(Based on a true story...) Mike, the internal operations manager for Lovely Homes, a multi-division home builder, was growing weary of the number of customers upset with their mortgage experience. A couple years prior, Mike was happy just to get his customers approved for a mortgage; but now that the mortgage crisis had passed, he felt that homebuyers should have an easier time getting through the lending experience.

As Mike monitored Lovely Homes’ Voice of the Customer (VOC) surveys and feedback, he noted that there were too many customers experiencing bumps during their mortgage experience. In fact, Lovely Homes’ mortgage and closing customer satisfaction ratings were falling below the industry benchmarks, and well below the industry’s top performers. He knew this was likely true because he was personally getting involved in too many customers’ unpleasant surprises at closing. Mike felt he spent too much time settling disputes, ironing out glitches, and occasionally contributing more funds to make the closings happen. Lovely Homes’ third-party VOC consultant had brought up customer satisfaction gaps with the mortgage and closing process as potential Lovely Homes’ improvement points in their prior quarterly reports. Now was the time to act. Mike reviewed the consultant’s recommendations and then dove deeper into the customer feedback to search for confirming clues and patterns. What he found was startling.

Mike had presumed the low customer mortgage experience ratings were coming from the customers who chose to use an outside lender/mortgage company rather than Lovely Homes’ preferred lender. Lovely Homes had worked out an agreement that gave their preferred lender the first shot at all Lovely Homes’ customers in exchange for some favorable terms, better customer service, and a little advertising budget kicker, too. Lovely Homes’ sales team worked from a script that espoused the virtues of using the preferred lender, and it was effective. Almost 70 percent of all customers used the preferred lender. Based on how well this system was working, Mike was quite certain that it was the non-preferred lenders that were messing up the overall Lovely Homes mortgage ratings.

Reality Check

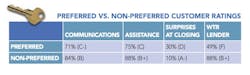

However, Lovely Homes’ third-party VOC survey and consulting firm suggested that there was too much customer dissatisfaction surrounding the mortgage processing for this to be exclusively an “outside lender” problem. They reported that early mortgage-processing discontent seemed to build upon itself and was adding undue stress on the customers near the time of closing. Mike was surprised to discover that the preferred lender was producing customer satisfaction ratings 10 percent to 20 percent lower than the non-preferred lenders (see table below). The more Mike dug into the preferred lenders’ VOC feedback, the more serious he realized these loan and closing problems were in terms of creating high levels of customer stress at an already stressful time—the transition from homebuyer to homeowner.

Mike, Lovely Homes’ management team, and their VOC consultant did some additional data analysis before accurately identifying the cause of the preferred lender’s poor performance. Bottom line: It was Lovely Homes’ fault, and it was all totally within their control and ability to resolve.

Lovely Homes is not alone in this situation; we, as the VOC partner for many home builders, have seen this phenomenon with dozens of companies, both large and small. The primary point of failure is that Lovely Homes (and many other home builders) treat their preferred lender/mortgage partner differently than almost every other trade partner. Let’s take a look at these all-too-common differences.

Why is it that so many home builders have a preferred lender, but have no detailed scope of work for this crucially important partner? Home builders usually have scopes of work (sometimes ad nauseum) for virtually every trade partner, from the major trades down to minor trades. For crying out loud, even mirror installation, gutter, and cleaning crews have detailed job scopes. Lovely Homes had set the large requirements and trusted their preferred lenders to create a customer-centric process and fill in many of the details. By not setting detailed performance standards and defining customer satisfaction metrics expectations for their “preferred” lenders, home building companies are risking both their companies’ reputation and their customers’ satisfaction on an undefined process. Imagine the havoc that would arise if any major trade did not have a detailed scope of work and performance/behavior standards.

The Fix

Mike got busy and, with the help of his purchasing and sales managers, defined exactly what was expected of the preferred lender and how its performance was going to be measured. If the preferred lender could not raise the customer satisfaction ratings, it would become a non-preferred lender. Mike met with each preferred lender to show them their past performance ratings (strengths and weaknesses) and reviewed the new preferred lender scope of work. Their scope of work called for weekly updates to the customers (prior to this the preferred lenders’ weekly updates were provided only to Lovely Homes, not the customer). Furthermore, the preferred lender was expected to change their customer communications strategies to closely parallel the communication approach taken by Lovely Homes. In other words, Lovely Homes wanted to convey the impression that the preferred lender was a teammate running the same play. Unfortunately, the preferred lenders’ communications had become so sloppy that they heavily relied on email and worse, untraceable texting. Text communications can be a huge liability to home builders, as important details and conversations are hidden on personal cell phones. To show how out-of-whack preferred lender communications had become, one preferred lender actually sent a text to a Lovely Homes’ customer while on the way to their closing. The message said, “You’re not qualified—the closing is off.” It appeared that this preferred lender had 1) become stressed and sloppy as Lovely Homes’ closing volume dramatically increased, and 2) was possibly taking Lovely Homes’ business and customers for granted. The new scopes of work and performance measurements brought clarity to the Lovely Homes and preferred lender relationship.

