How to Hone Your Skills at Bid Analysis

In my previous column, “An RFQ Checklist for Greater Efficiency and Better Margins,” I provided a comprehensive approach to gathering bids for residential construction work and materials.

This column is dedicated to properly and fully analyzing those bids, based on seven primary RFQ criteria, to arrive at the best trade partner or supplier for the job.

Most often, and unfortunately, many bids arrive as a lump sum number. Analyzing those bids is easy work, simply comparing one lump sum to another.

But my philosophy is that a “lump sum is dumb” because it tells you nothing about what actually went into those numbers. If you’re of the same mind and choose to request more detail in a comprehensive RFQ, you’ll end up with the best deal, if not the lowest number, to help you stay within budget and reduce your risk.

Honing It Down So You Can Decide Which Bid to Select

A comprehensive RFQ logically results in very dense and detailed bids. While you should evaluate all of it and raise red flags or note exceptions among the bidders, your decision to select one bid over another ultimately comes down to the following items:

1] Price lock, or how long the pricing is guaranteed

2] Material SKU numbers

3] SKU quantities

4] SKU unit pricing

5] Labor rates

6] Labor hours required to complete the scope of work

7] Overhead and profit

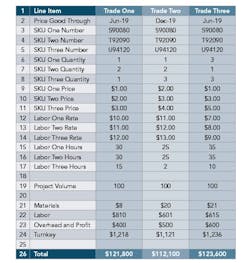

Once you identify these items in each bid, create a spreadsheet that lists them in separate cells (or rows) down the left side and the names of the bidders in separate columns across the top (see sample, below).

It is important to allow yourself to enter as much detail as possible in each cell of this spreadsheet. On the sample provided, for instance, I created multiple rows for material SKU numbers, quantities, and prices, respectively, as well as for labor rates and hours. That’s because you’ll want to compare labor rates and labor hours for different tasks or trades proposed in each bid, such as between equipment operators, truck drivers, and general laborers from each bidder.

(Side note: Material SKU numbers should be consistent across all bidders if required in your RFQ and as shown here. If you allowed “or equivalent” specs or left the material selections open for interpretation, it’s a lot more work to ensure a fair cost comparison.)

Your spreadsheet now has the first six criteria I listed above to properly (and efficiently) evaluate the bids against one another, but we’re far from making a decision. Now enter each bidder’s price lock, SKU numbers, SKU quantities, SKU pricing, labor rates, and labor hours into the spreadsheet.

Skip a row or two for a visual break and create a row for your Total Project Volume. A lot of purchasing professionals focus on the cost per home, but I also want to know the cost for the life of the project or at least for an annualized period, in this case, 100 units (row 19). A construction manager may be willing to pay an extra $200 per home to have a buddy work on the project, but likely less so when he sees that cost calculated to $20,000 for a 100-unit development.

Bid Analysis Lets Builders Formulate Comparisons for Labor and Materials Costs

Skip another row or two and enter the formulas to calculate the total materials and labor costs above, as well as the turnkey price.

First, materials: For each bidder, multiply each SKU Price by its SKU Quantity, then add those multiplied figures together to arrive at a total materials cost (row 21). The formula for the cell under the first bidder is akin to:

=((B6*B9)+(B7*B10)+(B8*B11))

to arrive at the total amount for that bidder’s materials ($8).

You can simply copy-paste that formula into the adjoining cells to the right to automatically arrive at the total materials costs for the other bidders.

Do the same for labor, multiplying each labor rate by its corresponding labor hours, then adding them together to arrive at a total labor cost for each bidder (row 22). Be careful to make sure you are calculating the correct labor rate with its corresponding labor hours.

Under the Labor row, create one (row 23) for Overhead and Profit. Enter in each bidder’s overhead and profit number from their respective bids.

Then add the total Materials, Labor, and Overhead and Profit line items to arrive at the “Turnkey” cost per home for each bidder (row 24). This is each company’s total cost to deliver the job per house.

But, as I mentioned earlier, a per-home cost doesn’t give you the full picture across a multi-unit project—the total cost of the entire job. So skip another row or two and create a row labeled “Total,” then multiply the Turnkey number for each bidder by the Project Volume.

What Thorough Bid Analysis Can Tell Home Builders

This method enables you to analyze a bid in many ways. For instance, you can see if all bidders are using the same material SKUs (see rows 3-5). This detail is important because not all materials are created equal. If someone is using a grade of material above or below what you specified in the RFQ, it’s better to know now than when the product fails on the job or after occupancy. Sometimes a low bid can be traced back to a trade using lower-grade materials in their bid that do not meet your original or required specifications.

In addition, you can see if some trades or suppliers are more efficient with their use of materials ... or perhaps made a mistake in their calculations (see rows 6-8). We all make mistakes, but if the low bidder has miscalculated the material quantity, they will be faced with doing the project at a loss or coming to you with a price increase.

Better to know there is a mistake while you’re analyzing the bid than after the job is awarded. If not, the trade that accurately calculated quantities (and would have won the bid) may have taken on other work before you figured it out, at which point you’re stuck with the trade that made a mistake and you suffer the potential of higher costs.

Also, analyzing labor rates is a leading indicator of a trade’s ability to perform to your scope of work, quality, safety, lead time, and cycle time requirements.

If a trade doesn’t pay its crews competitively for the market, the company will likely experience more turnover than its competitors. That scenario could show up in their Labor Hours line item (see rows 15-17). If those estimates are higher than the other bidders, it’s likely the trade is using less-experienced crews. More-experienced crews may have higher per-hour rates (see rows 12-14), but also will have lower labor hours and material quantities because they work faster, create less scrap, and require less rework.

Take the time to analyze your bids. Don’t just ask for a “lump sum” bid. It may seem like the easy path, but it is fraught with rework, added costs, and uncertainty. (Remember: “Lump sum is dumb.”) A properly analyzed bid will ensure you have the right trade at the right cost for the job.