As increasing numbers of consumers search online for a new home, it’s critical for builders to understand exactly which tools those prospective buyers are using. A recent study, produced by the online marketing management firm Bokka Group and conducted by Home Innovation Research Labs, sheds light on buyer acceptance of a range of digital tools.

The study, the “2014–15 Home Buyer Conversion Report,” identifies the digital tools and technologies that builders have invested in all along the sales process, and it attempts to document the effectiveness of those tools. The research strives to answer the following questions:

- What attracts visitors to a particular builder’s website?

- What tools and website components influence a buyer’s decision to provide personal information to builders?

- Which tools and website components influence a buyer’s decision to visit builders’ sales centers/model homes?

- Which tools, digital components, and content within a sales center influence a prospect’s decision to buy?

Understanding the Data

“The goal of the study was to make some assumptions: These are the sales tools that seem to be important, and then to ask if they’re worth investing in,” says Jimmy Diffee, the Bokka Group’s vice president and creative director.

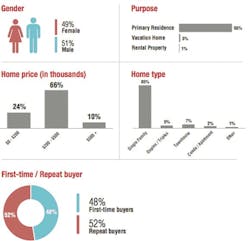

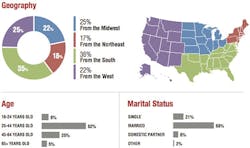

The study focused on recent new-home buyers throughout the U.S.; most were between the ages of 25 and 64, and the majority (69 percent) were married. The respondents were roughly equally divided between first-time and repeat buyers; 90 percent purchased single-family homes in the under-$500,000 range.

The results need to be understood within the proper context, notes Tim Costello, chairman and chief executive of Builder Homesite, parent company of the Builder’s Digital Experience, a national online marketplace specifically focused on the new-home market. Respondents were categorized by the age groups of 18–24, 25–44, 45–64, and 65+. Those groupings blend Millennials with Gen X, and Gen X with boomers. Some of the results that may seem tempting to apply to Millennials could actually be behaviors related to first-time buyers, regardless of age.

Diffee agrees and cautions builders about ascribing any of the results to a specific generation, such as Millennials. Because the Conversion Report data is separated into the specified age groups, Diffee points out, the data doesn’t fall exactly along generational lines.

The Home Search Begins Online

The study includes advice for attracting, engaging, and nurturing buyers, as well as on closing the sale. The “Attract” phase of the Conversion Report examines what draws prospects to specific builders’ websites. Since this is where builders’ marketing dollars are spent, the impact of the data can be significant. The survey looked at five channels:

- Organic search (when a buyer types terms into Google)

- Paid search (when a business pays for click-throughs)

- Listing sites (such as Zillow, Trulia, or NewHomeSource)

- Banner ads

- Offline marketing

It then examined the influence of these channels on prospective buyers. Which might prompt a visit to a builder website? Over a three-year period, the influence of organic search grew from 66.9 percent to 81.6 percent; for independent listing sites, the influence jumped from 61.9 percent in 2012–13 to 79.9 percent in the current study.

Carol Morgan, managing partner of mRelevance and author of the book Social Media 3.0: It’s Easier Than You Think, says it’s clear that organic search engine optimization (SEO) is the top digital tool to attract buyers, contributing 50 percent or more of the leads builders get from their websites. (A lead, in this instance, is defined as a person who completes a Contact Us form on the website.) “By installing Google conversion tracking on your website, it is easy to determine where your leads are coming from,” Morgan says.

Takeaway: Define your leads and make sure you set up the tracking code correctly.

Is Organic Search the Only King?

After seeing the data that shows that organic search is king, builders may be surprised by the survey’s reporting that homebuyers also place a high value on paid ads that come up in search results; 71.9 percent of respondents said that paid ads influenced them, up from 46.9 percent in 2012–13. When the data was dissected, it indicated that paid ads were considered more influential by younger (25–44), first-time buyers. Interestingly, in the area of price point, paid ads were considered most influential by buyers in the $500,000-plus range.

Organic search results will have the highest influence and click-through rates, which is why SEO—and now local SEO—is so important, says Mike Lyon, founder of the home builder digital marketing consultancy Do You Convert. But, he adds, the second tier of paid advertising really expands and reinforces the brand. “Think retargeting ads, as well as using paid search on Adwords, Bing, Yahoo, and third-party listing services,” Lyon says. “You shouldn’t only be seen in organic results, but on all the buying and research channels homebuyers use. That’s the new reach and frequency.”

Morgan isn’t so sure about that. A paid search is “certainly a good source of traffic, but dollar for dollar, these tend to be very expensive leads,” she says, adding that paid search results contribute a very low percentage of website leads.

