Exclusive Research: Builders and Bankers

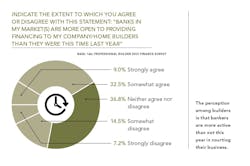

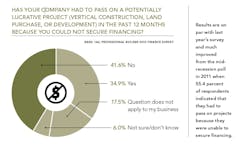

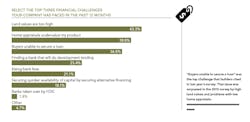

Builders, anecdotally at least, seem to be griping more about the availability of labor these days than they are about their access to financing. Tight credit has been a factor holding back a stronger rebound in new-home construction, but that situation appears to be improving. For example, the volume of residential AD&C loans outstanding posted its ninth consecutive quarter of growth, according to the FDIC, increasing 4.7 percent during second quarter 2015 and 16.4 percent compared with the 2014 second quarter.

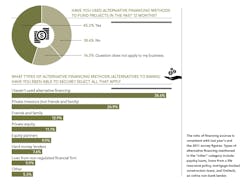

The NAHB’s most recent survey on AD&C financing found nearly all builders reporting that credit availability during the second quarter for land acquisition, land development, and single-family construction was about the same or better than the previous quarter. The finding is in line with Professional Builder’s 2015 Finance survey where most participants noted that the financing environment improved from last year. For more results, see the charts that follow.

METHODOLOGY & RESPONDENT INFORMATION

This survey was distributed between Aug. 3 and Sept. 1, 2015, to a random sample of Professional Builder’s print and digital readers. No incentive was offered. By closing date, a total of 171 eligible readers returned completed surveys. Respondent breakdown by discipline: 35 percent custom home builder; 25 percent diversified builder/remodeler; 13.7 percent production builder for move-up/move-down buyers; 5.9 percent architect/designer engaged in home building; 5.9 percent luxury production builder; 3.6 percent production builder for first-time buyers; 2.9 percent multifamily; 0.6 percent manufactured, modular, log home, or systems builder; and 7.1 percent other. Approximately 48.5 percent of respondents sold one to five homes in 2014, and 17.2 percent sold more than 50 homes.