NAHB Spring Forecast: Builders Have a Lot of Catching Up to Do

While 2015 will be a “good, but not great year” for home builders, 2016 will be much better with housing starts jumping 39 percent to an annual rate of 977,000 homes, David Crowe, chief economist and senior vice president for the National Association of Home Builders, said Wednesday during the group’s Spring Construction Forecast Webinar.

But a builder in the virtual audience asked isn’t that forecast overly optimistic? What are the supporting arguments for double-digit growth? Crowe admitted that previous NAHB forecasts perhaps did come out on the high side of what eventually did happen but those prognostications were accurate regarding the direction of the economy and the industry. And as for next year, he said the national economy is entering a period of reasonable strength and consistency. So those conditions bode well for an industry that has an enormous amount of space to make up in terms of lost sales just as more household formation and rising incomes could unleash pent up demand.

Robert Denk, NAHB’s assistant vice president for forecasting analysis, supported that message with a presentation showing how far builders are from normal in the midst of a rebounding economy.

“We really have turned the corner and the strength of the housing industry, particularly on a regional basis, will be about the underlying strengths of those local economies and a lot less about the boom and bust cycle,” Denk says.

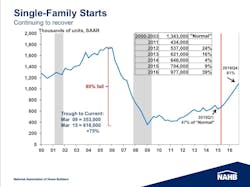

Defining 1.3 million starts that the industry saw between 2000 and 2003 as the norm for single-family housing construction, Denk said builders “have a lot of recovery ahead of us” as the national average for housing starts during fourth quarter 2014 was just 47 percent of the norm. Home prices in many locales and states have risen, which points to a healthy market.

“It’s too early to worry about a bubble,” Denk said, noting that rising prices during the overheated 2006 market pushed the ratio of median house price to median income to 155 percent, which was not sustainable. That figure was 124 percent going into 2015 and could fall to normal and sustainable levels if the rate of home price increases continues to decline and if mortgage interest rates stay low enough to support elevated price levels.

Foreclosures have declined in all states since 2009 and the inventory of distressed properties cutting into new home sales will be less of a problem moving forward in many markets. Distressed homes make up about 10 percent of residential properties available for sale nationwide--although there will be some metros, particularly in states where evictions run through a lengthy court proceedings that can take a couple of years--that will have more foreclosed homes are about one third of the properties in the market, said Sam Khater, deputy chief economist at CoreLogic.

Eight of the ten top sales markets are in the Carolinas and Texas, and home price growth was fastest in coastal states. But in noting how much ground builders have to make up, Khater said only three markets nationwide—El Paso, Texas; Raleigh, N.C.; and Charleston-North Charleston, S.C.--had more sales volume compared with the early 2000s. New home sales as a share of the total market averaged 8 to 9 percent nationwide during the past few months vs. 12 percent during 2001. Markets such as Chicago, Philadelphia, Detroit, Buffalo, N.Y., which usually have new home sales range between 10 to 12 percent of all single-family home sales currently are under 4 percent.

“We still have a ways to go,” Khater said.

Crowe estimated that between 2009 and 2014 builders were hit with lost sales of 7.4 million homes.

“We have a lot of catching up to do,” Crowe said. “Some of those lost sales will never take place, but it does give you the realm of how many we did lose and some of them will come back as new and existing home sales.”