Banner ads can be very effectively used for hunting, Morgan says. “Today, home builders can find their buyers before their buyers are even looking for them by using a combination of semantic, geographic, behavioral, keyword targeting and retargeting,” she says. “Talk about the laws of attraction.”

Offline advertising is a broad channel and can’t accurately be compared with the digital channels, the study notes. Yet, at 81.8 percent, it’s more influential in attracting buyers to a particular builder’s website than any other channel, including organic search (81.6 percent). “It was interesting to see how all of offline compares to online attraction efforts,” Diffee says.

Takeaway: Print, TV, and other offline advertising methods aren’t dead, and they’re still influential.

Mobile Is Mighty—and It’s Google’s Favorite

During the survey’s research, or engagement, phase, when prospective buyers are weeding out the builders whose homes they won’t go look at, the Conversion Report indicates that prospects rely on a number of digital tools. The survey asked buyers to rank the importance of photo galleries, videos, interactive floor plans, virtual tours, reviews/testimonials, a builder’s social media presence, and a mobile-friendly website.

Surprisingly, this was one area of the study where it appears that buyers may have begun to lose interest in some standard online tools. The tools are still considered important, according to the report, but from 2013–14 to 2014–15, the percentages had begun to taper off. For example, in 2013–14, 94.6 percent of respondents said that photo galleries are important; in 2014–15, that number fell to 89.6 percent. Again, context is important here: This year’s survey indicates that mobile-friendly websites saw an increase compared with the results from Bokka’s previous survey.

When the data is segmented for young buyers, it reveals that those buyers are actually less likely than the average new-home buyer to use their smartphones during the research phase to check out builders. The finding is surprising, given how many people seem to be surgically attached to their phones. But as Diffee points out, it’s not because buyers don’t want to use their smartphones; it’s because right now, most builders’ websites aren’t fully responsive to mobile devices.

The data reveals that young buyers are actually less likely than the average new-home buyer to use a smartphone during the research phase to check out builders. But that's not because buyers don’t want to use their smartphones, it’s because right now, most builders’ websites aren’t fully responsive to mobile devices.

The importance of a mobile-friendly website can’t be overstated, says Do You Convert’s Lyon. “Google’s recent changes actually reward mobile-friendly design because it is the best experience for the customer,” he says. Many builders who lack mobile-friendly, or responsive, design, have seen a significant drop in organic traffic—as high as 30 percent.

Not familiar with Google’s recent changes? Some refer to them as “mobile-geddon.” Morgan explains: As of April 21, 2015, Google started factoring “mobile responsiveness” into its search engine algorithm. If your website isn’t built to be mobile-friendly to devices such as cellphones, iPads, and tablets, your site disappeared from Google’s organic search results on those devices.

This is massive. Experts at the consultancy Marketing Relevance say that 50 percent of the traffic to its clients’ websites comes from mobile devices. If your site isn’t showing up in the search results, buyers can’t find you.

Though mobile is what we’re calling the technology now, that won’t be what we call it soon, Diffee points out. What will the nomenclature be? “We’ll be calling it wearables,” he says. Technology is getting “smarter, smaller, and integrated with so many other things.” And builders will need to be at the forefront of that technology as well.

Takeaway: Mobile responsiveness is crucial. The most important marketing tool of all is a responsive website that works on both smartphones and tablets.

Online Reviews Matter for Home Builders

If you’re thinking of going to a new restaurant, there’s a good chance you’ll check its online reviews first. It’s the same when consumers shop for everything from cars to a new dentist. Similarly, buyers will beat the bushes looking for reviews of a prospective home builder.

The Conversion Report notes that during the research phase, 78.6 percent of buyers said that reviews and testimonials are important to them. By comparison, 39.6 percent consider a builder’s social media presence important, 64.2 percent place a high value on a mobile-friendly website, and 71 percent think videos are an important tool.

No one expects a builder to have a spotless reputation, but buyers do want to confirm that they’re making a smart decision, Morgan says. Reviews help.

Takeaway: Consider creating a separate blog around your company specifically for happy customer reviews. In addition, claim your company profile on Yelp, Yellow Pages, and even Angie’s List so that you can better control and influence your reputation.

Social Media and Email Updates Play a Role

What about your social media presence? Among first-time buyers, 52.1 percent said it is important; among repeat buyers, the number dropped to 26.6 percent. Among the tech-savvy 25–44 age bracket, 47.3 percent said that a builder’s social media presence is important to them. In the 45–54 age group, it influenced just 22.4 percent of buyers.

Once on a builder’s website, what will convince a prospect to provide his name and contact information? The report’s answers are multifaceted, covering everything from the overall tone of the site and the privacy policy to the lure of access to restricted features and personalized content, and even the number of questions that prospects are required to answer.

