New Legislation Worsens Housing Affordability

In November of 2021, Congress passed the $1.2 trillion Infrastructure Investment and Jobs Act, which President Biden signed into law. Less than a year later, in August 2022, the president signed the Inflation Reduction Act. The two measures include a total of roughly $1.2 billion in funding to encourage states to update their energy codes for new homes.

As the Biden administration begins to implement the policies embedded in the two measures, it’s important to note there are significant differences between the two laws.

How the Infrastructure Investment and Jobs Act Differs From the Inflation Reduction Act

The Infrastructure Investment and Jobs Act provides $225 million ($45 million per year for fiscal years 2022-2026) for the Department of Energy’s Resilient and Efficient Codes Implementation (RECI) program. Under the RECI program, states can receive grants to update to more recent model energy codes. The money can be spent on conducting studies, training, implementation, and a host of other purposes.

The Inflation Reduction Act, on the other hand, sets aside nearly $1 billion for state and local governments to adopt the most recent energy codes, which, as of now, are the 2021 International Energy Conservation Code (IECC) or the 2019 edition of ASHRAE 90.1. These grants are expected to be awarded annually through fiscal year 2029.

RELATED

- Seeking Bipartisan Solutions for the Housing Affordability Crisis

- What the Inflation Reduction Act Means for Home Builders

- The State of US Housing: Joint Center for Housing Studies Perspective

But newer versions of energy codes add costs to housing production that aren’t paid back in efficiency gains, further exacerbating the housing affordability crisis. The National Association of Home Builders is recommending its members continue to inform their local and state officials that updating to newer energy codes will result in higher construction costs and higher home prices.

The grant programs outlined in both laws enable state governments to partner with local jurisdictions and other stakeholders, including home builders and state and local home builder associations, in the application process.

If your state is planning to apply for these grants, NAHB is encouraging states to apply for the infrastructure bill grants over Inflation Reduction Act grants because the RECI program offers considerably greater flexibility. Some initial deadlines have already passed, but even if a state misses the deadline during the first year, there will be opportunities to apply in future years.

If your state is planning to apply for these grants, NAHB is encouraging states to apply for the infrastructure bill grants over Inflation Reduction Act grants.

Housing Affordability Continues to Decline

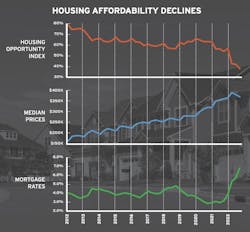

Metrics used to gauge housing affordability posted three consecutive quarterly declines in 2022 and now stand at their lowest level since NAHB began tracking them consistently in 2012. Declines in affordability have largely been the result of rising mortgage interest rates in combination with building material supply chain disruptions that have driven up the cost of new-home construction.

In the fourth quarter of 2022, only 38.1% of new and existing homes sold were affordable to those earning the median income of $90,000, per the National Association of Home Builders/Wells Fargo Housing Opportunity Index (see top chart, below).

The national median home price fell to $370,000 in the fourth quarter; while that was down $10,000 from the previous quarter, rising mortgage rates negated the effects of that decline. A drop in mortgage rates over the past two months, however, suggests that declining affordability conditions may have reached their low point for this cycle.