Survey Says: Insights on the Effects of the Labor Shortage, Part I

It’s true! Your shortage is the worst in America. Builders in at least 20 cities in the past year have insisted to me that their trade shortage is the worst in the nation. In most markets, reliable and current stats are so hard to come by that there’s little point in arguing.

But now that we’ve moved beyond mere awareness of the shortage to feeling the full impact, the conversation varies significantly by the attitude of local builder leadership. Some builders have an almost fatalistic take on it, “Que Sera, Sera.” They count on sufficient trades showing up somewhere, somehow. Purchasing managers in these firms lament that their superiors are in denial about the escalating costs inherent in this approach. The majority of builders are doing “something,” but that rarely amounts to anything beyond just trying harder at the same old methods. They scour the hinterland for trades, ask current trades for recommendations, and try to entice still others to work on their side of town. There’s nothing wrong with these efforts, of course, but they won’t keep prices in check.

There’s so little data beyond the anecdotal as it relates to builder impact that we decided to run a survey to see what we could learn. To increase the returns, our goal was to keep the survey short—just 10 questions—and try to gather a broad cross-section of responses from across the country. With about 165 responses, the statistics are pretty solid; enough to give us some insight into what’s happening and where we’re going in the near term. Let’s take a look at the responses for the first five questions, and next month we’ll review the other five.

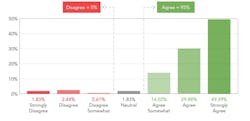

1] The availability of trades is a critical issue

The first question is simple and straightforward, with the results coming as no surprise. You can break down each of the seven responses, but to save you time adding up numbers, for each graph we’ve combined the three responses on the positive side of neutral and put them in a green box, while taking the three on the negative side and putting them in the red box. With about 2 percent neutral, we get 93 percent agreeing that the trade shortage is critical, with just 5 percent disagreeing. With nearly 50 percent in the “strongly agree” category, this may gain a big “Duh!” response, but looking at it this way provides a good feel for the problem’s severity.

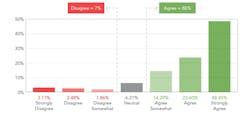

2] The shortage of trades has inflated our schedule

The numbers here are similar, with a slightly higher neutral response. Inflated schedules mean inflated costs—there’s no way around it. A delayed schedule also slows down cash flow, payments to trades, and frustrates customers. Nothing good about it. If you want a true picture of the cost of lost schedule days, send an email to [email protected] and request our “Saved Day Calculator” Excel template. It will help you accurately identify the cost. (Caution: Prepare to be shocked.)

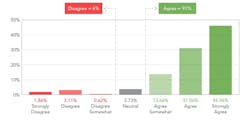

3] The shortage of trades has increased our direct costs

Once again, we see a huge consensus on the impact of the trade shortage, this time on direct cost, with nine out of 10 builders feeling the impact. Add to this the impact of schedule, above, plus other realities such as the increased costs in land and entitlements, and it’s easy to see why margins are squeezed. In most markets, the increases in retail selling price of new homes haven’t been enough to cover the rise in costs.

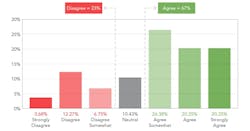

4] The shortage of trades has had a negative impact on quality

Although the numbers indicate that the trade shortage has affected quality less than it has cost, the impact on quality is still substantial. Two-thirds of surveyed builders see a negative impact on quality, about 10 percent have held the line with a neutral response, and about a quarter aren’t seeing a negative here. In truth, this is somewhat less than I expected, based on the anecdotal evidence from the field. Most of the big survey companies also see overall quality scores down since before the housing recession. This will be interesting to follow in the next few years.

5] The shortage of trades has limited deliveries and growth

Two years ago, I listened to the CEO of a Top 20 national builder lament how trade shortages have delayed closings and stymied growth, and little has changed. In this graph, nearly three-quarters of respondents report at least some impact, with 11 percent neutral, and just 17 percent seeing no negative impact at all. This is an obstacle both to short-term cash flow and longer-term opportunity.

In Part Two, we’ll examine the responses to the other five questions in our industrywide survey on the trade shortage. It looks pretty negative, but as I’ve discussed in previous columns this year, a select few builders are beating this rap. These builders are truly pushing the envelope, doing things that insulate them from the worst of the shortages. They’ve adopted a “builder of choice” strategy and focus on ways to help their trades become more profitable—without simply raising labor rates or commodity prices. The fact that most builders believe it can’t be done is the out-of-the-box builder’s greatest asset and guarantees that the vast majority of competitors will never copy them. But whatever your take, I hope getting a handle on how the shortage affects the industry provides some motivation to take another look, increase your focus, and make a plan for what you’ll do to remedy the situation.

Click here to read Part 2.

About the Author

Scott Sedam

Scott Sedam is president of TrueNorth Development, a consulting and training firm that works with builders to improve products, process, and profits. A senior contributing editor to Pro Builder, Scott writes about all aspects of the home building business and won the 2015 Jesse H. Neal Award, business journalism's most prestigious prize, for his commentary in Pro Builder. Scott invites you to join TrueNorth's Lean Building Group on LinkedIn and welcomes your feedback at [email protected] or 248.446.1275.