Beyond the trust-building tools on a website, the report notes that 88.6 percent of buyers consider access to useful, high-value information an important reason to register online. Such information includes email updates about current promotions or offers, pricing and availability, email invitations to exclusive events, a follow-up from a sales agent with more information, and access to a high-resolution, interactive brochure. The Conversion Report’s ratings in this category have stayed high year over year.

Of note is how often buyers want email updates. In the previous survey, the majority (41 percent) wanted to be contacted monthly. That number has dropped to 32 percent. The percentage of people who want to be contacted twice a month has gone up from 13 percent to 21 percent; weekly email preference increased from 21 to 29 percent. “They definitely want to be updated more frequently,” Diffee says.

Takeaway: Send out email blasts two to four times a month and make sure they contain information that’s useful and interesting to those searching for a new home.

Personal Phone Contact Is Powerful in Home Sales

The survey’s question about setting appointments to visit the sales center prompted varied responses. Respondents were asked which tools they would be most likely to use on a builder’s website to schedule an onsite appointment: map/directions page, phone, email, online appointment request form, a general contact form, or live chat. The winner? The phone.

Kevin Oakley, a managing partner at Do You Convert, found this intriguing. Online chat is significantly lower than any of the other forms listed “and yet so many builders are convinced that they need to prioritize executing on chat before the telephone,” he says.

In his surveys of builder sales teams, Oakley says he has consistently found that phone calls are usually only answered between 20 to 30 percent of the time; the rest go to voice mail, where only about 50 percent ever receive a response. “I continue to be puzzled as to why many builders will not dedicate a resource to better handling of incoming phone calls,” Oakley says, “especially since while chat does well at getting people to share some information, the phone is still king at actually converting an online shopper to an on-site appointment.”

Takeaway: Man the phones. There’s power in a real, live person answering an initial call.

Tech and People Are Equally Valuable Tools

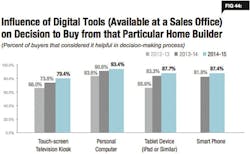

Many builders use touchscreen kiosks, personal computers, tablets, and smartphones to provide such information as floor plans, availability, community amenities, and exterior elevations. These tools give prospects easy access to meaningful information. Survey participants rated the value of these tools for conveying such information.

The study found that availability of tablets and touchscreen kiosks in sales centers is more important to younger and first-time homebuyers than to older, repeat buyers.

But the report reveals that what customers want to do with the technology is also worth noting. Far from seeing the tools as a platform on which to view a static display, customers want to make use of them through such features as interactive floor plans, interactive virtual tours, and virtual design centers to experiment with options.

There are a number of reasons for this, Morgan says. In today’s technologically savvy world, consumers expect immediate information that’s both accurate and timely. Interactive sales tools speak to this mindset, allowing new-home buyers to start the process of gathering information, even when the salesperson is busy with other visitors. “Visitors can zoom, scroll, and swipe their way through your content and data with the touch of their finger,” she says.

Of the high value attached to virtual tours—whether on builder websites (81.8 percent) or on devices in the sales center (95 percent)—Oakley says he’s learned that not many women warm to virtual tours. “They like them in theory, but the way that virtual tours often distort the image to give a feeling of space is off-putting to women,” he says. “So the fact that the survey seems to show that people would rather take a virtual tour than watch a professionally shot and edited video is surprising. When you consider that YouTube is the second largest search engine, we know people love video.”

However, the power of the words “virtual tour” is real, and that’s often why builders will simply call videos of floor plans “virtual tours.” Oakley theorizes that the large percentage of survey respondents who placed a high value on virtual tours simply stems from the fact that virtual tours have been around for a lot longer on builder websites than video has, and so this is more a nod to the fact that buyers expect to see virtual tours as an option; nothing more. Plus, there’s a lot of poorly shot video out there.

That said, this could change, Oakley points out. The type of virtual reality that can be achieved with the Oculus Rift 3D gaming headset “will completely change the way people shop for homes online,” he says. “That’s when a virtual tour will live up to its name.”

The study shows how dramatically the new-home sales process is changing. “Today’s buyers have more control over how they access, assimilate, and process information, and all of that has changed the role of the sales agent,” the report concludes. “Once the gatekeeper for information that influences a buying decision (i.e., pricing, availability, and upgrades), the sales agent today must play a new role.”

Takeaway: Many buyers will have already gathered significant amounts of information before their visit. Sales agents need to create high-quality interactions by personalizing technology and then by translating it to suit the buyer’s specific needs and wants.

A complete version of The 2014-15 Home Buyer Conversion Report is available here.