Change is a constant in the home construction industry; its cyclical nature is the stuff of legend. During the Great Recession and its immediate aftermath, housing production tumbled 75% and the skilled construction labor pool was drained.

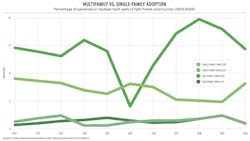

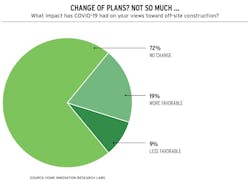

In late July 2021, 348 home builders nationwide responded to a quarterly survey conducted by Home Innovation Research Labs regarding a variety of topics related to changes in their businesses practices. Pro Builder provided additional questions about the adoption of off-site or industrial construction (IC) methods, which is often promoted as a potential solution to labor and production shortfalls. In fact, we’ve collaborated with Pro Builder to ask the same questions about off-site annually since 2019 to track changes in the trajectory of builder adoption of specific IC practices.

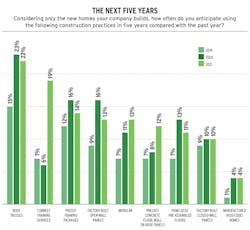

The primary question is whether home builders anticipate using one or more off-site construction practices, among a range of options, in five years’ time compared with the past year, as a way to gauge which, if any, IC solutions may be heading for the mainstream (see "The Next Five Years," below).

RELATED

- Housing, Industrialized: Your Road Map to Off-Site Construction

- Off-Site Construction: A Real-World Study

- HorizonTV: On-Site vs. Off-Site Construction Methods: How to Make the Right Decision

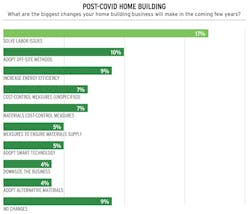

Overall, the data indicate that supply chain disruptions and the continued labor shortage since the beginning of the COVID-19 crisis have encouraged some builders to adopt more diverse and comprehensive solutions to housing production, with IC options leading the way.

So, what’s continuing to keep builders from adopting off-site practices? In the same survey, about half of the builders indicated there is no compelling reason to adopt, that they will continue “construction as usual.”

Following that, they cited IC’s perceived design inflexibility, higher costs, lack of local capacity, and buyer resistance, among other barriers to adoption (see "Barriers to IC Adoption," below).

Having spoken with several IC providers, off-site’s potential to go mainstream will require much higher rates of capital investment, which will only come with growing awareness and favorable risk/return ratios.

Methodology and Respondent Information: Findings are based on quarterly Omnibus Survey of Home Builders deployed and analyzed by Home Innovation Research Labs, most recently in July 2021 among Home Innovation’s Survey Panel of Construction Pros. A total of 348 home builders representing 48 states completed the questionnaire. Thoughtful participation was encouraged by providing a $35 cash honorarium to each respondent. Data derived from other Home Innovation studies is noted.