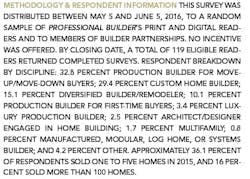

While the majority of builders reported in Professional Builder’s 2016 Finance survey that access to financing has improved over the past year, many, judging from their written answers, would like to have a time machine to skip the arduously long period for processing loans.

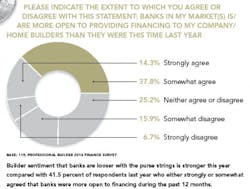

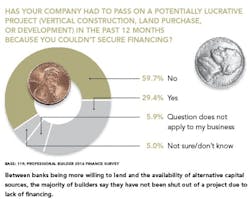

Fewer builders indicated that they were shut out of a project due to the inability to secure financing compared with the previous two years, when more than a third of respondents said they lost projects due to tight credit. But there were plenty of respondents—including members of Builder Partnerships—who grumbled about lending activity not keeping up with their ability to start projects. Other complaints included long delays in closing loan applications, the inability to close homes with lenders on time, and cumbersome regulations and paperwork. The NAHB first-quarter AD&C financing survey found that while credit conditions for that period were better compared with the fourth quarter, looking at the longer-term trend suggested that the easing of credit that began in 2012 peaked in the fourth quarter of 2014, and has been diminishing since then.

For more results, see the charts that follow. Click images to enlarge.