2024 Housing Giants Report and Rankings

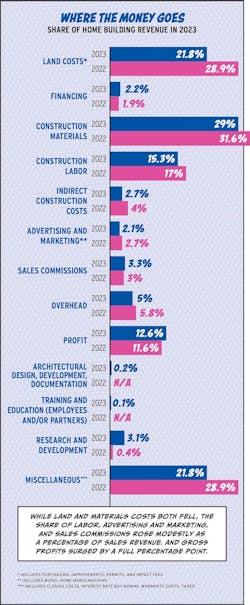

What does it say about the country’s leading home builders when they earn less housing-related revenue in 2023 than during the previous year but report higher profits, spend more to market and sell their homes, only gain a slight measure of market share at the top, and indicate greater interest in diversifying their operations in 2024?

It says “Watch for Trends,” particularly:

- Consolidation—Mergers and acquisitions activity is hot in the housing sector.

- Build-to-rent—B2R starts in 2023 hit record numbers, and 2024 promises similar momentum.

- The Economy—General economic conditions are providing a mix of challenges and opportunities for home builders in 2024.

1. Consolidation

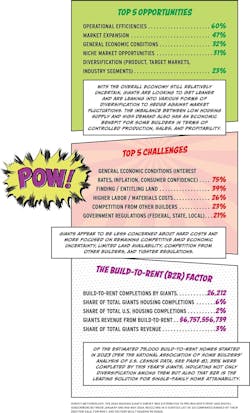

It’s no secret that the Housing Giants at the top of the revenue pyramid are gaining market share through mergers and acquisitions. “It’s an extremely active market,” says Chris Jasinski, founder and CEO of JTW Advisors, an investment bank serving home builders and land developers. “And the conditions are there for continued consolidation well into the future.”

Bolstered by the surge in housing activity during the COVID-19 pandemic, the nation’s largest public and private builders amassed a war chest of cash, combined with low debt. That’s now allowing them to gobble up both land and successful, smaller-volume builders to expand their geographical footprint and their product lines—especially in emerging secondary markets such as Huntstville, Ala., and Knoxville, Tenn., which is where the jobs are, Jasinski points out.

2. Build-to-rent

This year’s Giants delivered more than 26,000 build-to-rent (B2R) homes; a solid mix of single-family detached, attached, and apartment units.

Among the 64 Housing Giants reporting B2R completions in 2023, D.R. Horton (No. 1 in our overall rankings) led the way with 7,942 units, while the next five—Harkins Builders (No. 50), NexMetro Communities (No. 56), BBL Building Co. (No. 100), The Challenger Group (No. 39), and Edward Rose Building Enterprise (No. 203)—added 7,682 more; with D.R. Horton, the top six generated $4.2 billion in revenue from that activity.

With a record number of estimated B2R starts in 2023, build-to-rent’s future appears poised for growth ... so long as investment dollars roll in.

3. The Economy

For the second year in a row, general economic conditions are among both the top five challenges and top five opportunities anticipated by Giants in 2024. The former is a primary headwind preventing the industry from getting back to pre-pandemic levels of reliable activity and growth; the latter is driving operational efficiencies and a broadening mix of markets and products that will enable builders to better control their fate during persistent uncertainty and the outcome of the upcoming presidential election.

“The current economic environment feels similar to the long lead up to the 2008 recession, so I advise builders to be cautious,” warns Chuck Shinn, co-founder of home builder consulting firm the Shinn Group. “Scrutinize the national economic headline news coming out of Washington, D.C., and compare it with the trends you’re seeing in your local communities.”

SCROLL DOWN FOR A PDF OF THE 2024 HOUSING GIANTS LIST

MORE 2024 HOUSING GIANTS ...

Also in Pro Builder's 2024 Housing Giants Report:

- Home Builders, What's Your Off-Site Construction Super Power?

- MORE HOUSING GIANTS DATA: 2024 Housing Giants ranking lists by housing type and region