Despite continuing shifts in housing market dynamics—namely, the effects of inflation and the increase in interest rates to help cool it, not to mention lingering pandemic-induced pressures on production—home builders remain generally optimistic about the year ahead.

Not only do an overwhelming percentage of the respondents to Pro Builder’s annual Housing Forecast Survey think they will sell more homes and generate more revenue (see charts, below), but nearly 70% rate the overall health of their companies today as good or very good, and roughly half expect 2023 to be a very good or excellent year.

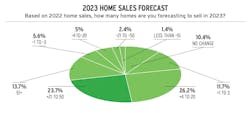

Likely due to lingering inflation and rising mortgage interest rates that quell demand, builders are slightly less bullish about selling more homes and reaping more revenue in 2023 than they were in 2022. Still, just 14% expect a decline in sales, and 19% anticipate lower revenues.

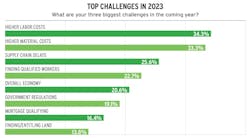

That optimism is especially impressive when you consider the potential barriers to growth and profitability, namely higher labor and materials costs, ongoing supply chain delays, concerns about the overall economy slipping into a recession, and—for the first time in a while—challenges getting buyers qualified for a mortgage loan (see “Top Challenges in 2023,” below).

Asked separately, 60% of builders anticipate materials costs will increase in 2023, while 53% think bid prices for labor and materials also will go up. Higher mortgage interest rates may hinder loan qualifying among some buyer cohorts, but competition from other new-home builders (12.4%), from rentals (8.4%), and from resales (8.1%) were considered minor barriers to success in 2023.

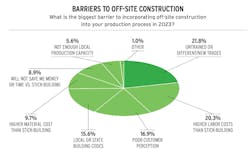

35.6% of home builders say they are likely or very likely to incorporate off-site construction methods (precut, panels, modular) into their production process in 2023, while 37.8% remain neutral.

Among the 68% of builders planning to purchase land in 2023 42.8% anticipate making some of those deals in the close-in suburbs, 35.2% in the suburbs, and 33.3% on urban/infill sites.

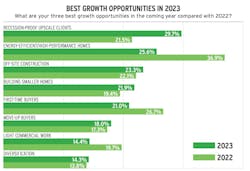

How will builders weather those headwinds? By focusing more on so-called “recession-proof” buyers, while also embracing new (and presumably more cost- and time-efficient) off-site construction methods that (ideally) alleviate a variety of pressures on production (see “Best Growth Opportunities in 2023,” below).

With that, 68% of respondents anticipate buying land next year, which is a healthy increase from their 2022 forecast and is supported by their anticipated (if slightly less bullish) uptick in sales in 2023. And, despite the “exodus to the exurbs” touted by many during the pandemic, most of those land deals will be in the suburbs and urban infill plots, an indicator (along with plans to build smaller homes) of higher densities and perhaps more affordable pricing.

How will home builders grow sales and revenue? By focusing more on their core competencies and target markets, relying on upscale “recession-proof” buyers, and incorporating off-site building methods to counter persistently high labor and materials costs.

The range of barriers to off-site construction indicates an industry that’s still immature and misunderstood from a total-cost perspective and both local code and consumer acceptance. Even so, home builders increasingly consider off-site a growth opportunity (see “Best Growth Opportunities in 2023” chart, above).

Methodology and Respondent Information: The 2023 Readers’ Forecast Survey was distributed to Pro Builder’s print and digital readers between Sept. 8 and Oct. 8, 2022, as well as to builder members and clients of Shinn Builder Partnerships, TrueNorth Development, Group Two, SMA Consulting, IBACOS PERFORM, and the Housing Innovation Alliance. Recipients were offered the chance to win one of four $50 Visa gift cards for completing the online survey. Gift cards were awarded in October 2022. As many as 1,432 responses were recorded and 1,375 surveys were completed.

RELATED

- Housing Outlook: Is This a Recession … or Not?

- Lessons Learned From Previous Housing Market Disruptions

- 2022 Housing Forecast: Opportunities and Challenges