Texas-only home builders in this year’s Giant 400 achieved an average year-over-year growth rate in housing revenues more than six times that of non-Texas Giants, and over two and a half times that of Texas-based Giants that also operate in other states. |

Let's not even mention the two Texas-based Supernovas, No. 2 D.R. Horton, in Fort Worth, and No. 4 Centex, in Dallas. Most of the other Texans — even those who also build in other states — seem to be riding their expansive markets (and the ill fortune of non-Texans) to higher ranks.

History Maker Homes, the suburban Fort Worth entry-level builder based in North Richland Hills, Texas, is typical. The former National Housing Quality award winner led by Bryan and Nelson Mitchell grew closings by 25.5 percent over 2006 — from 917 to 1,151 homes — and watched 2006 revenues shoot up 28.6 percent to $160.5 million. That was good for a 33-position advance from No. 203 last year to No. 170 in 2007. Houston-based Giant David Weekley Homes operates in seven states but still pulls more revenue from Texas than anywhere else. Weekley advanced six slots to No. 21 on a 16.2 percent gain in closings and 21.3 percent jump in revenues to $1.54 billion.

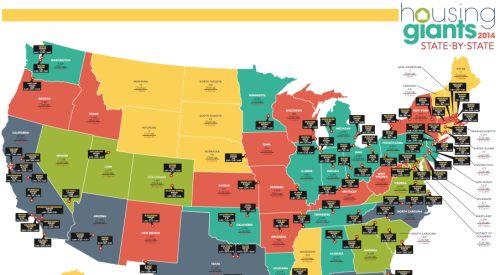

| Comparing the percentage change in housing completions for Texas-only builders to non-Texas Giants and those based in Texas (but with operations in other states) shows why Texans are climbing the Giant 400 rankings. |

|