| Rick Heaston |

Today’s builders are stuck in a world that not only expects change but demands it. It’s either reinvent yourself or fall too far behind to catch up.

Think about it. How much has your company changed during the past five to 10 years? A lot, I’m sure. Changes in partnering, service, scheduling and technology probably head your list, and that’s only the tip of the iceberg.

Customers are changing, too. Gone are the days when a standard floor plan would satisfy them. Today’s home buyers are more knowledgeable, more demanding and want more choices, which in itself creates challenges. On one hand, you know you must offer lots of choices to satisfy your customers and keep up with the competition. On the other, the more choices you offer, the more confusion you add to your customers’ shopping process. And confused customers take longer to make decisions, if they make decisions at all.

So what’s the solution? A new way of selling, one you might not have thought about or know you need. Research has proved that this new approach produces more sales, faster sales and more profitable sales.

“Buyers today don’t want the old way of selling,” says Bernie Glieberman of Crosswinds Communities, which sold more than 1,200 homes last year in the Detroit market. “They don’t want exaggerated claims like ‘best value.’ They want someone to help them make sense out of things. They want help to understand how your product matches their values.”

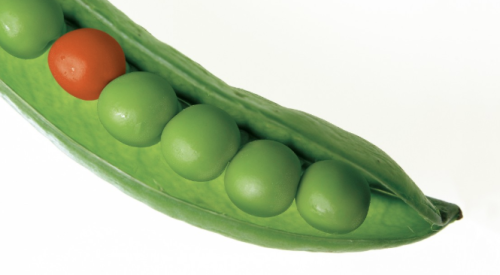

| Vast numbers of home shoppers can be made into active buyers. |

Why Change?

Until the mid-1980s, selling was selling. Regardless of industry or product, the skills were basically the same. You opened the sale, qualified your customer, demonstrated your product and then closed. Throw in handling objections, and you had the entire package.

But then something puzzling began turning up in research results. Customers weren’t reacting well to the “discover-present-close” process. No longer did one selling strategy apply to all products and all situations. Now there was a difference between “large-sale” and “small-sale” selling strategies.

Further investigation found that what separated a large sale from a small sale was risk. The higher the perceived risk, the more customers changed their shopping and buying behaviors. The strategies that worked in a small sale were counterproductive in a large sale. And the researchers discovered that almost everyone was using small-sale strategies on high-ticket products, often without realizing it. Analyzing companies that were successfully selling high-ticket products, the researchers found a common strategy, which was based on the interview process.

Question-Based Selling

“So what’s the big deal with questions?” you ask. “I ask lots of questions. I use the discovery process to explore and discover my customers’ ‘hot buttons.’ Once I know their hot buttons, I make my presentation and close the sale.” What might seem normal to you, however, exactly defines the difference between question-based selling and the traditional approach.

Traditional, or small-sale, strategy focuses on your customers’ needs. Once you have discovered their hot buttons and presented your product, the only question left for your customers to ask is, “How much?” In traditional selling, you focus on discovering your customers’ emotional needs and use them to support your close. This might seem like a good strategy, but it’s a small-sale tactic, and you’re selling the highest-priced product most people will ever buy.

Interview Selling™ has a completely different focus. It has an interview part and a selling part. In the interview, you focus your questions on your customers’ problems, concerns and dissatisfactions. After all, problems are the reason your customers have needs. And sales research has shown that customers will not purchase your home, community or lifestyle unless they believe it will improve their situations. What better way to create value than helping your customers compare their problems with your solutions?

In the selling part, you help your customers understand and attack their problems, issues and opportunities in a different way. You help them by using their priorities to introduce new and different solutions to their issues. Your sale is not only emotional in the beginning, but both emotional and logical in the end.

Sales You Might Be Missing

Several years ago, a major research study for Xerox Corp. found that only 8% of the people in a typical market were unhappy enough with their situations to actively look for alternatives. In home building jargon, we’d call these customers “active buyers,” or buyers with needs. It’s not hard to work with them or discover their needs.

Of the remainder, 6% were completely happy with their situations, and another 6% were choosing or validating a purchase. These numbers seem to be on target, so it’s the next one that’s the shocker: 79% of people had decided they had some dissatisfaction with their situations.

