NAHB Pushes Back on Federalization of Energy Codes

This article first appeared in the September/October 2024 issue of Pro Builder.

The U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) are seeking to federalize energy codes. The National Association of Home Builders is pushing back on the effort.

In April of this year, HUD and USDA issued a final determination that will require all HUD- and USDA-financed single-family new-construction housing to be built to the 2021 International Energy Conservation Code (IECC) and HUD-financed multifamily housing be built to the 2021 IECC or ASHRAE 90.1-2019.

The compliance date for multifamily housing is May 28, 2025, and for single-family homes is Nov. 28, 2025.

The U.S. Department of Veterans Affairs (VA) Home Loan Program is required to align with HUD/USDA, although the timing of that action is uncertain.

The Federal Housing Finance Agency is also considering applying these same standards to new homes and apartments financed by Fannie Mae and Freddie Mac.

The Effects of More Stringent Building Codes

NAHB contends that these efforts to federalize the energy codes, which conflict with existing energy codes in 42 states, will lead to construction delays and implementation problems. Likely challenges include uncertainty about compliance, a lack of qualified inspectors, inconsistent appraisals, and confusion about mortgage products.

The federal government in recent years has increasingly referenced model building codes in legislation and regulatory programs. The growing number of federal programs requiring the use of more stringent building codes is raising concern among home builders. The approach is unnecessary, unfairly burdens new construction and makes it more expensive, and often fails to achieve the intended energy-efficiency goals.

Modern energy codes are already highly efficient. Forcing the use of costly and restrictive energy codes to qualify for grants and financing will exacerbate the current housing affordability crisis.

One common method to increase energy code stringency is to mandate higher insulation levels in walls, floors, and ceilings. But most new homes already surpass the point where additional insulation provides meaningful benefits, so the requirement results in higher construction costs without significant energy savings.

Modern energy codes are already highly efficient. Forcing the use of costly and restrictive energy codes to qualify for grants and financing will exacerbate the current housing affordability crisis. According to Home Innovation Research Labs, compliance with the 2021 IECC can add $22,572 to the price of a new home. A recent study by home builders in Missouri estimated that the increased costs can be as high as $31,000. Homeowners may not see a payback for up to 90 years, making the investment impractical and financially burdensome.

The purported increase in home values associated with improved energy efficiency is often a fallacy. These upgrades have high up-front costs and long paybacks, and they are often not fully accounted for in appraisals, leading to higher down payments for homebuyers. When an appraisal comes in less than the contract sales price due to upgrades, the borrower must pay the difference. This places an additional financial burden on the homebuyer.

RELATED

- The Inefficiencies of the Latest Energy Code

- New Legislation Worsens Housing Affordability

- 2024 International Energy Conservation Code Will Use a New Development Process

NAHB has been working with members of Congress to stop this harmful push to impose the 2021 IECC as the de facto national energy standard for new construction. U.S. Rep. Warren Davidson (R-Ohio) recently introduced a Congressional Review Act resolution of disapproval to allow Congress to overturn the HUD and USDA final determination.

In addition, a provision was included in the fiscal year 2025 Transportation, Housing, and Urban Development and Agriculture appropriations bills to prevent the use of federal funds to implement the final determination.

The Senate VA Appropriations bill also includes a requirement for the VA to produce its own analysis on how the 2021 IECC would affect housing affordability and the ability of veterans to obtain VA home loans.

RELATED: National Association of Home Builders Releases 2024 I-Codes Adoption Kit

Single-Family Permits Rise

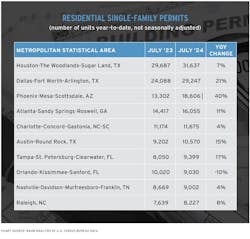

As single-family permits trend upward this year, Texas and other Sun Belt states are leading the way. Through the first seven months of 2024, the total number of single-family permits issued year-to-date (YTD) nationwide reached 599,308. On a year-over-year basis, this is an increase of 13.7% over the July 2023 level of 527,158.

Year-to-date (YTD) ending in July, single-family permits were up in all four Census Bureau regions, with permit increases of 18.2% in the West, 14.5% in the Midwest, 12.4% in the South, and 9.8% in the Northeast.

The top three metro areas, in terms of most single-family permits issued YTD through July, were Houston-The Woodlands-Sugar Land (31,637 permits, up 7% YTD compared with 2023) and Dallas-Fort Worth-Arlington (29,247, up 21%) in Texas, and Phoenix-Mesa-Scottsdale (18,606, up 40%) in Arizona.

For multifamily permits, three out of the four regions posted declines. The Northeast, driven by New York, was the only region to post an increase and was up by 32%. Meanwhile, the West posted a decline of 31.2%, the South declined by 22.7%, and the Midwest declined by 9.3%. The New York-Newark-Jersey City, NY-NJ-PA, metro area saw an increase of 59% to 28,327 multifamily permits issued YTD through July. This was followed by Dallas-Fort Worth-Arlington (14,505 permits, down 7% YTD) and Phoenix-Mesa-Scottsdale (9,125 permits, down 21% YTD).