NAHB Readies for Fight Over Key Tax Provisions

This article first appeared in the January/February 2025 issue of Pro Builder.

It’s time for another battle over taxes. President Trump signed the Tax Cuts and Jobs Act (TCJA) into law in December 2017. Most of the tax cuts and other changes introduced by the bill went into effect on Jan. 1, 2018. Now, seven years later, Congress will revisit the matter, as most of the tax provisions are set to expire on Jan. 1, 2026. Many are calling this “taxmageddon” or the “tax cliff,” as roughly $4 trillion in beneficial provisions will expire if Congress takes no action.

The National Association of Home Builders (NAHB) is working to make sure key provisions that benefit the residential construction industry, as well as homeowners and renters, are maintained.

RELATED

- Policies That Increase Access to Homeownership

- NAHB Discusses Tariffs and Their Potential Impact on Home Builders

- Webinar: 2025 Market Outlook

Which TCJA Provisions Should Be Maintained?

One of the many provisions of the TCJA that NAHB will fight to preserve is the deduction for small-business income. Provisions of the TCJA provided a tax deduction of 20% for qualified pass-through income—section 199A—for sole proprietorships, partnerships, and S-corporations. This will expire if no action is taken before Jan. 1, 2026.

NAHB believes it is important that Congress also maintain many other TCJA provisions that spur economic growth. These include:

- The lower individual marginal tax rates established in the TCJA

- Lower capital gains rates

- Estate tax rates and exemptions provided in the TCJA

- The real estate exemption to the Section 163(j) limits on business interest deductibility, as small home builders rely on debt to finance their operations

Another key provision in the TCJA that NAHB wants to preserve is its treatment of the alternative minimum tax (AMT). Many middle- and upper-middle class households have benefitted from this provision of the Tax Cuts and Jobs Act, which increased the AMT exemption amounts and raised the income levels at which the exemptions phase out. As a result, fewer households were liable for the AMT. The number of taxpayers subject to the AMT fell from 5 million in 2017 to 200,000 in 2018. If the higher AMT exemption limits expire, 4% of all taxpayers—7.2 million—will be subject to the AMT in 2026.

Tax Provisions That Benefit Residential Development and Homeownership

It is also important to preserve those tax provisions that recognize the unique challenges of residential development. This includes the Section 460 Completed Contract Rules, which clarifies that new homes sales are taxed when completed and sold, and the Section 1061 Carried Interest, which increases investment demand for multifamily real estate development projects.

Other tax provisions that encourage much-needed residential development include:

- Section 1031 Like Kind Exchanges, which allow property owners to balance their portfolios and incentivizes reinvestment into new real estate projects, increasing economic growth

- Section 179 Multifamily Rental Depreciation

- Section 1411 Net Investment Income Tax (this tax is targeted to passive investors. NAHB opposes any expansion to include active investors)

NAHB also believes Congress can make improvements to the TCJA that would encourage homeownership. For example, Congress could adjust state and local tax limits and eliminate the marriage penalty. NAHB also recommends an adjustment to the $750,000 limit for acquisition debt under the Mortgage Interest Deduction. Congress could also increase and adjust the Section 121 capital gains exclusion thresholds, which excludes up to $250,000 per person from the gain of selling a primary residence, to address the effects of inflation. This capital gains adjustment would help put more homes on the market act.

Congress should also expand housing affordability relief by providing additional resources for the Low-Income Housing Tax Credit to meet the demand for affordable rental housing. NAHB is also asking Congress to establish a tax credit to help finance the construction and preservation of rental housing that is affordable to middle-income families. The association also recommends that Congress enact tax incentives that encourage builders to produce more affordable, entry-level homes.

NAHB is also asking Congress to look at the Section 45L tax credit, which incentivizes technological advancements in home building. Changes made in the Inflation Reduction Act, including inserting prevailing wage requirements, undermined the purpose of this credit. To encourage energy-efficient new homes, Congress should roll back the IRA changes and re-focus the 45L incentives on their intended purpose of promoting energy-efficient new homes.

Housing Starts Forecast

Housing starts in 2024 tell a tale of two stories. Total housing starts in 2024 were 1.36 million, a 3.9% decline from the 1.42 million total from 2023. That total masks the very different outcomes for single-family and multifamily construction. On the one hand, single-family starts in 2024 totaled 1.01 million, an increase of 6.5% from 2023. Multifamily starts, on the other hand, ended the year down 25% from the previous year.

The year ended with better numbers, as overall housing starts increased 15.8% in December to a seasonally adjusted annual rate of 1.50 million units. That is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 3.3% to a 1.05 million seasonally adjusted annual rate. The multifamily sector, which includes apartment buildings and condos, increased 61.5% to a 449,000 pace.

With the industry facing a number of headwinds, including high mortgage rates, elevated financing costs for builders, and a lack of buildable lots, NAHB anticipates the growth curve this year will be somewhat flat.

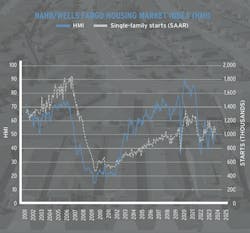

The association is forecasting a gain of 1% for single-family home building in 2025 as demand remains strong and mortgage rates ease slightly. Builders are expressing cautious optimism, as can be seen in the NAHB/Wells Fargo Housing Market Index, which recently hit 47. That mark is still below the neutral measure of 50, but it is the highest the index has been in nine months.

NAHB economists anticipate that multifamily construction will see modest declines in 2025 before stabilizing in 2026 as more deals pencil out for a sector buoyed by solid demand and a low national unemployment rate.