus numerous news and feature writing awards, including honors from the Society of Professional Journalists, the American Society of Business Press Editors, and the National Association of Real Estate Editors. He also operated a masonry restoration business for more than two decades. [email protected]

Sign up for our eNewsletters

Get the latest news and updates