The single-family build-for-rent market draws big investors

As institutional investors become more interested in single-family home rentals, they’re also driving growth in the build-for-rent (BFR) market. That’s according to a recent report by Yardi Matrix, which develops and supports real estate investment and property management software. (Download the Yardi Matrix report.)

Single-family home rentals make up about one third of the 46 million rental homes in the US, Yardi Matrix reports. Historically, these properties have been the domain of individual owners—who operate 98% of single family-rentals.

But that has begun to change.

Institutional investors first entered the single-family rental market after the housing bubble of the 2000s. Yet for them, it remained a niche concern—until the pandemic. Increasingly, they have been entering the single-family rental and build-for-rent (BFR) markets. Institutional investors have put more than $10 billion in single-family rentals over the past few years, according to Yardi Matrix. In 2021, about 12% of new single-family construction has been for rentals, according to John Burns Real Estate Consulting.

But as the need for more space grew, so did home prices. Home prices rose faster this spring and summer than during any other period on record—with median home list prices up 24% since the onset of the pandemic, Fortune reports.

“Young families and couples who, in a normal homebuying environment, would be looking to purchase were priced out of the market,” Nebenzahl says.

It all formed the perfect conditions for a rising demand for single-family rentals and for BFR.

Single-family rents continue to grow

For investors, single-family rentals look like an increasingly attractive bet. Since the start of 2016, the average single-family rent nationally has risen by over 24% to $1,691. In the first half of this year, single-family rents grew by 6.4% nationally, following increases of 5.3% in 2020 and 5.2% in 2019.

“We’ve seen rent growth in most markets for single-family rentals has significantly outpaced that for traditional multifamily, so the demand is definitely there,” Nebenzahl says.

BFR allows investors to build and control their own rental communities, rather than having to purchase existing properties one at a time. But BFR also comes with some real hurdles, Yardi Matrix reports. For one thing, the BFR market has yet to be tested over the long term. For another, investors have to find enough land for communities of single-family properties, which precludes many cities and inner-ring suburbs.

And perhaps most challenging: It’s not easy to manage a lot of separate properties. When a multifamily rental building needs maintenance—from fixing a toilet to installing a new roof—that works happens on one site. When a community of 200 single-family rentals needs maintenance, the owner has to dispatch crews to 200 work sites.

“Economies of scale are a definite potential challenge,” Nebenzahl says. But, he adds, investors find those costs can be offset by the strong growth in single-family rents.

Southwest region leads build-for-rent housing construction market

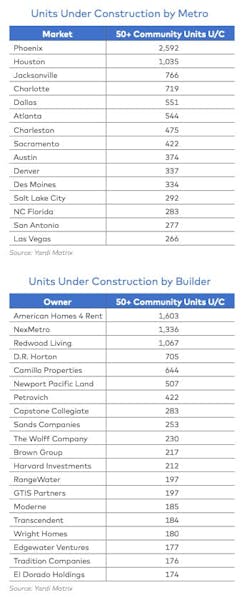

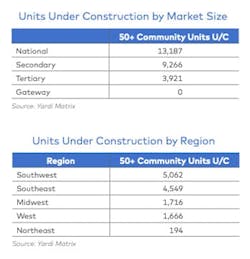

BFR has been more popular in some regions of the country than others, in part owing to land availability. Of the roughly 12,250 BFR units under construction in communities with at least 50 units each, almost 40% (4,896) are in the Southwest and almost one third (3,978) are in the Southeast. That’s followed by the Midwest (1,716) and the West (1,522).

The Northeast, however, where there’s generally less available land, has a negligible number of BFR units under construction: only 34.

Phoenix, in particular, has become a BFR hotspot. Since 2015, the Phoenix metro area has built more than 3.5 times as many BFR communities of 50-plus units as the metro area with the second highest number, Indianapolis (5,026 versus 1,419). In 2020, Arizona was among the top 10 states for inbound moves. “It’s a confluence of job growth, migration growth, and land availability,” Nebenzahl says of Phoenix’s BFR popularity.

Nebenzahl predicts the fast-paced single-family rental market won’t slow down any time soon. “As home prices go through the roof, it will keep more and more would-be homebuyers in the rental market,” he says.

Check out more build-for-rent housing trends coverage from Utopia editors:

- It's Build-for-Rent Boom Times For This California Developer

- Tracking the Build-for-Rent Housing Boom

- What Should Build-to-Rent Communities Look Like?

- Why Build-to-Rent is the Hottest Thing in Home Building

- 5 Ways To Make Distinctive Build-to-Rent Housing Units

- Scope of the Single-Family Rental Housing Market

- Best Practices for Getting into the Build-to-Rent Housing Business

- Startup Creates Investment Opportunities in Single-family Home Rentals

- Tricor Embarks on Workforce Build-to-Rent Project in West Dallas