What the Inflation Reduction Act Means for Home Builders

On Aug. 16, 2022, President Biden signed into law the Inflation Reduction Act (IRA), a sweeping measure that seeks to address climate change, lower prescription drug prices, and reduce inflation. The bill’s passage was assured after it cleared the Senate on a party-line vote, with Vice President Kamala Harris breaking the 50-50 tie.

“The final package is a mixed bag for housing and our members,” says Jim Tobin, the National Association of Home Builders’ (NAHB) chief lobbyist and EVP for government affairs. “The IRA’s biggest flaw,” he adds, “is the lack of any money to alleviate the housing supply crisis.”

The bill includes measures that may be beneficial to the housing industry, and others that may be harmful and are likely to drive up the cost of housing. Despite the positive 11th-hour changes to the legislation pushed by NAHB, overall industry concerns with the legislation outweigh the benefits.

RELATED

- NAHB Chairman's Message: NAHB Poised to Help Builders as Economy Slows

- NAHB 2022 Legislative Conference Puts Pressure on Congress to Act on Housing Affordability

- Refinance, Purchase Activity Slows as Mortgage Rates Surge

Climate Provisions in the Inflation Reduction Act

The measure’s much-touted climate provisions include programs to increase the efficiency and resiliency of Department of Housing and Urban Development-backed housing and existing homes, changes to the residential energy tax incentives, and a billion-dollar grant program to provide incentives for the adoption of the 2021 International Energy Conservation Code (IECC) for residential buildings, the ANSI/ASHRAE/IES Standard 90.1-2019 for commercial buildings, and net zero codes.

The grant program is designed to pressure state and local governments to adopt more stringent energy codes. The practical effect will be to raise housing costs even further while doing little to provide meaningful energy savings for homes and apartments.

Two-thirds of the funds, or $670 million, will be made available for the adoption of energy regulations for residential and commercial buildings that meet the zero energy provisions in the 2021 edition of the IECC. NAHB believes these zero-energy targets are not appropriate for most jurisdictions and are not cost-effective for consumers.

NAHB Successes in IRA Legislation

NAHB was successful in removing the Democrats’ plan to tax carried interest and in eliminating the proposed expansion of the net investment income tax.

Leading up to the vote, NAHB worked with Sen. Kyrsten Sinema (R-Ariz.) to address concerns about the bill’s provision that would curtail the tax break for carried interest.

“Senator Sinema’s decision to push back against the carried interest provisions is a meaningful win for real estate and for our multifamily members,” Tobin says.

The bill advanced after Sens. Joe Manchin (D-W.V.) and Chuck Schumer (D-N.Y.) reached an agreement in late July. Manchin’s support for the bill surprised politicians on both sides of the aisle because he was previously unwilling to support the Democrats’ expansive agenda on climate change and tax increases amid rising inflation and an uncertain economic climate.

“Without a doubt, this is a big—albeit smaller-than-hoped-for—political win for President Biden and congressional Democrats and gives their candidates something to run on in November,” Tobin says.

NAHB will continue to work at all levels of government to minimize the impact of excessively stringent energy codes on residential construction that drive up the cost of housing but deliver little benefit to consumers.

As Mortgage Rates Rise, Housing Affordability Suffers

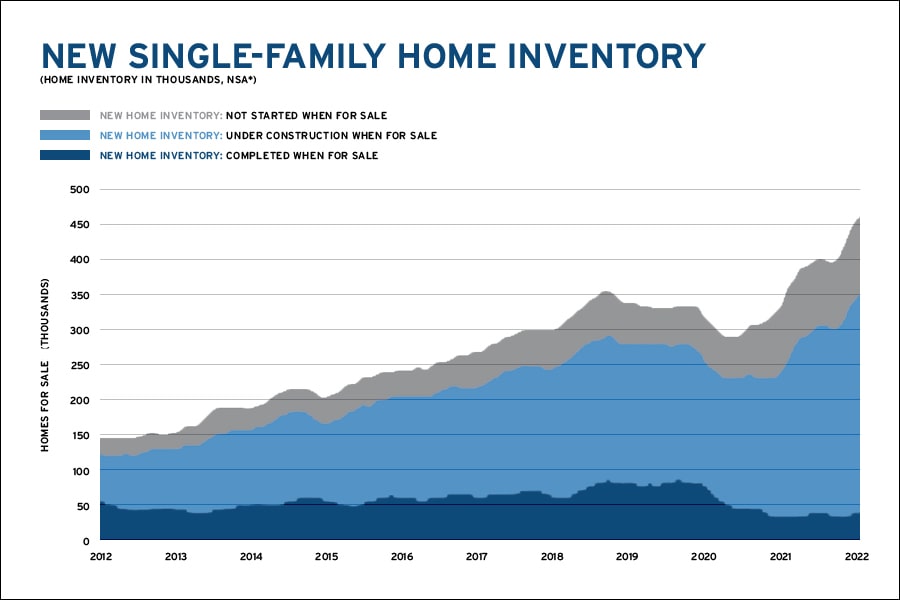

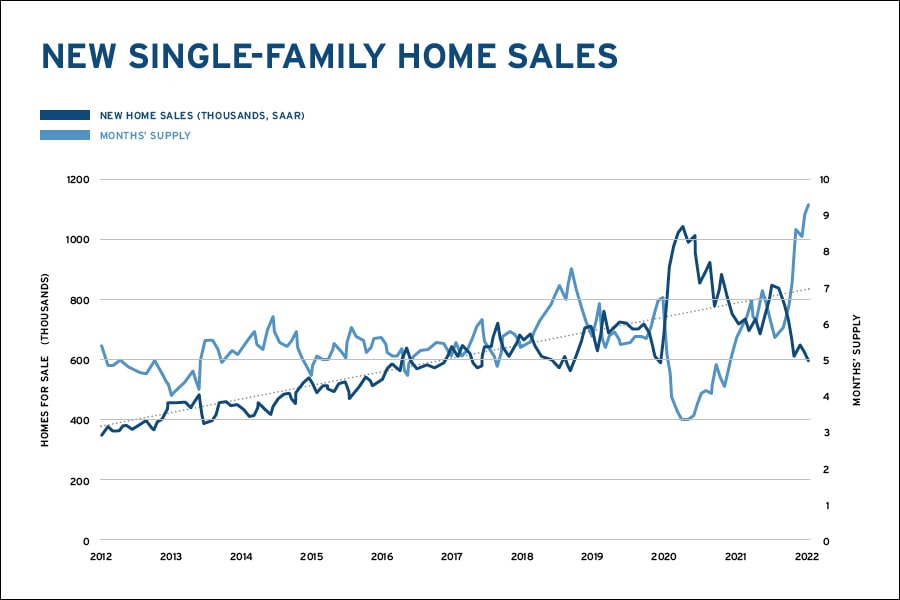

Rising mortgage rates and worsening affordability conditions caused new single-family home sales to decline in June. The U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau estimated sales of newly built single-family homes in June at a 590,000 seasonally adjusted annual pace, which is an 8.1% decline over the downwardly revised May rate of 642,000 and is 17.4% below the June 2021 estimate of 714,000. The count of completed, ready-to-occupy new homes is just 39,000 homes nationwide. And sales are increasingly coming from homes that have not started construction, with that count up 25.1% year-over-year, not seasonally adjusted.

The median sales price dipped to $402,400 in June, down 9.5% compared with May, but up 7.4% compared with a year ago. The 30-year fixed rate mortgage was 5.1% at the end of May and climbed to 5.7% by the end of June, according to Freddie Mac.