Think about that. Including the active buyers, nearly nine out of 10 customers who visit your community have problems, concerns and dissatisfactions with their situations. Sure, not everyone’s problems are severe enough to cause an immediate purchase, but a good number are visiting to compare the risk/reward of a change.

Here are a few questions that immediately slap me in the face: “If I’m using knockout or qualifying questions early in the selling process, am I discarding the biggest piece of the pie?” Or, “If I’m selling only to the 8%, like all of my competitors, doesn’t it come down to who has the best price?” And, “If the 8% are predisposed to buy, is the sale a function of sales skill, or is it just a popularity contest?” Here’s a different consideration worth contemplating: “Is my marketing program accomplishing what it should accomplish, or am I wasting valuable dollars?” All of these are legitimate questions you need to ask and answer for yourself. And there’s one final question: “Is my selling program as effective as it could be, or am I missing lots of sales I didn’t know I missed?”

Putting the Process to Work

Interview Selling is different because it’s designed to match the way you sell to the way your customer buys. Not only will it make your sales force more proficient, it will differentiate you from your competition.

“I want my sales staff to set themselves apart in the industry,” says Gary Sorrels, vice president of sales and marketing for Del Webb’s northern California communities. “I want buyers to say, `I like Del Webb. They went to the trouble to understand what I want to accomplish. They understand me, and I want to do business with them.’”

Why does question-based selling accomplish these things? Because it focuses on the customers’ objectives rather than the seller’s. When you’re helping your customers understand, compare and evaluate their alternatives — rather than trying to sell them what you have to sell — you’re creating happier buyers, fewer cancellations, higher referral rates and more sales.

In sales tests with builders across the country, question-based selling increased sales by 5% to 15%, decreased cancellations by 24% to 50%, increased referrals by 15% to 25%, increased customer satisfaction by 2% to 12% and decreased the time from the initial visit to the contract signing by 20% to 48%.

Let’s take a quick tour of the interview selling process and preview what we’ll be discussing during the next five months.

Opening the Sale: Every sale must start with an opening, and Interview Selling is no different. You begin by establishing rapport, except in this case you use the rapport process to qualify your customer’s agenda. Next is the unique selling proposition, in which you use the “Big Box” strategy to create memory points for your buyer. Your final step in opening the sale is setting expectations. This strategy helps you continuously advance the sale and moves you quickly and efficiently into your interview process.

The Interview Process: Research has shown that customers’ “buy/no buy” decisions take place during the interview process, the second part of the question-based selling system. If you’re good here, closing will be a snap. Your first step in the interview process is to understand the issues surrounding your customer’s current situation. The information you gather here will position you to be involved in the customer’s final decision process. Next, you explore your customer’s present needs, which are the keys to the customer’s definition of value. In the final part of the interview process, you explore and organize your customer’s future decisions, helping the customer turn thoughts and priorities into a value list.

Closing the Sale: If you’ve done a good job with your interview, closing the sale becomes the easiest part of your selling process. Closing is made up of three parts: matching, summary recommendations and commitment. In matching, you link your customer’s values to your product. If you’re effective, you can change the way your customer compares, evaluates and decides. In summary recommendations, you summarize your customer’s values in terms of your product and make a recommendation. And in commitment, you ask for your customer’s decision. In some cases you will take an assumptive position, and in some cases you will just ask. The choice depends on your style.

Where It Works Best

Builders who have installed this question-based selling system have realized many benefits. At Crosswinds Communities, Glieberman reports that the average number of buyer visits before signing a contract has dropped from seven to five. And in Del Webb’s northern California active-adult communities, Sorrels says cancellation rates have fallen to about half the industry average and referral rates are climbing steadily.

The key issue, though, isn’t these results, it’s the predictability of the results. Although both companies have embraced the same large-sale strategies, Del Webb and Crosswinds sell to completely different buyer segments. “Our buyers are active-adult, 50-plus,” Sorrels says. Glieberman says most of his buyers are “Generation X,” in their late 20s to mid-30s. When describing character traits of their buyers, however, both men use the same words: “They’re searching for and buying solutions.”

Have a Question?

Do you have a question about sales or sales management? E-mail Rick at rheaston@touchpt.com. He’ll choose a question to answer in each of the last five parts of this series.