A 2023 Outlook on Building Product Install Volumes

Building product demand in residential construction is likely to be down for the reminder of the year compared to 2022, but the researchers behind John Burns Research and Consulting’s (JBREC’s) new Building Products Demand Meter don’t believe the industry will have to wait another 12 months before things start bouncing back.

Introduced earlier this year, JBREC’s Demand Meter, built in partnership with Home Innovation Research Labs, is a quarterly report that tracks and forecasts demand across multiple product categories for both new construction and remodeling industries. The Meter draws on data from Home Innovation Research Labs’s Annual Builder Practices and Consumer Practices surveys.

“We’re really excited about the data,” says Matt Saunders, senior vice president for building products research at JBREC. “We have over 20 years of data and we’ve accounted for changes over the several surveys to develop one continuous time series.”

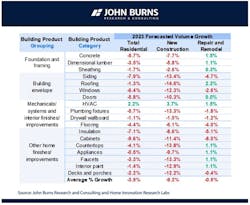

The difference between new construction and remodeling is indiciative of how remodeling has historically performed during times of economic strife and uncertainty.

Image: JBREC

While full access to JBREC’s Demand Meter is limited to company clients, a broad-strokes report was recently released to the public, which provides a demand forecast for the remainder of the year. Of the 18 product categories accounted for across the residential construction industry, 17 are projected to end 2023 with year-over-year declines.

“As you can see, we’re pretty negative for this year just in general,” Saunders says.

HVAC products are the sole category expected to end the year in the green. But Saunders explains that while the forecast is, at a glance, grim, a deeper analysis of the data reveals a optimistic trends.

An Increase In Builder Activity

“For the first half of the year, home starts were down quite a bit,” Saunder says, referencing US Census data that showed in July home starts were down 13% year over year. “But we think activity is going to be much stronger for the back half of the year.”

The anticipated surge in starts is reflected in JBREC’s Demand Meter, Saunders says. “The uptick during the back half of the year is going to impact early stage materials first. Think foundation and framing.”

Divisional lumber, for example, is expected to experience a 1.4% increase in install volumes during Q3 and then a further 8.9% increase in Q4—which doesn't have the category ending the year in the green, but it does put it on a good trajectory for 2024.

Image: JBREC

Saunders expects early-stage materials (ie, materials installed early in the building cycle) to get a boost as soon as this year from increased builder activity. However, other materials will have to wait for the same boost. “The strength we’re expecting to see in starts activity during the back half of the year isn’t really going to filter through to those to those products that are installed later in the build cycle until 2024”

A Resilient Remodeling Market

On the remodeling side, JBREC’s Demand Meter shows install volumes for 10 product categories ending the year with positive year-over-year growth. Though, the growth is limited.

“Historic install volumes in remodeling are around 3% or so, with around 2% inflation, which accounts for a nominal growth rate of about 5%—so we’re still off that on the remodeling side,” Saunders says. “The weak growth there is particularly due to a dip in volumes for products used in large discretionary projects—something Home Depot essentially reiterated in a recent fiscal update.”

On August 15, Home Depot’s Chair, President, and CEO said in a statement, “While there was strength in categories associated with smaller projects, we did see continued pressure in certain big-ticket, discretionary categories.”

Saunders points to “cabinets” as an example of a product category taking a hit. JBREC’s Demand Meter shows remodeler install volumes are likely to end the year down 8% compared to 2022—the lowest forecasted drop across all 18 categories.

A Positive Outlook for Residential Construction

Despite those certain weak points, Saunders and JBREC are bullish on demand for residential construction products. “We’re anticipating positive growth in both remodeling and new construction next year.”

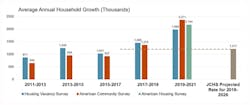

Saunders links that expectation to what he describes as “structural drivers,” or the drivers tied to long-term performance in any particular industry. “For builders, there is a deficit of housing on the new construction side and household formations are increasing, so someone is going to have to fill that void,” he says. “Builders are in a good position there.”

A January 2023 report from the Joint Center for Housing Studies at Harvard University reads, "The number of households headed by 25-34 year-olds grew by 300,000 per year in 2016-2021, up sharply from average annual growth of 45,000 households between 2011-2016, a difference of 260,000 additional households per year."

Image: JCHS

On the remodeling side, JBREC and Home Innovation Research Lab data also points to positive growth. “Households are locked in place at very high home equity levels,” Saunders says. “If homeowners do the math, even with interest rates as high as they are right now, it makes sense in a lot of cases to remodel rather than move.”

Despite some experts predicting an economic recovery that won’t fully begin until 2025, Saunders and JBREC remain more optimistic. “We don’t think we have to wait till 2025.”