In December 2021, Home Innovation Research Labs, in collaboration with Pro Builder, polled new-home builders about changes to their business practices due to the pandemic, specifically what they viewed as temporary measures and what they considered permanent changes to their home building business going forward.

As expected, issues surrounding labor and materials rose to the top, but there was a notable, unanticipated tidbit that caught our attention: a more widespread embrace of “smart” home technologies.

Many builders admitted they had been caught off-guard by the expansion of home tech and were scrambling to keep up with the expectations of a new wave of tech-savvy homebuyers—especially as they began spending more time at home during the pandemic for work, school, and entertainment. In short, their technology needs and expectations had shifted upward, and builders were responding.

Since the inception of home automation more than 40 years ago, home electronics have evolved from a mere curiosity for the small “ahead-of-the-curve” segment of luxury homebuyers, to our current technology reality. In the 1980s, Smart House was established here at Home Innovation Research Labs (then known as the National Association of Home Builders Research Center) with the goal of bringing the disparate wiring technologies and communications protocols onto a single platform to speed up adoption. Even then, it would have been hard to imagine the direction home technologies have taken since.

Gaining Greater Insights Into Smart Home Systems and Installation

Last month, we collaborated with Pro Builder again to dive deeper into the home smart home systems and products home builders are offering.

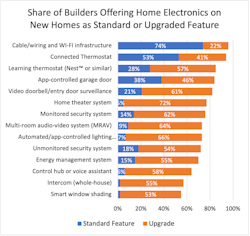

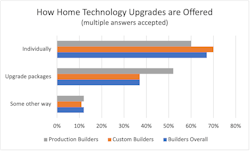

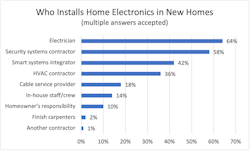

Specifically, we asked which systems and products were being offered as standard features and which were sold as upgrades (see Chart 1, below). We also asked whether smart/connected home features were offered as a package or individually (Chart 2), and who among their trade partners installed those systems (Chart 3).

The results revealed a far more mainstream approach and attitude about smart home technology in the new-home sector, with builders nationwide, across all housing types and price points, offering some measure of smart home features to their buyers, indicating a definite (and likely permanent) shift in the market.

This study found that nearly 75% of home builders that responded to the survey install or provide the infrastructure (for example, cable, wiring, and Wi-Fi) to enable homeowners to plug and play smart home devices; another 22% offer that backbone as an upgrade. Connected programmable thermostats were by far the most-offered standard device (and also offered at some level by almost all builders), followed by remote/app-controlled garage doors, learning thermostats, and video doorbells.

Cross-tabulated with new-home price points, the data shows that luxury home builders are more likely to offer smart home technologies than starter-home builders—although in some cases, not by much more when it comes to basic cable/wiring/Wi-Fi infrastructure, unmonitored security devices, and connected programmable thermostats.

RELATED

- Smart Home Tech Will Take a More 'User-Centric' Route in the Next Five Years

- The Builder's Role in a Connected Home Future

- Why Builders Can’t Afford to Ignore the Smart Home Tech Trend

- 6 Steps for Building Smart, Connected Homes

Smart Home Features: Packaged or Not?

For builders offering smart home systems or devices as optional upgrades, they tended to pose them as individual purchasing options rather than packaging two or more. Production builders, however, were much more likely to offer packages of smart home features than custom builders, but only a little less likely to offer them as individual upgrades, as well.

On average, the cost of a packaged smart home upgrade was about $7,100 across all builder types and price points.

Smart Home Systems: Who Does the Installation?

A big question among home builders is who will install the smart home systems and devices they offer? Can they rely on their existing trade base, such as electricians and HVAC contractors, or do they need to add another subcontractor to the mix?

In fact, both are true. Electricians are likely geared to run low-voltage wiring and high-speed cable to create a basic backbone of service, while HVAC contractors are equipped to install programmable (and, for an extra cost, learning) thermostats to control the home's heating and cooling equipment.

Newer subs, including those for security and whole-house system integration, appear to be more common than they were pre-pandemic, especially among the luxury and custom home builders surveyed.

Ed Hudson is the director of market research at Home Innovation Research Labs, in Upper Marlboro, Md., where he brings more than 25 years of experience conducting research in the home construction industry. He and his team conduct a wide array of both qualitative and quantitative marketing research supporting the development and commercialization of new building products and technologies.