Lending for acquisition, development and construction (AD&C) purposes in home building remains restrictive, according to the National Association of Home Builders’ blog. Even in areas of the country where growing demand for new construction exists, the lending environment is challenging, which constrains residential construction’s traditional role of leading the economy out of recession.

Lending for home building purposes is significantly tighter than loans for commercial construction activities. Data from the FDIC’s Statistics of Banking confirm the anecdotal evidence from builders of overly restrictive AD&C lending conditions.

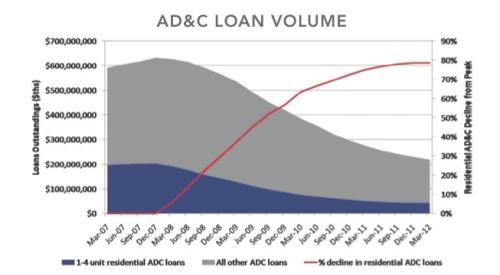

Since the first quarter of 2008 peak of AD&C lending for residential construction (1 to 4 unit properties), the total volume of loans is down from $204 billion to $51 billion – a decline of $153 billion or 75 percent. Since early 2008, the stock of home building AD&C loans held by FDIC-insured institutions has declined on average 10 percent every quarter, with the decline equal to 9.3 percent for the second quarter of 2011.

Moreover, while ADC lending is down 75 percent since the first quarter of 2008, single-family permits are down 41 percent over the same period, a considerable difference between permitting and construction loan availability.

All other construction and development loans, including commercial and 5+ unit residential properties, are down 49 percent since the peak in the third quarter of 2008. This decline, while large, is still smaller than the decline for residential AD&C loans.