When it comes to specifying and selling green, high-performance products in the new-home building market, energy-efficient systems and building envelope upgrades, such as high-performance windows and air-sealing packages, are in highest demand by home builders and buyers, according to a October 2010 survey of Professional Builder readers.

Nearly three-quarters of builders surveyed (72.7 percent) said they specified energy-efficient windows in all of the homes they built in the past 12 months, while 59.7 percent installed energy-efficient appliances and 55.9 percent specified an air-sealing package to reduce infiltration in all of their homes. Other popular green products include: low-flow toilets (54.8 percent), high-efficiency HVAC systems (51.8 percent), enhanced insulation packages (51.8 percent), and low-flow showerheads and faucets (49.7 percent) (see table at bottom).

Builders are also having the most success selling energy-efficient products as premium upgrades versus other popular green, high-performance approaches, such as VOC-free materials and low-flow plumbing fixtures. Top green product sellers include energy-efficient windows, high-efficiency HVAC systems, enhanced insulation packages, and air-sealing packages (see table at bottom).

When asked if they believe that the incorporation of green products helps sell homes, 44.7 percent of builders said they agreed (9.1 percent “strongly agreed”), while 26.4 percent disagreed.

“Saving ongoing energy and maintenance costs for the customer is a strong selling point,” said one builder respondent, “especially if there is value and a reasonable payback period.” Several respondents said they offer green products as standard in their homes because it is “the right thing to do” for their customers.

Of course, consumer demand is not the only key driver in builders’ decision to incorporate green products and systems in their homes. In fact, more than one in five respondents (21.7 percent) said meeting more-stringent energy codes is the biggest driver in their decision to go green, followed by consumer demand (20.0 percent), going green as a core company mission (18.3 percent), keeping up with/staying ahead of the competition (17.2 percent), and meeting a green standard (17.2 percent).

Said one builder respondent: “Building codes are a huge issue. The market is not selling as it is, and then we have to increase the cost of the home to comply with ‘greener’ codes. People just don’t want to pay more for that stuff.”

Indeed, higher first cost for green remains a key barrier to the adoption of sustainable, high-performance products and technologies. More than a quarter of respondents (26.6 percent) said consumers’ unwillingness to pay a premium for green is a primary barrier, while 22.5 percent said added first cost for green is a key obstacle.

“Consumers don’t assign value to green products,” said one builder. “They expect that green products are in the home, but look at the lowest price to get them in the door. So without a low starting price, we can’t even get them in the door to talk green.”

How much more are builders paying for green products? Anywhere from 6 to 10 percent more than comparable non-green products, according to 45.1 percent of respondents. Another quarter of builders said green technologies cost “substantially more” (11 percent or more), while only 1 percent said there is no cost difference.

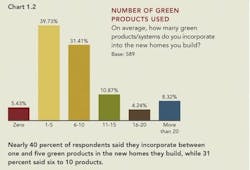

Still, despite the apparent barriers to green adoption, the green homes movement continues to gain traction, even in the difficult economic climate. Case in point: The percentage of homes that are being certified or rated through a green homes program continues to grow. Nearly 60 percent of respondents said they plan on certifying (self- or third-party certifying) at least one of their new homes as green/energy-efficient in the next 12 months — up significantly from the 27 percent that stated they had certified at least one home in 2009 (Professional Builder, Feb. 2010, page 17). Perhaps the best explanation comes from the numerous respondents that mentioned energy-efficient, green design is more and more becoming a reflection of quality. That is, all things being equal, most buyers will choose the similarly priced and styled certified-green home over a non-green home. The challenge for builders is either solving the first-cost equation or selling buyers on the long-term payback of green.

Which green products have you had the most success selling to home buyers as an upgrade?

- Energy-efficient windows 11.18%

- Energy-efficient appliances 9.99%

- High-efficiency HVAC systems 9.92%

- Enhanced insulation package 8.50%

- Air sealing package to reduce infiltration 7.67%

- Energy-efficient lighting 6.91%

- Low-flow toilets 5.80%

- Tankless water heaters 5.40%

- Low-flow showerheads and faucets 4.95%

- Open cell or closed cell spray foam insulation 4.29%

- Low- or no-VOC paints/sealants 3.81%

- Moisture-management products and methods 3.38%

- Advanced framing techniques 3.31%

- Products with recycled content 2.70%

- High-efficiency roofing systems 2.35%

- Products with low off-gassing 2.27%

- Drought-tolerant landscaping 1.97%

- Geothermal heating/cooling systems 1.82%

- Light shelves/enhanced daylighting measures 0.91%

- Photovoltaics/solar panels 0.78%

- Rainwater harvesting system 0.73%

- Gray water reuse system 0.45%

Approximately how many of the houses built, designed, or engineered by your company during the past 12 months include the following features?

All Most Some None Not sure

- Energy-efficient windows 72.74% 18.92% 6.08% 1.56% 0.69%

- Energy-efficient appliances 59.76% 25.78% 10.63% 2.79% 1.05%

- Air sealing package to reduce infiltration 55.96% 19.47% 14.39% 8.60% 1.58%

- Low-flow toilets 54.82% 23.64% 14.89% 6.13% 0.53%

- High-efficiency HVAC systems 51.86% 25.13% 18.23% 4.25% 0.53%

- Enhanced insulation package 51.84% 25.39% 15.76% 5.25% 1.75%

- Low-flow showerheads and faucets 49.74% 23.99% 17.81% 6.53% 1.94%

- Moisture-management products and methods 46.65% 20.43% 16.82% 12.48% 3.62%

- Energy-efficient lighting 37.91% 29.04% 25.91% 5.74% 1.39%

- Low- or no-VOC paints/sealants 34.29% 21.72% 24.60% 14.00% 5.39%

- Products with low off-gassing of indoor pollutants 21.44% 21.08% 24.50% 23.96% 9.01%

- High-efficiency roofing systems 20.29% 17.57% 24.28% 32.25% 5.62%

- Open cell or closed cell spray foam insulation 19.57% 14.86% 28.62% 34.60% 2.36%

- Products with recycled content 15.44% 23.16% 42.01% 14.72% 4.67%

- Drought-tolerant landscaping 13.92% 11.17% 30.04% 38.46% 6.41%

- Tankless water heaters 12.83% 16.40% 35.65% 32.26% 2.85%

- Light shelves/enhanced daylighting measures 5.68% 8.42% 24.91% 53.66% 7.33%

- Geothermal heating/cooling systems 4.53% 5.80% 21.38% 64.13% 4.17%

- Rainwater harvesting system 3.43% 4.69% 16.61% 69.86% 5.42%

- Photovoltaics/solar panels 2.54% 4.36% 19.06% 70.05% 3.99%

- Gray water reuse system 1.47% 2.20% 11.54% 79.85% 4.95%