In its monthly Homebuilder Survey, BTIG/HomeSphere asked 50-100 builders across the country about sales, customer traffic, and pricing trends in the industry. Seventy-eight respondents shared their insights on what they’ve found in March 2022.

HOMEBUILDING INDUSTRY MARCH REPORT RESULTS

Sales and Traffic

Year-over-year (YOY) sales picked up slightly in March. Almost half of homebuilders (46%) reported an increase in orders YOY vs. the 44% of builders that reported an order increase in February.

Comparatively, some builders (22%) saw a YOY drop in orders vs. twenty-four percent last month and only 8% in March 2021. Nineteen percent of builders saw a drop in community traffic this month, while 21% reported the same in February, and 12% last March.

BTIG reminds readers that the pandemic still has lasting effects on YOY comparisons. Additionally, some builders continue to purposefully slow order to match sales with production capacity, given the tight supply chain environment and other material issues.

Expectations

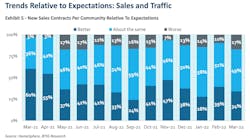

According to the March data, traffic relative to expectations remained in-line with February. Sales relative to expectations dropped, on the other hand.

Thirty-four percent of respondents saw sales as better than expected vs. 39% last month, while 17% saw sales as worse than expected vs. 10% last month.

Just 8% of builders saw traffic as worse than expected vs. 10% last month. The better- minus-worse expectations ratio for both indicators continues to be positive.

Pricing and Incentives

The number of builders raising prices increased slightly in March, while the use of sales incentives remained limited and was relatively unchanged from February. Eighty-six percent of builders raised some, most, or all base prices in March from February (95% last March). This is up from 85% last month, but down from the peak of 100% of builders in May 2021.

As for incentives, the change from last month is minimal. Just 8% of builders increased “most/ all” or “some” incentives vs. 9% last month.

Special Question

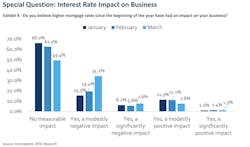

Each month BTIG asks respondents a unique question. This month, they asked builders about the business impact of higher mortgage rates since the beginning of the year. Over the last three months, more and more builders are saying that high mortgage rates have negatively impacted their business.

Though nearly half of builders have yet to see higher rates have a measurable impact on business, over 41% of them have faced some negative consequences to the rise in rates.

As shown in the graph above, the trend shows a growing number of builders that feel this way. From 15% in January to 34% in March, high mortgage rates have led to negative impacts like decrease in sales/traffic and order cancellations.

THE BOTTOM LINE

Overall, demand trends remained steady while expectation of sales dropped in March.

The survey also found a slight increase in builders who raised prices compared to the previous month—likely due in part to material costs and shortages.

Carl Reichardt, BTIG homebuilding analyst, notes that demand appears to be generally healthy, but higher interest rates are beginning to have a detrimental impact. He believes that builders continue to benefit from a short supply environment, but absent lower rates makes him expect demand to begin to ease.

To read the entire Homebuilding Industry Report, click the DOWNLOAD REPORT button below.