Research Shows Americans Are Borrowing $16.16 Billion for Home Improvements

With home renovations on the rise, personal finance website Finder.com reports that the credit cards are the most common method that Americans use to finance their home improvements.

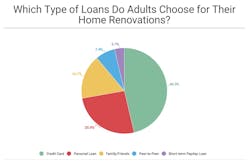

Finder.com found that in the past year, 5.41 million adults sought financial help for home renovations, borrowing an average of $2,990 for an estimated total of $16.16 billion in loans. In a survey conducted by the site, 46.3 percent of homeowners reported financing improvements with their credit card, while 25.9 percent took out personal loans, 16.7 percent borrowed from friends and family, 7.4 percent used peer-to-peer lending, and 3.7 percent took out short-term loans.

“Loans can be a viable option for those looking to expedite the home renovation process, particularly in making updates that will net more money in a sale,” says Jennifer McDermott, consumer advocate at Finder.com. “However, with Americans taking out an estimated $16.16 billion for home improvements, it’s more important that we’re properly researching and comparing all our borrowing options, weighing up the true cost in the long run, that is the principle and the interest.”

So which option is the best deal? Finder.com used the $2,990 average loan to calculate how much a homeowner who repays a loan in the average amount of time for each option would end up paying in interest.

The site found that borrowing with a credit card at the average 18.62 percent interest rate is the best deal, resulting in only $297.27 in additional payments if repaid over 13 months. A 24-month personal loan with the average 10.57 percent interest rate follows closely behind, with $312.72 in additional payments. Loans from friends and family can also be beneficial depending on the terms agreed upon with the lending individual.

Short-term loans are best for homeowners who can repay within the short two-week term, costing $54.54 on average when paid on time. Peer-to-peer lending shakes out at the bottom of the list; with a 18.01 percent average rate and a 38-month average term, they cost homeowners $802.82 on average.