Buyer Budgets and House Sizes [Research]

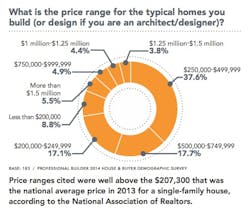

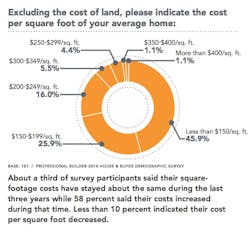

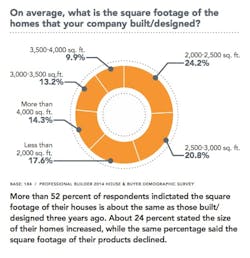

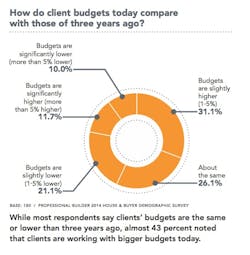

When an industry comes out of a slump the way home building has, building product suppliers and trade contractors are going to try to recover some of those lost years by raising prices. So it’s no surprise that builders, architects, and designers participating in Professional Builder’s House and Buyer Demographic Survey report material and labor costs are rising and their average cost per square foot has increased.

Methodology and Respondent Information

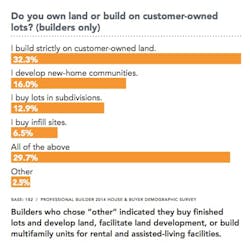

This survey was distributed between January 28 and February 10, 2014, to a random sample of Professional Builder’s print and digital readers. No incentive was offered. By closing date, a total of 187 eligible readers responded. Respondent breakdown by discipline: 34.6 percent custom home builders; 16 percent builder/remodelers; 14.1 percent for production builder for move-up buyer, 13.5 percent architects engaged in home building; 4.3 percent production builders for first-time buyers; 3.8 percent multifamily; 3.8 percent manufactured or modular builders; 2.2 percent luxury production; and 8.1 percent other. Almost 52 percent of respondents sold one to five homes in 2013, and 16 percent sold more than 50 homes.

That happens when demand picks up amid a tight labor market and just as low inventories for building products start to ramp up. But other factors cited by builders included the cost of regulatory compliance, health care, and code changes.

Some builders, however, report their cost per square foot declined because they’re building smaller homes, and one Midwest builder said his costs fell because his market went from using union to non-union labor for residential construction.

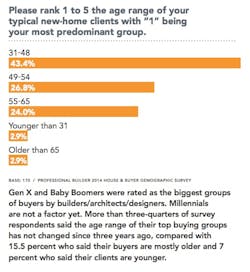

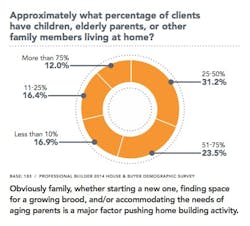

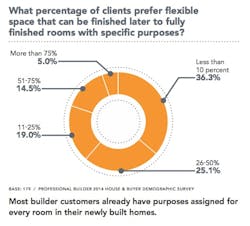

More findings about house size, price, and buyer profile statistics are presented in the charts that follow: