|

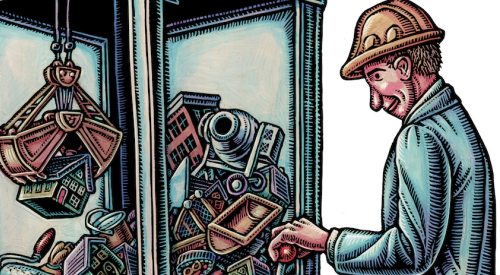

But today, housing's Giants are diversifying into many different products — some of them far removed from the conventional, stick-built subdivision. On page 18 of this issue, you'll find senior contributing editor Matt Power's report on the burgeoning high-rise condominium sector, a beacon now attracting the largest public home builders. What's happening here? Why are the big boys rushing into a market segment so dramatically different from the one that sustained their growth for decades? Is the traditional subdivision an endangered species? Does the multiplicity of products undermine the efficiency and profitability of the big public builders?

Housing markets are local, even if the large builders operate on a national (or even international) scale. In some markets, political and economic forces do, indeed, make the conventional, four-to-the-acre subdivision an endangered species.

There's something even more fundamental than land costs and political opposition to sprawl at work here. Housing demand is fragmenting into smaller market segments, just as it is with every other consumer product category. When buyers have 100 TV channels, they're not going to accept choosing among only two or three different types of ownership housing.

The housing Giants quickly identified infill high-rises as a product to meet growing demand for city living among young professionals and older empty nesters. High-rises also allow housing Giants to build a lot of units in one location. That fits the mass-production model. And the big, national builders have a competitive advantage over local and regional players in that sector. Because they are so well-capitalized, they don't have to pre-sell 60 percent of the units before starting construction.

Selling so far ahead of closing takes a lot of pricing power out of the builder's hands. Even though it increases risk, public Giants can finance construction of a building out of pocket if they want.

Certainly, product diversification challenges public builders' profitability. It's easier to maintain margins building one product type than 10 different ones. And high-rises require a completely different production machine. But what choice do these builders have? The steam may go out of the market, reducing land cost pressures, but fragmentation of housing demand is not going to end.

Attached housing will soon make up as much as a quarter of big builders' product mixes. (It's already 17 percent at D.R. Horton.) And while conventional subdivision homes remain the right product for some buyers, high-density detached projects at five to 12 units an acre will soon be important. Compact, in-fill neighborhoods of such homes can lure buyers from both subdivisions in the boondocks and close-in high-rises.

Only time will tell if public builders can handle all this product diversity and maintain margins. But in a fragmented market, they'll need a bunch of product types to meet Wall Street's demands for top-line growth. I believe diverse housing demand presents an opportunity for private production builders to specialize in one or two niche product types and compete with the big boys, who really have no choice but to build them all.

e-mail Bill at bill.lurz@reedbusiness.com