New Guidelines for Determining Worker Status

On Oct. 13, the U.S. Department of Labor (DOL) issued a proposed rule that will change the way DOL determines whether workers should be classified as employees or as independent contractors under the Fair Labor Standards Act (FLSA).

If finalized, the proposal will replace the current standard, which the National Association of Home Builders (NAHB) supports for giving regulated employers and small businesses, including home builders and specialty trade contractors, a clearer, simpler federal test for determining worker status.

Residential construction remains an industry of independent entrepreneurs, with most residential builders typically subcontracting a large portion of their construction work to independent specialty trade contractors. In fact, the typical home builder uses up to 30 subcontractors to construct a single-family home.

RELATED

- 3 Ways Home Builders Can Address Labor Shortages by Investing in Trade Partners

- Are Your Trade Contractor Relationships Strategic or Transactional?

- 5 Steps to Circumvent the Labor Shortage and Be a Builder of Choice

Test to Determine Worker Classification

The proposed rule would use a revised “economic reality test” to determine whether a worker is economically dependent on the employer or truly in business for himself or herself. This “economic reality test” consists of six factors:

- Is the work performed an integral part of the employer’s business?

- Does the worker’s managerial skill affect the worker’s opportunity for profit or loss?

- Is the relationship between the worker and employer permanent or indefinite?

- What is the nature and degree of the employer’s control?

- Does the worker use specialized skills to perform the work, and do those skills contribute to business-like initiative?

- Are investments by a worker capital or entrepreneurial in nature?

A Way to Combat Employee Misclassification

DOL officials said they are putting forward the rule to combat employee misclassification, which occurs when an employer incorrectly defines a worker as an independent contractor rather than an employee. “[Employee] misclassification deprives workers of their federal labor protections, including their right to be paid their full, legally earned wages,” said Labor Secretary Marty Walsh.

NAHB supports enforcement of the rules on the classification of workers, including the current FLSA rule. That rule gives greater weight to two factors in determining whether a worker is an employee or an independent contractor: the nature and degree of the worker’s control over the work, and the worker’s opportunity for profit or loss.

The Labor Department’s Wage and Hour Division is soliciting comments on the proposed rule until Nov. 28, 2022. NAHB is reviewing the proposed rule and its potential effects on the home building industry and will provide comments to DOL.

Housing Market Index Indicates Builder Confidence Continues to Decline

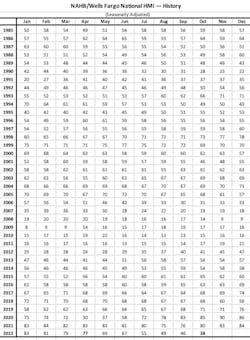

Builder confidence in the housing market fell for the 10th consecutive month in October, battered by rising mortgage interest rates and ongoing supply chain disruptions. Confidence in the market for newly built single-family homes dropped eight points in October to 38—half the level it was just six months ago—according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

The HMI gauges builder perceptions of current single-family home sales and sales expectations and asks builders to rate traffic of prospective buyers. Any number under 50 indicates that more builders view conditions as poor than good. This will be the first year since 2011 to see a decline in single-family starts as high mortgage rates approaching 7% have quashed demand, particularly for entry-level and first-time move-up buyers. NAHB economists forecast additional single-family building declines in 2023 as the housing contraction continues.

For more historical HMI data (1985-2022), see below.

About the Author

National Association of Home Builders

The National Association of Home Builders (NAHB) is a Washington, D.C.-based trade association representing more than 140,000 members involved in home building, remodeling, multifamily construction, property management, subcontracting, design, housing finance, building product manufacturing, and other aspects of residential and light commercial construction. For more, visit nahb.org. Facebook.com/NAHBhome, Twitter.com/NAHBhome