| Laing's infill team: (from left) Javier Mariscal, director of urban regeneration; Dan Konnor, director of infill land acquisition; Dan Flynn, director of land acquisition; and Abel Avalos, infill manager | ||||||||||||||

|

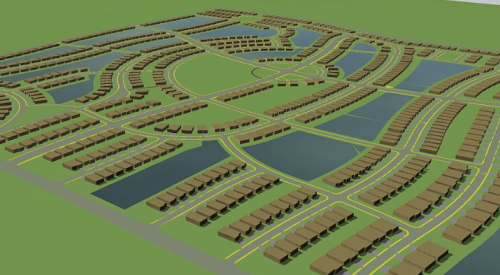

Konnor must "sell" Laing's ability to clean up brownfields, develop constrained sites and build to densities as high as 85 units per acre. On the receiving end of his pitch are private landowners and public agencies with little or no knowledge of what Laing does in the Orange County and Inland Empire suburbs. Here is some of what Konnor tells them:

"John Laing Homes is one of the few remaining large private home builders in California. The big publics don't have the patience to go through two to five years of entitlement processes to build only 30 to 40 units of housing. They'd rather use their resources to build 200 to 300 units at a time in Texas or Florida, with no delays. They're playing a numbers game to hit 50,000 units a year to impress Wall Street investors.

"Infill is more suited to us, yet we are still large enough to tackle that entitlements process and willing to do it if we can get 50 homes that will be profitable at the end of the day. Smaller builders may be willing to do it, but they don't have the capital or strong balance sheets to finance it. We're just the right size."

Urban Regeneration Politics

Urban regeneration and infill housing is a market hugely constrained by local politics as well as environmental and entitlement issues. As such, it's attractive to Laing, which soon might be the biggest player willing to play that game in many Southern California cities. Financial staying power could give Laing a leg up on even The Olson Co., PB's 2000 Builder of the Year and the reigning kingpin of California urban regeneration.

"What we're looking at is an opportunity to take advantage of all the urban sites that are overlooked because something is wrong with them," says Javier Mariscal, JLH's new director of urban regeneration. "Landowners of these sites are not just looking for a buyer willing to pay top dollar, they are looking for someone who can solve the problems that constrain development."

Environmental problems are sometimes part of it, Mariscal says, but not the hard part. The real problems are political - existing residents and neighbors. "Unless you bring them into the process, they will shoot down whatever you come up with, even if you have the mayor, city staff and an army of consultants on your side," Mariscal warns. "If you leave out the neighbors, it won't fly."

What's starting to set Laing apart is its willingness to do outreach to these local constituencies upfront. Planners used to go out and set the table for development. Today, with all of the budget cuts, they are lucky if they can just process plans, let alone do advanced planning for redevelopment.

That role now falls to developers. If Laing puts together a team to deal with all of these issues, cities will seek it out. Olson is the big player in this game now, but JLH soon might bring resources to the table that will make it a very tough competitor even for Olson.