How Immigration Helps the Housing Industry

Demographics has been called “the glacial science” because it progresses slowly but can move mountains. That’s fortunate for the housing industry because looking at population trends across several decades allows demographers like me to anticipate the future for home builders and developers.

Since the widely regarded end of the pandemic in late 2021, immigration into the U.S. has reached unprecedented levels and has been a primary driver of population growth. The Congressional Budget Office (CBO) reports that 6 million immigrants moved to the United States in 2022-2023, which is more than triple the annual rate from 2020-2021.

That’s significantly higher than previous estimates and it's helping ease the labor shortage and boosting demand for new homes, especially rental units, while the nation’s natural birth rate declines.

RELATED

- The Right Immigration Reform Means More Affordable Homes

- What Impact Does Immigration Have on Housing?

- Which States and Construction Trades Rely Most on Immigrant Workers?

What Is Immigration?

First, let’s define what, exactly, we mean by immigration. There are three types of immigration we follow at John Burns Research and Consulting, as do other organizations, including the CBO. They are:

- Lawful permanent residents and their families

- Students and temporary workers

- Legal status-pending immigrants

Of the three groups, legal status-pending immigrants represent 4.9 million people (70% of total immigration since 2022). These immigrants are typically those who cross our borders, claim asylum in the U.S., and are being processed through the U.S. immigration and naturalization system.

As they await their court dates to determine their final status—some scheduled years in the future—these immigrants are considered U.S. residents and as such can apply for a Social Security card, are allowed to work legally, are obligated to pay taxes, and—of course—are in need of homes.

As you can see in the chart below, legal status-pending immigrants have made up the vast majority of all immigrants in the U.S. since 2022.

With that, immigration represented the bulk of a 3.6 million person increase in the U.S. population in 2023—the largest one-year increase in our nation’s history.

What Is the Impact of Immigration on Housing?

Legal immigration since 2022 has been affecting the housing industry in two important, positive ways. First, it is easing the labor shortage, and secondly, it’s increasing demand for housing.

1) Easing the labor shortage

Today’s tight labor market—not just for construction but overall—is driven by demographics.

Specifically, about 4.2 million people will turn 65 in 2024, effectively aging out of what’s considered “working age.” On the flipside, an estimated 4.4 million people will turn 20 during 2024, thus entering that “working age” cohort.

That’s a fairly narrow net gain of workers going forward, and without immigration, the pool from which we pull workers will continue to shrink over time.

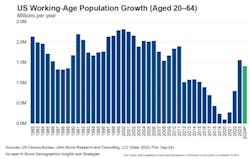

In fact, population growth among working-age adults had steadily waned since peaking in 2000—and nearly so again in 2010—from more than 2.25 million to about 100,000 in 2020, and population growth was in danger of going below net zero for the first time.

But when U.S. borders reopened after the COVID-19 pandemic, the working-age population growth rate surged again to more than 1.5 million workers in 2023, and it’s expected to be about 1.4 million more this year (see chart, below). This surge will boost labor availability and allow for the creation of millions of jobs without furthering inflation after it peaked in 2022.

The recent influx of above-average immigration also will add $8.9 trillion to our country’s gross domestic product (GDP) over the 2024–2034 period, according to the CBO, primarily by expanding the labor force.

RELATED

2) Increasing housing demand

In normal years (about 1.2 million in net annual immigration growth) new immigrants form about 300,000 new households.

But from 2022 through 2024, net immigration is expected to be 2.7 million new residents per year, resulting in approximately 200,000 more immigrant households per year than in normal years. That’s 1.5 million new households during that time, about 27% of the 5.5 million net new households formed since 2022.

Of those 1.5 million new immigrant-led household formations, 84% (or about 1.3 million of them) are renting. And while that segment is a complex mix of apartments, two- to four-unit structures, and both existing and new single-family homes, the message (and opportunity) is clear that more for-rent units are needed to satisfy demand—and specifically those units that are designed for families and multigenerational households.

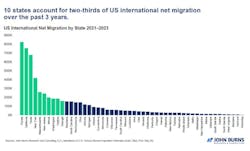

That’s especially true in areas of the country that have high immigrant populations, namely Florida, Texas, New York, New Jersey, and California (find your state in the chart, below).

Immigration and Housing: Looking Ahead

While recent policy changes have led to a slowdown in border crossings into the U.S., 2024 is still expected to be a near-record year for immigration. The housing industry should prepare for continued strong demand for housing, particularly in the rental sector, as these demographic shifts reshape the market.

Watch the full recording of Eric’s webinar presentation, "U.S. Demographics and Insights for 2025 and Beyond." Provide your name and email address for access.

Eric Finnigan is VP of demographics research at John Burns Research and Consulting where he produces the “US Demographics Insights and Strategies” suite of reports and helps clients plan around demographic shifts that affect housing and the overall economy. He holds a master’s degree in economics from Fordham University.