Top 10 steps for improving the customer mortgage and closing experience1. DO: Define the Best Imaginable Customer Experience (BICE) for the mortgage/closing process with the help of the preferred lender, sales manager, and Voice of the Customer partner.2. DO: Create a BICE matching scope of work for the preferred lender with the help of the purchasing and closing manager.3. DO: Objectively measure the preferred lender’s performance (preferably via a third party, objective VOC survey) and provide regular feedback to the preferred lender and home building management.4. DO: Retrain or terminate any non-performing preferred lenders.5. DO: Praise and reward high-performing preferred lenders with more opportunity.6. DO: Share mortgage results with the sales team, so they have objective customer-based feedback to share with prospective clients (i.e., “Our preferred lender has an industry-leading 93 percent willingness-to-refer lender rating.”)7. DON’T: Pick your preferred lender just because they are providing an operational line of credit to the home building company.8. DON’T: Treat your preferred lender as a special “hands off” class of trade partner.9. DON’T: Rely on a self-administered preferred lender’s closing survey for accurate performance feedback.10. DON’T: Let salespeople or Realtors add outside lender business cards/contacts to the sales office or model. You don’t want customers to perceive unapproved businesses as official preferred lenders.

The mortgage application and closing customer experiences are critically important parts of the overall new-home customer building experience. Studies show that the mortgage application process happens during one of the customer’s first emotional lows (the buyer’s remorse phase), and the final approval/closing happens during the second-most influential emotional low (just prior to home acceptance). Engineering the best imaginable customer mortgage/closing experience was something that Lovely Homes had never taken the time to define and implement. Mike and Lovely Homes assumed the preferred lender would somehow mysteriously know what was best for Lovely Homes’ customers, though this was clearly not the case. Realistically, how was the preferred lender to know that Lovely Homes required their own salespeople to place weekly update calls to the customer? Without this knowledge, the preferred lender felt that one-to-two calls during the six-month build time was sufficient, but it definitely was not. The preferred lender did not know that way too many customers felt that the preferred lender was not on the same page (or team) as Lovely Homes. It is true that sometimes, homebuyers give the lender they selected a break, but hold the designated preferred lender to a more rigorous standard—and understandably so. Lovely Homes’ preferred lenders’ communication difficulties, combined with a stressful process, caused too many customers to feel that Lovely Homes fooled them into going with the preferred lender.

Inspect what you expect

Recently a client asked me to meet with their five preferred lenders to teach them the homebuyers’ hierarchy of customer satisfaction, and to show how these needs can be objectively measured. I then shared with the preferred lenders how they had fared in meeting these customer needs. Three of the preferred lenders had good ratings, one had average ratings, and one had horrible ratings. Unfortunately, this poor-performing lender was getting the largest chunk of the home builder’s mortgages, and their poor performance was adversely impacting the company’s overall customer satisfaction ratings. When I showed the preferred lenders a chart of comparative performances, the room went silent. The most glaring result was that this lone non-performing lender’s ratings showed “poor” and “very poor” ratings in every single category including a willingness-to-refer (WTR) score of less than 50 percent.

Things were quiet until the next day, when I received a phone call from the non-performing lender’s manager. The call started civil enough, but the lender’s manager grew agitated when I told her that their company’s biggest problem was the lack of communication with the customer. I explained that this preferred lender’s overall communications and customer assistance was rated as “very poor” by 60 percent of their homeowners. When I suggested that this lender make weekly update calls to all in-process homeowners, the managing partner shouted, “That’s impossible! With all the staff cutbacks at our company, we are lucky to call the customer every other month!” My response was honest and straightforward: “Thank you, this is very valuable information for the home building client to know.” This conversation was quickly relayed to the client, who realized this preferred lender’s capabilities (and maybe culture) were not a good match for either the home builder or their buyers.

In closing, doesn’t it seem odd that so many home building companies allow this important hands-on customer satisfaction trade partner to perform without a detailed scope of work, setting performance expectations, and regularly reviewing the trade partner’s performance? If you would like to improve your customer mortgage and closing experience, then take charge of it, like you do other critical tasks, and don’t treat your preferred lender as an exception. A well-written scope of work, performance measurement, and objective feedback will be a win-win-win for the home building company, the preferred lender, and most importantly, your customer. PB

Sign-up for Pro Builder Newsletters

Get all of the latest news and updates.