NAHB’s Response to COVID-19, Supporting Builders

This is a longer version of an article that appeared in the April 2020 issue of Pro Builder.

Mitigating the Effects of the Pandemic

Recent weeks have seen growing concern and economic stress related to novel coronavirus mitigation efforts, including social distancing. The recommended strategies will continue to place large sections of the U.S. economy on pause through mid-April, and potentially much longer. With a growing number of individuals altering their work schedules and working from home, construction and manufacturing are experiencing disruptions as well.

As COVID-19 continues to affect all sectors of the economy, the National Association of Home Builders, in concert with its state and local partner associations, is working hard to moderate its effects on the housing industry and help members understand and respond to the evolving economic slowdown by:

• Providing NAHB members with access to a range of materials online, including updated economic forecasts and information about business continuity and personal preparedness on nahb.org/coronavirus.

• Offering consumer resources and materials to assist NAHB state and local partner associations on our coronavirus web page.

• Conducting a series of webinars to inform members about the association’s resources, policy advocacy efforts, and the industry outlook from NAHB chief economist Robert Dietz.

• Working with the White House on strategies to help support the housing sector regarding COVID-19’s economic impact.

Government Efforts and Response to Coronavirus

NAHB participated in a call with White House officials to discuss COVID-19 and strategies to aid the housing sector. Less than 48 hours later, President Trump put into effect NAHB’s recommendation to provide mortgage relief to homeowners, specifically that HUD would suspend foreclosures and evictions for FHA-insured mortgages through the end of April. Fannie Mae and Freddie Mac also will suspend foreclosures and evictions for at least 60 days for homeowners with mortgages backed by those enterprises.

Meanwhile, Congress passed an emergency response coronavirus bill that includes tax credits to help businesses and the self-employed cover some of the costs of mandatory sick leave included in the legislation.

Senate Republicans offered a $1 trillion economic stimulus bill that includes checks of up to $1,200 for taxpayers and $300 billion earmarked for loans to small businesses with fewer than 500 employees. These loans would be made available through lenders certified by the Small Business Administration.

The short-term outlook is negative for the economy as a whole, but policy help is underway.

NAHB’s government affairs team continues to work closely with the Trump administration and Congress and is encouraging policy makers to take action in the following areas:

- Work with HUD and USDA to ensure federal rental assistance programs are properly funded.

- Ensure uninterrupted processing of applications for federal mortgage insurance and loan guarantee programs assistance.

- Provide emergency rental assistance to help those unable to pay their rent due to lost income from COVID-19.

- Ensure there are no delays to Low-Income Housing Tax Credit projects that are in the pipeline.

- Let Fannie Mae and Freddie Mac purchase AD&C loans from community banks to help maintain the flow of credit for home building.

NAHB has also put forth a number of other policy proposals to ensure the residential construction sector remains healthy during this difficult time. Our message to the White House and Congress is simple, yet urgent: As housing goes, so goes the economy.

Meanwhile, Treasury Secretary Steve Mnuchin has announced that households and small businesses can defer tax payments without interest or penalties for 90 days. This covers a broad range of Americans, including small businesses that file as individuals that owe up to $1 million, and other categories of small businesses, sole proprietors, and corporations owing up to $10 million.

On the trade front, although the U.S. and Canada have agreed to temporarily close their border to “all nonessential travel,” trade will not be affected. As a result, lumber shipments into the U.S. should continue unabated. This is a positive development for the home building industry.

The Pandemic's Effect and the Economic Outlook

NAHB forecasts that second quarter GDP growth will be markedly negative, likely the worst performance since the third quarter of 2008. Approximately 40% of the economy is on a full or partial pause due to the coronavirus. Assuming containment efforts are successful within an eight-week period (consistent with South Korea's experience), NAHB forecasts a weak third quarter followed by a rebound at the end of 2020.

The unemployment rate will certainly rise in the months ahead. Furloughs and layoffs are already being announced in heavily impacted sectors.

While this 2020 downturn will be sharp, it may also be short. The economy was in solid shape at the start of 2020, which was particularly true for housing. Single-family home construction in February was up almost 7% from an already strong pace in January, as warm weather accelerated 2020 construction activity.

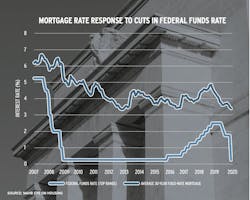

The short-term outlook is negative for the economy as a whole, but policy help is underway. The Federal Reserve dramatically reduced the federal funds rate to effectively zero (see chart, below), restarted quantitative easing (including for mortgage-backed securities, in response to recent liquidity concerns in the mortgage market), and made other policy moves to help ensure the continued operation of the financial system. If Congress and President Trump can agree on a $1 trillion stimulus package, that will help the economy bridge the gap from now through August.

Photo: avmedved / stock.adobe.com

This is uncharted territory, and NAHB will continue to survey the industry, analyze the data, and advocate on behalf of the residential construction sector. The association has gone into overdrive to help members understand and respond to the fast-changing economic environment, making sure its members have the tools needed to come out of this crisis ready to respond to an improving market.

All things considered, history suggests a robust rebound will follow this significant but temporary shock to the economy.

Access a PDF of this article as it appeared in Pro Builder's April 2020 digital edition